Hot Louisiana chalk play spawning more drilling, added facilities

Richard Wheatley

Associate Managing Editor-News

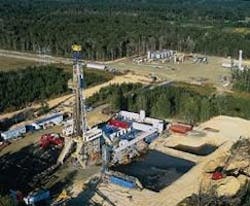

Chesapeake's 19-1 Lord, being drilled by Parker Drilling Co. Rig 203, is located at the Glenmora, La., central tank battery, in the heart of Chesapeake's Masters Creek drilling activities. Parker's Rig 180, not shown, is also working for Chesapeake, drilling the 40-1 Thomas in East Baton Rouge Parish. Photo by Alan Becker Photography, Aspen, Colo., courtesy Chesapeake Energy Corp.Driven by superior economics and improved technology, drilling action in Louisiana's Austin chalk trend is heating.

Operators are pressing a variety of development projects to support increasing production from the rapidly maturing oil and gas play.

Although discoveries were slow in coming during the early years of the play-in part because of a lack of infrastructure-the rate of successful wells has been increasing.

That improving success rate in turn has been boosting operators' hopes, swelling their ranks, and continually lowering finding costs-all of which combines to enhance the exploration and development attractiveness of the Louisiana chalk.

Another attraction is the high BTU content of chalk gas, which commands premium prices but necessitates a major processing infrastructure.

During just the past 6 months, companies have committed more than $125 million for infrastructure development projects to accommodate anticipated production increases, according to one operator's estimates, which may be conservative.

But based on the level of current and anticipated activity, considerably more infrastructure will be needed to keep pace with Louisiana chalk E&D action, judged to be one of the hottest onshore plays in the U.S. today.

About Louisiana chalk

The Louisiana portion of the Texas-Louisiana Cretaceous trend cuts a wide and narrow diagonal swath several hundred miles from the Texas border at the Sabine River east across Louisiana, tracking under Lake Pontchartrain and into the Gulf of Mexico (OGJ, Apr. 9, p. 15).

Chalk wells are typically drilled as vertical holes with single and dual horizontal laterals on 1,920-acre spacing. But there are larger spacing units found near Baton Rouge and smaller units closer to the Sabine River.

So far, chalk production in Louisiana is found in only about the westernmost 100-150 miles of the trend, generally from Avoyelles Parish on the east to the Texas state line on the west.

Several years ago, there was virtually no significant chalk production to in Louisiana. But that is changing because of the increasing positive role technology is playing-including measurement-while-drilling (MWD) technologies, improved mud and bit programs, and use of 2D and 3D seismic-and because operators now have a lot more well histories in their hip pockets when staking and drilling new chalk locations than was the case previously.

"Technology is now allowing it to become a commercial reservoir," said Bryan Humphries, Oxy USA Inc.'s Louisiana and Mississippi asset team leader.

How play evolved

Most drilling and development action is found in and around Brookeland field, which extends across the Texas-Louisiana border, and in and near North Bayou Jack, North Hadden, Masters Creek, Burr Ferry, and South Burr Ferry fields.

Geographically, operators also refer to the active trend areas as South Brookeland, Leesville, Masters Creek, St. Landry, Baton Rouge, and Livingston.

With the exception of Brookeland field, discovered in 1983, and North Bayou Jack, which was developed vertically, all of the fields that are seeing most action now were found in just about the last 5 years.

The current play's roots trace to Cliffs Oil & Gas Co., Houston, which drilled the reentry horizontal 1-A Martin in Avoyelles Parish in East-Central Louisiana in 1991 that tested almost 2,600 b/d of oil and 1.5 MMcfd of gas from a single 2,135-ft lateral. The well, drilled to 15,339 ft TVD and 17,103 ft measured depth, opened North Bayou Jack field in Avoyelles and St. Landry parishes to horizontal development.

In July 1992, Sonat Exploration Co., a unit of Sonat Inc., Birmingham, Ala., drilled the single-lateral 1-C Sonat Minerals, which opened North Hadden field in western Vernon Parish.

Union Pacific Resources Group Inc. (UPR), Fort Worth, with partner Helmerich & Payne Inc., Tulsa, opened LaCour field with 1 O.B. LaCour et al. in Point Coupee Parish in February 1994. The well holds the distinction of being the first dual-lateral horizontal drilled in the Louisiana chalk. It started off strong, testing more than 1,600 b/d of oil, 734 Mcfd of gas, and 113 b/d of water; however, by the following year, production rates had become marginal.

