EIA: Yearly US motor fuel spending to be lowest in 12 years

The US Energy Information Administration forecasts in its April Short-Term Energy Outlook that, during the April-through-September summer driving season this year, US regular gasoline retail prices will average $2.04/gal, compared with $2.63/gal last summer.

According to the outlook, for all of 2016 the forecast average price is $1.94/gal, which if realized would save the average US household about $350 on gasoline compared with last year, with annual average motor fuel expenditures at the lowest level in 12 years.

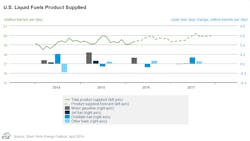

US oil consumption, production

Total US liquid fuels consumption, which increased 290,000 b/d in 2015, is forecast to increase 120,000 b/d in 2016 and 190,000 b/d in 2017, slightly higher than the forecasts of last month.

EIA forecasts motor gasoline consumption to grow 130,000 b/d in 2016, with improving vehicle fleet fuel economy offsetting a forecast 2.6% growth in highway travel. Motor gasoline consumption increased by an estimated 240,000 b/d in 2015 to an average of 9.2 million b/d, the highest level since the record 9.3 million b/d in 2007.

Forecast jet fuel consumption is mostly unchanged through the forecast period, with improvements in average airline fleet fuel economy offsetting growth in freight and passenger travel. Consumption of distillate fuel, which fell 60,000 b/d in 2015, is expected to fall an additional 70,000 b/d in 2016. Hydrocarbon gas liquids (HGL) consumption is forecast to increase by 40,000 b/d in 2016.

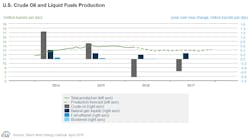

Total US crude oil production is projected to decrease from an average of 9.4 million b/d in 2015 to 8.6 million b/d in 2016 and 8 million b/d in 2017, which are both 100,000 b/d lower than forecast in last month’s report. EIA estimates that crude oil production in March 2016 averaged 9 million b/d, down 90,000 b/d from the February 2016 level.

“The forecast reflects a decline in Lower 48 onshore production driven by persistently low oil prices that is partially offset by growing production in the federal Gulf of Mexico,” EIA said.

Several projects in the Gulf of Mexico that began operations or will begin operations in 2014–16 will increase production from an average of 1.5 million b/d in 2015 to 1.9 million b/d in the fourth quarter of 2017. Although production in Alaska is expected to decrease in response to BP PLC’s recent reduction in drilling rigs in the Alaskan North Slope, ConocoPhillips brought two projects online there that could moderate production declines in the region.

HGL production at natural gas liquids plants is projected to rise 200,000 b/d in 2016 and 300,000 million b/d in 2017.

Global oil market

EIA estimates that world petroleum and other liquids consumption grew 1.3 million b/d in 2015, averaging 93.7 million b/d for the year. Global consumption is expected to grow 1.2 million b/d in 2016 and 1.3 million b/d in 2017.

Consumption outside of the Organization for Economic Co-operation and Development (OECD) increased 700,000 b/d in 2015, and is expected to grow 1 million b/d in 2016 and 1.2 million b/d in 2017, reflecting higher growth in the Middle East and in Eurasia, while slowing economic growth in China poses a downside risk to the forecast.

Oil production outside of the Organization of the Petroleum Exporting Countries (OPEC) is expected to decline 400,000 b/d in 2016 and 500,000 b/d in 2017. Most of the forecast production decline in 2016 is expected to be in the US.

Not assuming a collaborative production cut among OPEC members and other major producers in the forecast period, EIA projects OPEC crude production to increase 600,000 b/d in 2016 and an additional 500,000 b/d in 2017, with Iran accounting for most increase.

Crude oil prices

According to the outlook, both Brent and West Texas Intermediate (WTI) crude prices are forecast to average $35/bbl in 2016 and $41/bbl in 2017, $1/bbl higher than forecast in last month’s STEO, respectively.