Encana plans to hit the ground running in Permian

Encana Corp. has announced its second major acquisition in a Texas oil play this year, agreeing in September to acquire Permian basin-focused producer Athlon Energy Inc. for $7.1 billion.

The purchase boosts Encana's oil production and establishes its presence in one of the fastest-growing resource plays in the US.

"With productive intervals spanning over 5,000 feet of stratigraphy and up to 11 potential-producing horizons, these assets have a massive resource potential and generate significant high margin liquids production," Doug Suttles, president and chief executive of Encana, told an investor presentation.

Encana acquired 140,000 net acres, the bulk of which is concentrated in Midland, Martin, Howard, and Glasscock counties.

Suttles said the leasehold is in the early stages of horizontal drilling and multiwell pad development. Most production now comes from vertical wells. Athlon had 1,121 vertical and 17 horizontal producing wells on the acreage. Proved reserves are estimated at 173 million boe.

Encana sees the potential for 5,000 horizontal drilling locations with 3 billion boe in potential recoverable reserves. Potential productive horizons have been identified in the Middle and Lower Spraberry shale; Middle Spraberry; the Wolfcamp A, B, C, and D; and the Cline formations.

"Going forward, we see further upside with type curve and capital efficiency improvements, additional downspacing and the development of additional horizons," Suttles said.

Development plans

Encana will invest at least $1 billion in the acquisition area next year.

Three rigs were drilling horizontal wells on the acreage, and Encana plans to add four more before the end of 2015.

The company will add another six to eight rigs to drill vertical wells and advance a land retention and delination program. Seventy percent of the Athlon's leasehold is held by production.

"Our plan is to hit the ground running in 2015," Suttles said.

The acreage now produces 30,000 boe/d, comprising 80% liquids. Encana expects to increase output 67% next year, to a full-year average of 50,000 boe/d.

Activity is picking up across the Permian basin as producers increasingly apply horizontal drilling and completion techniques pioneered in unconventional formations to the basin's numerous staked intervals.

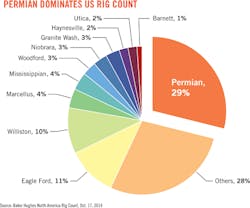

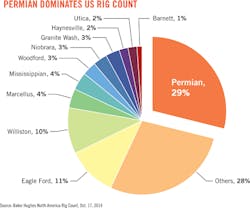

The Permian accounts for 29% of US drilling activity. Baker Hughes data show 561 rigs were active in the basin in mid-October, compared to 448 rigs a year earlier (see figure).

Other active Permian operators include Approach Resources, Anadarko Petroleum, ConocoPhillips, Devon Energy, and Pioneer Natural Resources.

Strong drilling activity is raising production. Permian basin production was 1.8 million b/d in August, up from 1.4 million b/d a year ago and 1.3 million b/d 2 years ago, according to Energy Information Administration data.

Strategic significance

For Encana, the Permian acquisition advances a strategic initiative to increase the proportion of oil, condensate, and NGL in its production base.

The company is selling natural gas-weighted assets and expanding liquids-rich US resource plays.

Recent divestitures include the $541 million sale of coalbed methane assets in Alberta and the $1.8 billion sale of Jonah gas field in Wyoming.

The Permain acquisition comes on the heels of another liquids-rich deal. This summer, Encana paid $3.1 billion for a foothold in the Eagle Ford shale by purchasing Freeport-McMoRan Oil & Gas LLC's assets in South Texas.

Encana is focusing on seven, key growth areas this year, all of which are rich in liquids. Along with the Permian basin and Eagle Ford shale are the Montney and Duvernay shales in Alberta, the Denver-Julesburg basin in Colorado, the San Juan basin in New Mexico, and the emerging Tuscaloosa Marine shale in Louisiana and Mississippi.

Growth from these areas is expected to lift Encana liquids production to 250,000 b/d by 2017, comprising 75% oil. Last year, Encana produced 54,000 b/d of liquids.

"By 2017, we expect that 45-50% of our total production will come from liquids. This is a tremendous shift when you consider that only a year ago, only 10% of our production was liquids," Suttles said.

Shale expertise

The company has already demonstrated proficiency in shale operations and expects it can apply this expertise to the stacked reservoirs in the Permian basin as well.

"We see tremendous opportunity to enhance and accelerate value by leveraging our technical expertise and proven resource play hub development model," Suttles said.

In the Montney shale, Encana introduced a high-intensity completion design that nearly doubled 30-day initial production rates, Suttles said. In the Duvernay, utilization of the company's resource play hub development model has reduced the average time needed to drill a well by more than 40% (see story p. 15).

"And, very importantly, in the Eagle Ford, we've demonstrated our ability to hit the ground running and drive upside when integrating new plays into our operations. In the 3 months [leading up to September] or so that we've owned the asset, we've reduced spud-to-rig-release days by about 20%, and the 18 new wells we brought on production are exceeding type curve," Suttles said.

New outlook

For Encana, the focus on liquids-rich areas represents a strategic reversal from 5 years ago.

In 2009, under the leadership of former Chief Executive Officer Randy Eresman, Encana spun off its oil sands and refining assets into Cenovus Energy. The move transformed Encana into a pure-play gas producer, but an abundance of North American shale gas has led to persistent weakness in gas prices, reducing the attractiveness of that strategy.

The acquisition included a $5.93 billion all-cash tender for Athlon stock and the assumption of $1.15 billion in debt. Athlon shareholders received $58.50/share.

Suttles told investors: "Ultimately, we believe the Permian's unconventional production potential will exceed the Eagle Ford and the Bakken combined."