A conversation with BHP executive Rod Skaufel

Editor's note: Rod Skaufel joined BHP Billiton Ltd. in 2007 before the company was preparing to make its first foray into US shale. Five years later, the company purchased Chesapeake Energy Corp.'s Fayetteville shale assets in Arkansas. Later that year, it acquired Eagle Ford shale pioneer Petrohawk Energy.

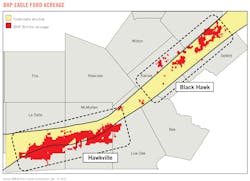

Today, BHP is a prominent participant in the US unconventional oil and gas business, with operations spanning the Haynesville, Fayetteville, and Eagle Ford shales as well as the Permian basin. It is the largest foreign investor in US shale, as well as one of the largest producers in the Eagle Ford shale.

Skaufel, now president of North American shale for BHP, recently sat down with UOGR to talk about why he joined BHP and efforts to improve the performance of wells in one of the company's most prolific operating areas—the Eagle Ford shale. Below is an excerpt from the interview.

UOGR

What prompted you to start working with BHP after spending more than 20 years with ExxonMobil Corp.?

Rod Skaufel

I left ExxonMobil in 2007, at the time Mike Yeager was the chief executive (of BHP Billiton Petroleum) and Tim Cutt was the production division president. Those were two former ExxonMobil executives that I had worked with my entire career. I came over to BHP because I had confidence in the management team and BHP presented an opportunity to try and build something from the ground up.

I joined as the vice-president of engineering so I was going to be able to be involved in all aspects of the business. It was an exciting opportunity, and I said to myself, ‘If I don't do this, 5 years later I will regret not trying.' I haven't looked back. Now I'm the president of North American shale, and we've got positions in the Haynesville, Fayetteville, Eagle Ford, and Permian.

UOGR

BHP will allocate $3 billion of its $3.9 billion budget for the onshore US to the Eagle Ford shale this year. What makes the Eagle Ford shale a compelling place to invest?

Rod Skaufel

It's a fantastic economic opportunity. Our position in the Black Hawk field in DeWitt County is right in the heart of the condensate window, and the economics of the wells average a 70% rate of return. Our focus is really in the liquids-rich portions of the Eagle Ford because of the high returns.

UOGR

What is BHP doing to improve estimated ultimate recoveries from wells in the Eagle Ford shale?

Rod Skaufel

We have a significant effort under way to improve completion optimization and well spacing. We have multiple trials under way in both areas but, on the completion side, we're testing different types of fluids, various diversion technologies, and high-temperature gels to get better carrying capacity (for dispersing the proppant within the fracture).

UOGR

What else is driving improvements in estimated ultimate recovery (EUR)?

Rod Skaufel

The other big EUR driver is well spacing. We are trialing 40-acre spacing, but we've got developments that range from 40-acre to 80-acre spacing. In our more prolific areas we typically use 40-50-acre spacing. We still need to gather more empirical data before we can determine truly what the best spacing is.

UOGR

Just how much improvement you have seen in your Eagle Ford EURs?

Rod Skaufel

(Keep in mind) we are in the early days as I am talking about this and it is difficult to try and translate initial production rates into EUR. We have seen increases in 90-day cumulative production totals of anywhere from 10% to 40% above surrounding wells. We're very encouraged by what we're seeing. Not only are the results supported by production, but we also use microseismic and production logging to try and validate what is happening downhole. Both of these indicate that we are stimulating more rock volume. I think we are doing some really interesting things right now.

UOGR

What else can you tell me about your dynamic reservoir modeling efforts in the Eagle Ford shale?

Rod Skaufel

Right now we have full-field geologic models, but what we have tended to do is build small sector models in different areas of the field that have different performance and/or different geologic characteristics. The matches on these models are not unique. You can get a range of matches with different parameters, and so we do a fair amount of uncertainty analysis. We try to calibrate those models using microseismic and production logging in order to reduce uncertainty and evaluate different fracture geometries, different fracture architectures, and well spacing. Our modeling has been the basis for how we have set up what pilots we want to trial. It is a very important tool in our tool kit.

UOGR

How long does it take to drill a well in the liquids-rich Black Hawk field, where BHP is seeing the highest rates of return in the Eagle Ford shale?

Rod Skaufel

Black Hawk field drilling times are averaging about 20 days. We have drilled wells as fast as 12 days. But it's not just about speed; it's also about cost. A typical Eagle Ford well will cost anywhere from $9 million to $10 million, of which about half of that is drilling costs. The drilling portion of that well cost has gone from about $5 million down to $4 million over the past year.

We have reduced costs partially by going faster, but it has also been about waste elimination, reviewing our specifications to make sure that they are fit for purpose, and contracting. Those four areas have allowed us to pull $1 million out of well costs, and we figure that we can do more. The drilling team has done a great job.

UOGR

What unexpected challenges have you faced in the Eagle Ford?

Rod Skaufel

It involves the integration and the coordination of many activities across multiple work fronts every day in the field, and it is extremely complex. Initially, I don't think we really had an appreciation for how intricate the work environment is and how well coordinated it needs to be.

The second piece is that the workforce is relatively inexperienced. It has a very high turnover rate. The stability and the experience of the workforce has been an unexpected challenge. We are highly reliant on contractors. Safety is our highest priority, but when you have different people coming to site every day it makes showing everyone the way BHP works difficult. It involves constant training, retraining, auditing, and verification.

UOGR

What kind of reception is BHP receiving from South Texas communities?

Rod Skaufel

They have been extremely supportive of what we are trying to do. People are either benefitting directly or indirectly from the development of the Eagle Ford shale, which is a good thing. We are very conscious of how we operate in the communities. We want to be known as a good, responsible neighbor, and we meet with county judges and government officials on an ongoing basis to stay in step with the community.

UOGR

Is BHP considering expanding shale operations into countries outside of the US?

Rod Skaufel

We have a shale exploration group, and their assignment is to build our liquids-rich portfolio. They are looking at the global endowment as part of that.