Statoil tackles Bakken flaring with innovation

Rachael Seeley, Editor

WILLISTON, ND—Statoil North America Inc. is at the forefront of efforts to reduce flaring in the Bakken shale in North Dakota, pilot-testing a mobile system that converts associated gas into CNG at the wellsite.

The system, called the Last Mile Fueling Solution, uses a device the size of a standard 8 ft-by-20 ft shipping container to compress associated gas.

"We were trying to come up with a system that would allow us to go where the flaring problem is," said Statoil Regional Manager Lance Langford. The system was the result of a collaborative effort with GE Oil & Gas Inc., and Ferus Inc.

A mobile system is necessary because flaring moves around the Williston basin, occurring wherever midstream infrastructure is overwhelmed. Flaring often occurs in an area when a group of wells is brought online at a multiwell pad at high initial rates, knocking other wells off local midstream systems.

The benefits of Statoil's pilot CNG program are numerous. Emissions are reduced and, rather than flare associated gas, the CNG program puts the fuel to work powering rigs and equipment. Using locally sourced CNG also displaces more-expensive diesel that is typically brought in by truck, pipeline, or rail from out of state. North Dakota has just one small refinery and a second refining unit under construction near Dickenson.

CNG from Statoil's system can be dispensed on location or loaded onto tube trailers, owned by Ferus, and trucked to Statoil operations elsewhere. "Now we can get gas to wherever our equipment is … Basically, when we get up and running full-scale, we'll be able to supply gas reliably to all of our rigs no matter where they are," Langford told UOGR.

Statoil, based in Norway, entered the Bakken shale in 2011 through a merger with Brigham Exploration Co., a miles to the east.

Diesel demand, historically driven by agriculture, has risen alongside activity in the Bakken. During the past 5 years, state-wide consumption increased 60% to 55,000 b/d. It is expected to reach 75,000 b/d by 2025.

MDU Resources worked with Calumet Specialty Product Partners LP to plan, design, and build the facility in Stark County, near Dickinson. Subsidiary WBI Energy and Calumet each holds a 50% interest in the project.

Stumpf said the Dickinson site is well-suited for the new refinery, with a large rail facility and crude pipelines nearby, as well as access to electricity and natural gas pipelines. "The infrastructure needed to support the refinery is right here," he told UOGR.

The feedstock for the topping facility will consist primarily of light, sweet, Bakken crude—a portion of which will come from MDU Resources' exploration and production arm, Fidelity E&P.

Refinery construction is about 60% complete. The project took delivery of its crude oil distillation tower in January, and a stripper tower was being installed in April.

The facility will have 18 storage tanks and 30 miles of above-ground pipelines to carry crude, naphtha, atmospheric tower bottoms (ATBs), and diesel.

Construction on the 318-acre site is expected to take 20 months. Matt Albright, cost control manager for engineering and services group Bilfinger Westcon Inc., said 1.5 million cubic yards of dirt was moved to prepare the site for construction. "That's enough dirt to fill the Rose Bowl Stadium four times," he told UOGR.

Naptha will likely be shipped to Canada to be used as a diluent for oil sands bitumen, and most of the ATBs will be sold to partner Calumet.

Diverse holdings

In addition to the exploration and production arm, MDU Resources also has two construction groups; natural gas transmission and midstream infrastructure; and an electric and natural gas distribution utility business. All five units are playing a role in the refinery project.

Pipeline and energy services business WBI Energy, in addition to its investment in the refinery, will provide natural gas; Fidelity E&P will supply crude, either directly or in kind; utility business Montana-Dakota Utilities Co. will provide electricity; and construction materials arm Knife River Corp. is providing site work and aggregate materials. The company's construction services group is providing electrical contract services.

"We think of ourselves as a diversified natural resources company," said Dave Goodin, president and chief executive officer of MDU Resources. "We've got a birds-eye view of the industry from a variety of angles."

Investing upstream

Fidelity E&P produces 7,600 b/d from the Bakken and will likely direct a portion of its production to the Dakota Prairie Refinery. "Now the refinery will act in its best interest and Fidelity will act in its best interest, but it's possible that all of our production could go to the refinery," Kent Wells, chief executive officer of Fidelity and vice-chairman of MDU Resources, told UOGR.