According to a Petroleum Information report published late last month, the well's cumulative production totaled about 28 MMcf of gas and more than 74,500 bbl of oil. But PI said the well, which is no longer operated by UPR, was inactive at last report.

Oxy's 1-A Monroe horizontal well in Rapides Parish opened Masters Creek field in November 1994, currently one of the trend's most active areas. The 1-A Monroe tested more than 6 MMcfd of gas and more than 2,100 b/d of condensate from a single 4,425-ft lateral at 14,803 TVD.

Sonat opened Burr Ferry field in April 1995. The 28-1 Temple in Vernon Parish extended the Austin chalk's productive limits at Brookeland field 5 miles east. The well, drilled to 11,422 ft TVD, flowed on test at rates of 8.5 MMcfd of gas, a little less than 1,700 b/d of condensate, and 638 b/d of water from laterals of 3,880 ft and 4,226 ft.

The 1-A Monroe and 28-1 Temple established production in new areas between productive areas.

The 27-1 Sonat Minerals, drilled by UPR as operator and subsequently assumed by Sonat, extended Burr Ferry to the south, opening South Burr Ferry field.

1996-97 action

Focus of most 1996 drilling activity centers on the western portions of the trend, principally in Vernon and Rapides parishes, and in the Point Coupee-West Baton Rouge Parish area, in the central portion of the state.

There, UPR and Amoco Corp.'s Southeast Business Unit have significantly increased the size of their joint venture (JV), and the partners have plenty of work on tap for the coming year, both in and out of their joint exploration area.

Operator Chesapeake Energy Corp., Oklahoma City, one of the most active companies in the play-and believed to be the largest leaseholder of any Louisiana chalk operator at 1.1 million net acres-is planning an intense drilling program in 1997 on the heels of an already hefty 1996 program.

Currently running nine rigs, Chesapeake reports it is obtaining wellhead price realizations of more than $4/Mcf on a gas-equivalent basis (Mcfe).

In St. Landry Parish, the company is drilling what it claims is the world's deepest horizontal well targeting Austin chalk pay.

The list of operators and companies involved in the play continues to grow. Other companies with interests in the trend, active in exploration, development, or involved in infrastructure development include: ARCO Pipe Line Co., Houston; Belco Oil & Gas Corp., Houston; Chevron Corp., Columbus Energy Corp., Denver; El Paso Energy Corp. (including merged Tenneco Energy), Houston; Enron Louisiana Energy Co., a unit of Enron Liquid Services Corp., Houston; Great West Energy & Exploration, Dallas; Koch Oil Co., Wichita, Kan.; and Mitchell Energy & Development Corp. and unit Mitchell Gas Services Inc., The Woodlands, Tex.

Plants, pipelines

Infrastructure expenditures are earmarked for expansions of oil, gas, and liquids pipelines; gathering systems; and for new or expanded gas processing plant capacity to keep pace with current drilling campaigns planned during 1997.

In a 50-50 venture, operator Mitchell Energy and partner Chesapeake in September 1996 agreed to construct the 350 MMcfd design capacity Louisiana Chalk Gathering System, consisting of 49 miles of 12-in., 20-in., and 24-in. pipeline, as well as 90 miles of associated gathering lines. A mid-December construction start was imminent at presstime.

The system is the first major gas gathering infrastructure to be built in the area, Mitchell said.

"The system...will expand as production increases," added Allen Tarbutton, president of Mitchell Gas Services.

When the project is completed, production will be moved from Chesapeake's Masters Creek area wells and from wells in neighboring parishes to the Eunice, La., gas plant operated by Enron Louisiana Energy in Acadia Parish (OGJ, Sept. 16, p. 21).

The pipeline will have sufficient capacity to handle Chesapeake's production volumes from the Masters Creek and St. Landry areas, as well as from third-party producers in Rapides, Allen, Evangeline, Avoyelles, and St. Landry parishes. Cost of the first phase of the project is pegged at $25 million.

Initial construction involves the North Extension and Forest Hill lateral, consisting of 11 miles of 20-in. and 4 miles of 12-in. pipeline, beginning at the Forest Hill, La., tank battery and extending south to El Paso's Tennessee Gas Pipeline junction, about 5 miles southeast of Glenmora, La.

From there, phase one involves 18 miles of 24-in. to the Louisiana Intrastate Gathering (LIG) pipeline junction. Phase one completion is set for mid-March.

