Heavy oil production rising, but exploration low in Cuba

Exploratory drilling is at a low level in Cuba, but development drilling by one group has boosted domestic production to its highest level in years.

The country generated little interest last year when it first offered Gulf of Mexico blocks during a period of historically low oil prices. Now at $30 oil it plans to re-assess interest in that area and other opportunities with a presentation at the World Petroleum Congress in Calgary this June.

The production increases consist of heavy oil from fractured reservoirs near Havana in Cuba's northern basin.

The chief joint-venture operator of wells in Cuba, Sherritt International Corp., Toronto, said new oil treatment facilities at Puerto Escondido and a new pipeline from the Varadero area to the Matanzas supertanker port are to be completed in first half 2000. The facilities are expected to alleviate current limits on production from north-coast fields.

At 44,000 sq miles, Cuba is not quite as large as Louisiana. It is the largest country in the Caribbean and claims a 200 nautical mile exclusive economic zone.

State-owned Cubapetroleo (Cupet) is in charge of all exploration, development, refining, marketing and transportation. Its affiliate Comercial Cupet negotiates contracts with outside companies.

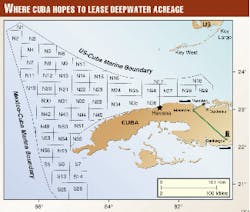

Cuba's offshore offering

Cuba is attempting to raise interest in 59 blocks in the eastern Gulf of Mexico and western Straits of Florida. The blocks average 2,000 sq km and are in 2,000-4,000 m of water. A production-sharing contract is in place to govern exploration there.

Officials hope to make available later this year 2D seismic and other geophysical data which Cie. Generale de Geophysique acquired in 1999 for the government.

The northernmost of the blocks lies south of three US Minerals Management Service planning areas-Rankin, Dry Tortugas, and Key West-which themselves lie off Florida's southwest coast.

Cuba has not identified several non-US companies it said have already expressed interest in the blocks.

Officially Cuba welcomes the participation of US firms, but Washington's economic sanctions prohibit it.

The westernmost blocks come close to the eastern of two "donut holes," areas of disputed deepwater acreage (see map, OGJ, Apr. 22, 1996, p. 31).

Cuba previously has not offered offshore acreage beyond the bays and waters adjacent to the island.

Heavy oil production

Cuban officials said the island's production is averaging close to 50,000 bo/d. If true, this would be far above levels of the 1980s and most of the 1990s, when maximum production barely exceeded half that figure.

Cuba relies on imports, mostly finished products, for the majority of its needs. Most of its domestic oil is 8-14° gravity with about 8% sulfur. Cubapetroleo produces about half, and the other half comes from joint ventures with non-Cuban companies.

Sherritt said its net production averaged 13,143 bo/d in 1999, up 69% from 1998 and a record for the third straight year.

More than two-thirds of the increase came from new wells on the Puerto Escondido and Varadero West blocks east of Havana and the full-year impact of production from the blocks. The rest came from exploratory wells in Yumuri, Canasi, and Seboruco fields that started up during the year along Cuba's north coast.

Sherritt's net fourth quarter production averaged 12,686 b/d, up 23% on the year.

During 1999 Sherritt's capital spending in Cuba was $40.2 million for six development wells, one appraisal well, and the three successful exploratory wells.

Sherritt said its proved gross reserve base increased by 14.3 million bbl during the year. It also held interests in oil production in Italy and Spain in 1999, but those fields were in decline. The company sold its 20% indirect interest in nearly-depleted Vega oil field off Sicily in December 1999 and is disposing of its remaining indirect interests in onshore gas-producing properties in Italy.

Sherritt did not reveal its planned capital spending in Cuba for 2000.

Sherritt's partners are Maurel & Prom, Paris, and Pebercan Inc., Ville St-Laurent, Que. Pebercan said in February that the group's Seboruco-2, a 3,305-m directional well, was successful and that the group was spudding Seboruco-3.

The group reported success in 1999 at Canasi-1 and 2, Yumuri-201, and Seboruco-1. Some of the wells involve directional and horizontal drilling from onshore pads to tap reserves a short distance offshore.

Other activity

As previously reported, Petrobras International SA's Brasoil is to begin exploratory drilling later this year on 3,000-sq-km Block L (Block 50) off the northern coast of central Cuba, pending environmental approvals (OGJ, Feb. 28, 2000, p. 74).

Beau Canada Exploration Ltd., Calgary, which entered Cuba in early 1998 with purchase of a 63% interest in Genoil Inc., is in stand-by mode for geological reasons in Cuba this year. It drilled two 1999 wells about 400 miles southeast of Havana. Cresciente-1X is on a reef play on Block 20, and Angelito-1X is on a wrench-related anticline play on Block 22.

Neither well encountered significant evidence of source rocks, seriously questioning the further viability of exploration in Cuba's southern basins.

Alturas Resources Ltd., Calgary, holds 1.4-million-acre Block 8 just southeast of Havana and just south of Sherritt's Block 7. The private company led by geologist James Podruski has held the block since early 1998.