The company operates 130 Bakken wells and is this year running one rig each in Stark and Mountrail counties. Fidelity holds 121,000 net acres in the Bakken—including 51,000 acres in Stark County and 16,000 acres in Mountrail County.

Twenty percent of the company's capital budget, $130 million, is dedicated to the Bakken. Spending was reduced from 2013 levels of $200 million, reflecting a shift in emphasis toward improving completion practices over increasing the pace of drilling. "The real thing we're focused on is the completion techniques: How can we get better initial rates? How can we get more recovery?" Wells said.

As many as 90 completion stages are being performed per well, up from 30 stages a few years ago. Plug-and-perforation technology is the primary method used, though early tests with coiled tubing sleeves are producing encouraging results. "That sort of new technology [coiled tubing] is right on the cutting edge, and we're a little bit in the infancy of it. We've only done a couple of wells that way, but we're encouraged with the initial results."

Fidelity is also focused on drilling wells faster and reducing costs. During the past 2 years, the time from spud to total depth fell from 24 days/well to 14 days/well.

Wells said one unexpected challenge that has arisen for Fidelity and other Bakken operators is dealing with associated gas production. Fidelity flares about 17% of its Bakken gas production, roughly half of the state-wide average. The figure has been kept relatively low through investment in pipelines and gas processing facilities. "We believe it's the right thing to do to capture the gas, and we've taken proactive steps to make that happen," Wells said.

Pipeline planning

Pipeline and energy services group WBI Energy is in the early stages of planning a natural gas pipeline in the Bakken—a project that would ease the capacity constraints that contribute to flaring.

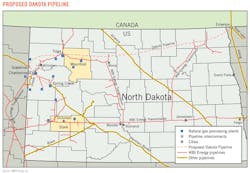

The Dakota Pipeline is slated to have an initial capacity of 400 MMcfd, expandable to 500 MMcfd. The line would extend 375 miles from western North Dakota to northwestern Minnesota. In the east, it may tie into TransCanada Corp.'s Northern Border pipeline. In the west, it may link with TransCanada Corp's Great Lakes Gas Transmission line and ONEOK Partners LP's Viking Gas Transmission lines, granting Bakken gas producers access to eastern Canada and the US Midwest (See figure).

Steve Bietz, president and chief executive officer of WBI Energy, said, "You've got a growing [gas] supply here; it's got to have an outlet … There's a need for takeaway capacity." Total Bakken gas production is roughly 1 bcfd and rising.

The Dakota Pipeline would be the largest pipeline construction project ever undertaken by WBI Energy. It is set to boost the company's deliverability by one-third to 1.6 bcfd.

The open season for the pipeline is slated to end on May 30. If all goes well, Bietz said, WBI Energy could begin compressor station construction in late 2016 and pipeline construction in the spring of 2017. The targeted in-service date is in the fall of 2017.

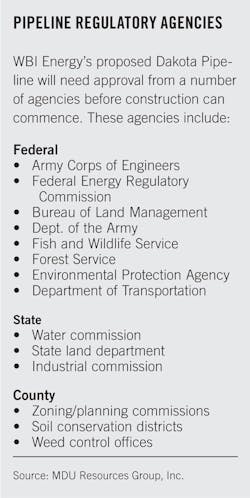

Since it crosses state lines, the pipeline is subject to the regulatory oversight of the Federal Energy Regulatory Commission (FERC). Permitting is expected to take about 2 years. "There is an extensive environmental review and permitting process that you go through to get a certificate to build this pipe," Bietz said.

WBI Energy will likely start the FERC prefiling process once it has sufficient shipper commitments. Work will involve selecting the route, conducting land surveys, and collaborating with a number of other federal, state, and local agencies that must approve the project during the environmental assessment process. These include the Bureau of Land Management, the Environmental Protection Agency, and the US Army Corps of Engineers, along with state and local jurisdictions (see box).

"All of those are cooperating agencies that need to look at what we're doing and sign off, from their own perspective, on the pipe," Bietz said.

MDU Resources has worked in North Dakota for decades, and its presence in the state continues to grow as evidenced by work on the refinery, the pipeline, and exploration in the Bakken. Kent Wells, president, vice-chairman, and chief executive officer of MDU Resources' oil and gas segment, sees a bright future ahead for the company and North Dakota.

"The Bakken is really a world-class play," he said. "I've worked in several places around the world and, it's not the biggest field, but this is a really top-notch, world-class asset."