BHI: US rig count surges up by 27 to 624

The US rig count has recorded an increase of 20 or more units twice in the last 4 weeks, accelerating a drilling rebound that spans more than 6 months.

Baker Hughes Inc.’s tally of active rigs in the US climbed 27 units to 624 during the week ended Dec. 9, surpassing the 20-unit jump in late November as the biggest weekly increase since April 2014, well before a plunge in drilling wherein the count dropped from 1,920 rigs working on Dec. 5, 2014, to 404 on May 27 of this year (OGJ Online, Dec. 2, 2016).

Since the rebound began following May 27, the count has added 220 units. This week, as with many others since late last spring, was bolstered by units deployed in Texas and specifically the Permian basin, and those targeting oil and drilling horizontally.

US oil-directed rigs during the week gained 21 units to 498, an increase of 182 since May 27. Gas-directed rigs gained 6 units to 125, up 44 since Aug. 26 as part of their own rebound. One rig considered unclassified remains operating.

All 27 units to start work this week were onshore, with 18 drilling horizontally, which now total 503, an increase of 189 since May 27. Directional drilling rigs rose 5 units to 51.

Offshore rigs and those drilling in inland waters were static this week at 22 and 1, respectively.

Texas, Permian gold rush

With a 17-unit jump to 303, Texas posted its largest weekly increase since August 2014. The state’s count has risen 130 units since May 27. Neighboring New Mexico, which is partially encompassed by the Permian, added a unit to reach 30.

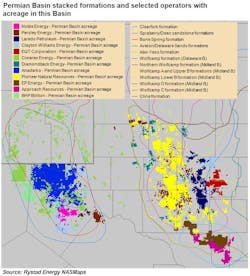

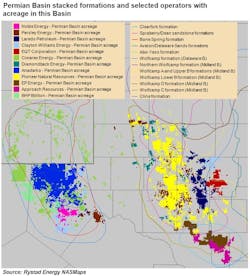

The Permian gained 11 units for the second time in 4 weeks, bringing its tally to 246, up 112 since May 13 with the Delaware and Midland basins serving as the primary forces of attraction for US exploration and production firms.

Chevron Corp. said this week that it plans to direct $2.5 billion of its 2017 capital budget to shale and tight oil and gas, with the majority of that total slated for Permian developments (OGJ Online, Dec. 8, 2016).

Devon Energy Corp., meanwhile, said it has increased its risked drilling inventory in the Delaware basin following a Leonard shale stacked spacing test in southeastern New Mexico (OGJ Online, Dec. 7, 2016). The firm has 60,000 net surface acres in the Leonard shale, with gross pay ranging up to 1,100 ft and as many as three different landing intervals.

Independent oil and gas consultant Rystad Energy notes the basin’s attractiveness primarily reflects its large stack potential, which comprises more than 12 formations “already proven to deliver competitive well results at low breakeven prices.”

This has resulted in more than $22 billion invested in mergers and acquisitions involving Permian shale plays during 2016, the firm says.

Movement outside of West Texas during the week included a 3-unit rise in the Eagle Ford to 43, its highest point since April; and a 2-unit increase in the Granite Wash to 13. The Barnett dropped a unit to 3.

Spreading riches

Several other major oil- and gas-producing states and basins got in on the action this week. Leading the way outside of Texas was Colorado with a 6-unit gain to 26. The DJ-Niobrara rose 3 units to 24, double its June 24 count.

Wyoming increased 3 units to 20, up 7 in the last 2 weeks and up 13 since July 1. Pennsylvania rose 2 units to 31, up 18 since July 8. The Marcellus also gained 2 and now totals 40, nearly doubling its Aug. 12 total while leading the overall US gas drilling rebound.

In addition to New Mexico, North Dakota, Arkansas, and Kansas each gained a unit to respective counts of 32, 2, and 1. As with its home state, the Williston rose 1 unit to 32.

Oklahoma, Louisiana, and Alaska each dropped 1 unit to 80, 47, and 6, respectively. The Cana Woodford lost 2 units to 37.

Canada managed to top this week’s US increase and its own jump a week ago, leaping 30 units to 230, a rise of 194 since May 6. Oil-directed rigs gained 17 units to 117 while gas-directed rigs rose 14 units to 112. One rig considered unclassified went offline, halving that tally.

Cenovus Energy Inc. this week said it plans a targeted drilling program during the year ahead on Palliser block in southern Alberta where it has “a large inventory of highly attractive short-cycle tight oil opportunities.” The firm says it has identified 700 drilling locations to date with high-return potential. It plans to drill about 50 horizontal development wells and 60 stratigraphic wells at Palliser (OGJ Online, Dec. 9, 2016).

The recent surges in the US and Canada continue to almost singlehandedly account for the global drilling expansion. During November, the two countries contributed 53 units to the 58-rig increase in the average global rig count, according to global data from BHI (OGJ Online, Dec. 7, 2016).

Contact Matt Zborowski at [email protected].