EIA: US refinery capacity increased for first time since COVID-19 pandemic

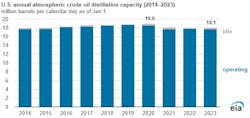

US refining capacity increased slightly for the first time since the COVID-19 pandemic, as of Jan. 1, 2023, reversing 2 years of decline, according to the US Energy Information Administration (EIA)’s annual Refinery Capacity Report.

Operable atmospheric crude oil distillation capacity, which serves as the primary measure of refinery capacity in the US, totaled 18.1 million bbl per calendar day (b/cd), a 1% increase from 2022.

The Refinery Capacity Report provides two measures of US refinery capacity: b/cd and bbl per stream day (b/sd). The former represents the operator's estimate of the input a distillation unit can process over a 24-hr period under usual operating conditions, while the latter reflects the maximum input a distillation plant can process within a 24-hr period when running under ideal conditions with no downtime. Typically, stream-day capacity is about 6% higher than calendar-day capacity.

As of the beginning of 2023, the number of operable refineries in the US decreased to 129, down from 130 at the beginning of 2022. The reduction is due to the closure of a small plant in Santa Maria, Calif., which had a crude oil distillation capacity of 9,500 b/cd. However, despite this closure, total US capacity increased because PBF Energy reactivated a previously retired crude oil distillation unit at its refinery in Paulsboro, NJ. The capacity of this unit increased to 160,000 b/cd in 2023 from 100,000 b/cd in 2022.

The 2023 Refinery Capacity Report does not account for changes in US refining capacity after Jan. 1, 2023. ExxonMobil completed a significant refinery capacity addition in mid-March, which boosted the refinery's total crude oil distillation capacity by 250,000 b/d to 630,000 b/d.

Additional recent expansion projects include a smaller crude oil capacity expansion at Marathon’s Galveston Bay refinery and a coker expansion project at Valero’s Port Arthur refinery, which are also not reflected in this year’s report. Phillips 66 has announced plans to stop refining petroleum at its 120,200 b/cd Rodeo refinery in California while the refinery transitions to refining biofuel, but it had still not terminated its refining operations as of Jan. 1, 2023. LyondellBasell previously noted plans to close its 263,776 b/cd refinery in Houston by end-2023, but the company in May said it would delay shutdown until 2025.