Bakken production growth expected to slow as the play matures

Production growth from the Bakken tight oil formation is expected to moderate in the next 2 years as older wells decline and new wells strain to offset natural production declines, analysis by Wood Mackenzie Ltd. shows.

The research and consulting firm expects Bakken oil production will increase at a rate of 100,000 b/d/year, rising from an average of 1.1 million b/d in 2014 to 1.7 million in 2020. By comparison, US Energy Information Administration data show oil output increased by 220,000 b/d in 2012 and 260,000 b/d in 2013.

Jonathan Garrett, upstream analyst for Wood Mackenzie, said the estimates take into account the steep declines seen in the initial years of production for any given well.

"Any time you have an unconventional well, whether it be in the Bakken or otherwise, the declines are pretty significant during the first year and you must drill more wells to offset those declines," Garrett told UOGR. "So we think that while production will continue to increase, the rate of growth will begin to slow a bit."

Output from the average Bakken well falls 60-70% in the first year of production, Garrett said. Declines level off after 4 or 5 years, and the wells are expected to last for 25-30 years.

Lower well costs

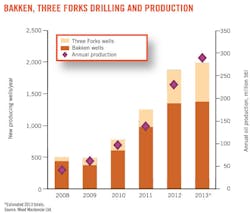

The Bakken formation stretches across portions of the Williston basin in North Dakota, Montana, and southern Alberta. Output began ramping up in earnest about 4 years ago in conjunction with a steep rise in drilling activity (see table). EIA data show production jumped to 550,000 b/d at yearend 2011 from 350,000 b/d at the end of 2010.

Wood Mackenzie estimates $15 billion will be spent on drilling and completion operations in the Bakken year, second only to the Eagle Ford shale in the US Lower 48. Garrett notes that although the estimate reflects higher overall spending, costs on a per-well basis are trending down.

The cost to drill and complete a Bakken well is averaging $7-8 million, Wood Mackenzie found, down from more than $10 million prior to 2011. Cost reductions come as operators move into development and become more efficient in drilling and completion, for instance by drilling multiple wells from a single pad.

Garrett said well costs could be reduced further but does not expect them to fall with the same velocity that they have in the past.

"We're not going to see big leaps in costs, but there are things we can do with multiwell pad drilling. I wouldn't be surprised if Bakken costs land somewhere in the $6 million range when everything is said and done."

Ample transportation

The bulk of crude moving out of the Williston basin is transported by rail. Wood Mackenzie expects the region's growing infrastructure base will be adequate to facilitate its growth forecast.

Seventy-three percent of crude departs the Williston basin by rail. Regional rail capacity recently reached 1.2 million b/d, greater than current production from the Bakken.

A handful of high-profile rail accidents have prompted calls for more robust rail car construction standards in the US and Canada, measures that would necessitate costly upgrades to many rail cars (UOGR, March-April 2014, p.17). Even if more stringent regulations are enacted, Garrett does not expect the higher cost of upgraded cars to dampen Bakken production growth.

"Operators in the Bakken have been really getting ahead of the issue. Instead of waiting for legislation and new rules to basically come down they have been proactive in making sure the tanker cars that they use to move their crude are going to fit the new specs. So we don't see that as any type of major constraint, nor do we see it as a bottleneck," Garrett said.

While there might be cost adjustments, Wood Mackenzie does not expect new regulations to "materially move the needle" for operators and their decision to ship crude by rail.

Recoverable resources

The US Geological Survey estimates the Bakken contains 7.38 billion bbl of undiscovered, technically recoverable crude. Wood Mackenzie analysis places that figure even higher, at 20 billion bbl. Both estimates could rise if operators like Continental Resources Inc. continue to have success with pilot downspacing projects and efforts to prove up lower benches of the Three Forks.

"Wood Mackenzie is pretty bullish on the Bakken. We think it still has a lot of running room," Garrett said.

Continental's pilot programs have yielded encouraging results so far, and Wood Mackenzie is waiting to see if these results can be replicated across the formation before factoring these efforts into its resource estimates.

"I think we'll see some surprises to the upside as companies begin to more heavily downspace the lower benches of the Three Forks," Garrett said.