Phase two is set for completion late in spring 1997. It involves 16 miles of 24-in. line from the LIG junction south to the Eunice, La., gas plant/fractionator. Initially, lateral pipelines will be built to seven central tank batteries, with each designed to accommodate as many as 20 wells.

Enron's plant will be expanded to accommodate the increasing Chesapeake production that will be delivered to Eunice via the Mitchell/Chesapeake pipeline. Enron is now conducting preliminary engineering and design, which was scheduled to be completed late in December. Construction will be done in phases; bids have been requested, but no awards for initial work have been made, Enron said.

Chesapeake and Koch signed an agreement calling for Koch to purchase Louisiana chalk crude oil and condensate production from Chesapeake via a 70-mile, 10-in. pipeline from the Masters Creek area to Beaumont, Tex. An early 1997 completion is scheduled for this project, which will provide Chesapeake with higher wellhead oil prices, the company said.

El Paso Energy will process Oxy's Masters Creek production and construct the Glenmora gas processing plant with a 50 MMcfd inlet capacity. The plant was expected to be operational during the fourth quarter, and plans have been made to double the plant's capacity during 1997. In addition, plans call for an NGL line to be constructed in 1997, with processed gas to be sold into Tennessee Gas Pipeline.

In August 1996, ARCO and UPR formed a $32 million JV to build and operate an NGL pipeline system (OGJ, Aug. 19, p. 30). Beginning during second quarter 1997, the line will transport NGL from the Masters Creek plant. ARCO is upgrading the system to handle as much as 50,000 b/d of NGL.

ARCO contributed its Black Lake pipeline to the JV, and UPR contributed its 52-mile Rosepine lateral pipeline. ARCO operates the combined system. Currently, the 255-mile Black Lake pipeline transports NGL from the Cotton Valley area in northern Louisiana to Mont Belvieu, Tex., for fractionation. Also, it serves UPR's Brookeland gas processing plant in Jasper County, Tex.

A 100 MMcfd gas processing plant at Masters Creek is also planned by UPR. It is expected to be operational in second quarter 1997. UPR owns a 55% interest and will operate the plant. Other interests are held by Sonat 20%, Chesapeake 15%, and Helmerich & Payne and Oxy 5% each.

Learning curve

Production levels are rising, but incremental increases have been gradual because of the trend's size, minimal infrastructure, and the 1,920-acre spacing that together have reined drilling activity.

John Vering, UPR's vice-president of exploration and production services, said, "I'm guessing you could take maybe four, five, or six Giddings fields and fit them in along the trend from the Sabine River over to Baton Rouge, just in the area that has seen the activity thus far."

All of the trend's chalk wells to date are either single- or dual-lateral horizontal holes. The chalk is geo-pressured, with high bottomhole temperatures on the order of 300° F. or more.

In addition, heavy faulting can play havoc with well bore trajectories, complicating the understanding of geology and communication between reservoirs. Also, wells are prone to have high water cuts, resulting in surface handling problems and increased costs.

"The Austin chalk is a pretty unpredictable reservoir," said UPR's Vering. "What we've been wondering about is how it's alike and how it's different from the Austin chalk we've seen elsewhere."

In comparing the Louisiana Austin chalk wells with UPR's massive chalk program in Texas, totaling almost 1,300 wells, UPR says drilling one Louisiana chalk well can average 90-120 days, compared with Giddings field in Southeast Texas, where a well can be drilled in about 30 days or less.

"One rig-year would get you 10-12 wells," said Vering. "Over here (in Louisiana), one rig-year will get you maybe three or four wells. These are such deep wells that you don't get a lot of wells drilled."

In the active Masters Creek field, the chalk is encountered at 14,000-15,000 ft, but the depth varies throughout the trend.

"It's anybody's guess how far updip the productive area extends, and how far downdip," said Vering. "We're still feeling our way through the edge of it."

Improving economics

As has been the case in chalk drilling in Texas, technology is continually aiding the economics of the Louisiana chalk play, which is still more costly and time-consuming than drilling and completing the chalk in Texas' Giddings and Pearsall fields.

Some of the factors extending the economic limits in Louisiana are enhancements to horizontal drilling MWD techniques, dual-powered mud motors, and geosteering/bit-position-signaling, as well as improved reservoir simulation-evaluation.

According to research by Union Bank of Switzerland's UBS Securities LLC, New York, while drilling and completing are still more expensive in the Louisiana portion of the trend, operators are benefiting from wells being more oil-prone. Also, Louisiana chalk gas has a higher BTU content, which yields a price premium over other gas sold at New York Mercantile Exchange Henry hub prices.

