Haynesville continues decline as operators seek out wet gas plays

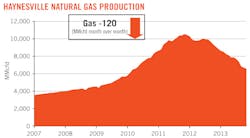

In October, Louisiana's Haynesville shale produced approximately 6 bcfd. The EIA 's Drilling Productivity Report for October 2013 projected each rig working in the play would add 5 MMcfd of production in November. Overall, Haynesville gas saw a sharp increase in 2010 and 2011 but has declined almost as sharply since then.

Dry gas is costly to drill, and with the abundance of wet gas plays available in other regions the Haynesville has seen a drastic decline in drilling. The average cost of a Haynesville well was about $11 million in 2012, according to the Louisiana Department of Conservation. In October, only 50 rigs were active in the play—a number that has been flat since mid-2012. Data from the Louisiana Department of Natural Resources (DNR) shows that well development in the Haynesville peaked in March 2010 with nearly 100 wells drilled. By March 2012, drilling rates rapidly declined with less than 10 wells a month spudded in the region.

According to the Louisiana DNR, 127 wells were waiting on completion as of October 1, 2013. Due to a lack of pressure in the reservoir, these wells are likely not ready to be converted to producers. Further substantial development can compound this problem when producing dry gas volumes. The Louisiana DNR also reported 28 wells as drilling and 55 were permitted (not drilling). Twenty-five wells were listed as shut in.

Production

The Haynesville formation produced 2.1 tcf in 2012, a number that accounted for 70% of the state's natural gas production. Production from the Haynesville formation is in decline and will likely continue this trend if gas prices remain in the $4-$5/Mcf range.

The Haynesville had 2,248 producing wells as of March 2013. Total expected recovery is estimated at 13.9 tcf. Unconventional development requires a large number of wells. In addition, the low permeability of most shales require expensive stimulation operations. Performance risk is high, especially for operators in the Haynesville.

Technology may still hold the key for Haynesville profitability. In 2010, Petrohawk experimented with redesigning its well using smaller diameter casing. The process resulted in lower horsepower requirements—15,000 hp reduced to 10,000 hp—which is a major concern for Haynesville wells. Along with its redesigned wells, Petrohawk also began using restricted choke rates. The company has found restricted chokes are less effective for wells with higher EURs. In several case examples the company reduced the decline curve of several of its high producing Haynesville wells.

Given the historical premium on liquids compared to gas costs based on equivalency and Btu, oily plays still rank ahead of dry gas. Production and profits will dictate the pace for Haynesville development as it enters its second phase of manufacturing and build out. In addition, the Haynesville is known for its rapid decline rates. According to the EIA report, Haynesville gas production dropped 120 MMcfd month over month from November through December.