"Both of these factors lead to excellent economics...despite the higher drilling costs," said UBS analysts Michael Barbis and Christopher Eades.

UBS data indicate typical finding costs for a single lateral completion in Masters Creek are on the order of $0.94/Mcfe, while a dual lateral is about $0.80/Mcfe, using reserve expectations on a billion cubic foot equivalent (bcfe) basis of 3.2 bcfe and 5.6 bcfe, respectively, net of royalty.

According to UBS, based on flat Henry hub prices of $18/bbl oil (West Texas intermediate equivalent) and $2/Mcf gas, a dual lateral completion with 5.6 bcfe of reserves after royalty and $0.80/Mcfe finding cost, can yield an attractive net present value (NPV) of $5.8 million pretax and a pretax return on investment (ROI) of 129%. A single lateral can yield a $2.9 million NPV and a 96% pre-tax ROI.

But with recent prices of about $24-25/bbl for oil (Henry hub WTI equivalent) and $4/MMBTU gas (Henry hub January contract), returns can easily exceed the UBS economic examples.

Furthermore, UBS points out, chalk economics are enhanced by an applicable Louisiana severance tax holiday. All production until payout or 2 years, whichever occurs first, is exempt from taxes. After payout, or 2 years, oil is taxed at 12.5% of revenue and gas at the rate of $0.077/Mcf. Chalk wells can pay out in a matter of months.

Chesapeake view

Aubrey K. McClendon, chairman and chief executive officer of Chesapeake, maintains Louisiana chalk payouts for his company are now on the order of 3-5 months, and the economics continue to improve with each new completion. Chesapeake reports it's obtaining a gas-equivalent blended oil-gas price that exceeds $4/Mcf. "We're getting about $4.30/Mcfe at the wellhead," McClendon said.

"My view is this would have to be the highest wellhead realization of any play in the country."

In characterizing the play's potential, McClendon said it involves 2-3 million acres, with 1,920-acre spacing/well that could allow for about 1,000 or more wells. With expected reserves of about 5-7 bcfe/dual lateral completion, McClendon said, the size of the play could be on the order of a 7 tcf discovery on a gas-equivalent basis.

"There's not another play in the country that's potentially this size, and it was not economical 18 months ago," McClendon said. "Today, because of improvements in horizontal drilling technology, you've got a play that could be the largest onshore play in the country, not only in size of potential reserves but also in areal extent."

Chesapeake program

Chesapeake, which has the largest known Louisiana chalk net acreage position of any single company currently active in the trend, is pursuing an intense drilling program that could result in a total of 150 wells being drilled.

In its third quarter 1996 report to shareholders in mid-November, Chesapeake said its leasehold position should lead to a multiyear inventory of drilling prospects, adding that it plans to be running as many as 15 rigs by mid-1997 in the Louisiana portion of the trend.

In the South Brookeland area, Chesapeake's 33-1 Rice-Land Lumber in Beauregard Parish is drilling horizontally in the chalk. Eight miles north and 18 miles northwest, the company has encountered shows in the 29-1 Singletary, a Tuscaloosa reentry, and in 1-H Southern Pine, its second and third tests of the South Brookeland area. Chesapeake said if they prove to be commercial, the wells could begin chalk production early in 1997.

In the heart of Masters Creek field, Chesapeake's 7-1 Laddie James had produced about 2.3 bcfe of gas in the first 4 months of production. The 9-1 Cloud was placed on production early in September and has produced 800 MMcfe of gas.

The well spots southeast of UPR's 1-A Labokay Corp. chalk producer, now shut in. It was drilled to 14,750 ft TVD with a 21,400 ft measured depth and a single 6,737 ft, south-oriented lateral. After it was completed, PI reported the well represented "the longest horizontal lateral wellbore in Louisiana, and one of the longest ever drilled."

The 31-1 Lyles, Chesapeake's third Masters Creek well, has been temporarily abandoned while the company evaluates new seismic. Chesapeake may reenter the well and drill an updip lateral in 1997.

The 25-1 Lawton began producing early in November at a rate of 4,700 b/d of oil and 10 MMcfd of gas through a 26/64-in. choke with flowing tubing pressure of 6,700 psi. Chesapeake owns a 98% working interest and a 78% net revenue interest in the well. The 31-1 Lawton offset is drilling ahead, and the company plans to drill five more wells on the Lawton block in the Masters Creek area during the next 12 months.

Another Masters Creek well, 19-1 Lord in Rapides Parish, 2 miles south and 500 ft downdip of the 7-1 Laddie James, was nearing completion earlier this month. And operations recently commenced on the 34-1 USA/LROC, in the Masters Creek area, 9 miles north of the James and Cloud wells.

Meanwhile, 11-1 Martin, the company's seventh Masters Creek well, is drilling horizontally. It spots midway between the Cloud and James wells.

About 50 miles southeast, in St. Landry Parish, Chesapeake is drilling what it claims is the world's deepest horizontal well, 19-1 Grezaffi, drilled to a TVD of 17,400 ft, a reentry of an abandoned Tuscaloosa dry hole targeting chalk objectives. Production is anticipated early in 1997 after pipeline connection.

The 40-1 Thomas, Chesapeake's first Tuscaloosa test, 40 miles to the east of 19-1 Grezaffi, is drilling vertically below 18,500 ft. Chesapeake reported hydrocarbon shows in upper Tuscaloosa sands early in November. The company said as a result of this apparent discovery, it plans to accelerate its seismic and drilling activity in pursuit of Tuscaloosa targets in the Baton Rouge area.

UPR's latest results

UPR is operating five rigs in Louisiana. Two are drilling in the Masters Creek area, one is drilling a Tuscaloosa reentry in the Baton Rouge area in the UPR-Amoco JV, and two are at work in western Vernon Parish.

During 1996, UPR expects to spend about $425 million to develop its total Austin chalk leasehold in Texas and Louisiana, with a similar spending level slated for 1997. An expenditure of $40.4 million is planned for 1996 in the Louisiana chalk.

So far, it has participated in a total of 21 Louisiana chalk wells at a cost of $23.5 million. Fifteen are producing about a net 1,600 b/d and 6 MMcfd of gas. Three wells are in the Masters Creek area and 12 in the North Burr Ferry area.

UPR, which has interests in 1.5 million net acres in the trend in Texas and Louisiana, recently reported achieving record total Austin chalk sales volumes for 10 consecutive quarters, and it disclosed sales volumes totaling 642 MMcfe in October, up 19% from 1995.

UPR recently reported three significant horizontal completions in the chalk, two in Washington County of Southeast Texas, and 33-1 Crosby Land & Resources in Rapides Parish. The latter is producing 10 MMcfd of gas and 3,200 b/d of oil. Gas production from the well will be processed at the Masters Creek plant.

In October, the UPR-operated 21-1 Crosby Land & Resources, a dual lateral horizontal completion, tested at a rate of 10 MMcfd of gas and 1,700 b/d of oil. It is shut in, awaiting pipeline connection.

The Washington County wells, 2 Bluebell Unit and 1 Emma Bell, at last report were producing 39 MMcfd and 40 MMcfd of gas, respectively.

"These wells show the tremendous potential of the Austin chalk," said Jack L. Messman, UPR chairman and chief executive officer.

UPR plans to operate five rigs in the Washington County area and increase its rig count in the Louisiana chalk extension during 1997.

UPR-Amoco JV

Last March, UPR and Amoco formed a joint venture designed to capitalize on 3D seismic data in pursuit of the chalk in a 400,000-acre area in East Central Louisiana in Point Coupee and West Baton Rouge parishes.

Amoco had already held by production about 40,000 acres and had completed four 3D surveys over its existing Tuscaloosa trend fields.

"Within that 400,000-acre block, we and Amoco have been active in buying additional leases, and we now have an acreage total of up to 120,000 gross acres," Vering said. Of the total, UPR's interests involve 60,000 net chalk acres.

UPR in mid-December was completing its first well in the project area, a reentry of an abandoned Tuscaloosa well in Point Coupee Parish, the 2 F. & L. Planters, which was targeted to around 15,000 ft. Testing was planned before yearend.

Oxy, Sonat work

Oxy, with a leasehold of about 100,000 net acres, is active in the Masters Creek, Livingston, and South Brookeland areas.

So far in Masters Creek field, it has interests in five Oxy-operated wells, plus non-operated interests. It will have interests in six more wells planned in Masters Creek field in 1997.

As operator, Oxy drilled the Masters Creek discovery 1-A Monroe, a November 1994 completion. Other Oxy interest wells include: 1-A Murry offset, 11/2 miles east of 1-A Monroe; 2-A Murry offset; 1-A Exxon Minerals; and 1-B Exxon Minerals.

The 1-A Murry and 1-A Exxon Minerals were put on production in February and July, respectively. The 1-A Murry tested 10 MMcfd of gas and 2,200 b/d of oil, and 1-A Exxon Minerals tested 14 MMcfd of gas and 5,400 b/d of oil.

Its latest test, the 14,300 ft TVD dual lateral 1-B Exxon Minerals in Rapides Parish, is currently drilling. The well's north lateral was drilling ahead at a measured depth greater than 17,640 ft, to be followed by a south lateral. Oxy has an 83.7% working interest.

Also, in Livingston Parish, Oxy is drilling 1-A Denkmann, a dual-lateral chalk exploratory well, on 2,560-acre spacing. The well is the farthest southeast location to be drilled in the trend to date, PI said late in November.

The test is being drilled to a 21,596-ft measured depth, about 7 miles northwest of Springville, La. Proposed TVD is 16,718 ft, PI reported.

Sonat, with an acreage position of about 350,000 net acres, is active in Masters Creek, Burr Ferry, and the South Brookeland area. Its interest wells include 28-1 Temple Brookeland field extension, 1-C Sonat Minerals North Hadden field discovery on production in April 1996, and 2-A Sonat Minerals.

Sonat expects its 1996 Louisiana chalk production on a barrel of oil equivalent (BOE) basis will account for about half of its total 6 million BOE Louisiana and Texas chalk production forecast for 1996.

Sonat is currently operating seven rigs that are drilling chalk objectives in both Louisiana and Texas, but it plans to increase its activity in the trend in Louisiana.

During 1997, Sonat plans a total Texas-Louisiana chalk capital program of $89 million, including $82 million for development. It plans to have interests in 46 wells, of which 33 will be in Louisiana. On the exploration side, Sonat's 1997 Texas-Louisiana chalk program calls for three wells budgeted at $3 million, with another $4 million earmarked for leasing.

Other work

Columbus Energy, Belco, and three individual private co-venturers have increased the size of their 44,000-acre Columbus-operated Area of Mutual Interest (AMI) to about 50,000 gross acres, encompassing North Bayou Jack field in Avoyelles and St. Landry parishes.

Columbus said it has proposed a plan for one dual-lateral well in the AMI, south of the A-1 R.O. Martin reentry in North Bayou Jack field, which was a Columbus group farmout obligation. The well has been plugged and partially cased.

Belco drilled a 3,900-ft horizontal lateral from the well's 15,333 vertical TD. The initial rate on test was 2.7 MMcfd of gas and 2,500 b/d of oil through a 1/2-in. choke with 1,000 psi flowing tubing pressure.

Terms call for Belco to next drill an offset dual lateral. Regulatory approvals have yet to be received for Belco to drill planned 4,500-ft dual laterals from a 15,400 TVD well, 1.8 miles south-southwest of the R.O. Martin reentry.

Belco also had a strike in 21-1 Turner, about 13.5 miles southeast of the A-1 R.O. Martin. A 3,850-ft single lateral was drilled from a TVD of almost 17,000 ft. The well had an initial test rate of 6 MMcfd of gas and 4,800 b/d of oil on a 20/64-in. choke with 6,800 psi flowing tubing pressure.

In mid-November, PI reported that Great West Energy & Exploration staked 1 Morgan et al. in Concordia Parish of Northeast Louisiana, which PI said was the farthest north chalk location to be drilled in the trend to date.

The 1 Morgan et al., in Esperance Point field, is surrounded by Wilcox oil producers and is targeted to a measured depth of 13,900 ft with a proposed 4,000 ft horizontal displacement.

The nearest chalk horizontal well drilled on trend is UPR's LaCour field in Point Coupee Parish, about 45 miles south-southwest.

Outlook

Based on current economics and anticipated success rates, operators say the play is expected to be slowed only by the need to add infrastructure.

Improvements to drilling technology stand to further improve the economics. Drilling costs are decreasing from the typical initial dual-lateral costs of about $6.5 million/completion to current average costs of $4-5 million/dual lateral completion and $2.5-3.5 million/single lateral completion.

"I suspect, in another year, you're going to be seeing $3.5-4 million dual-lateral wells," said Chesapeake's McClendon. "It's happened everywhere in the deep chalk to date.

"We know what mud programs work, what bit programs work. You just get better at it the more you do it."

Copyright 1996 Oil & Gas Journal. All Rights Reserved.