Larne basin exploration weighs Carboniferous potential

Tayvis Dunnahoe

Exploration Editor

Northern Ireland's Larne basin is sparsely explored, with only one oil and gas exploration well drilled in 1971 in the main fairway of the basin. New seismic technology and a recent gas show in a gas storage site test, however, are leading to new conventional exploration. A group of US and UK-based companies, including Horizon Energy Partners LLC and Petro River Oil Corp. in the US and InfraStrata PLC, Brigantes Energy Ltd., Terrain Energy Ltd., Ermine Resources Ltd., Baron Oil PLC, and Tudor Hall Energy Ltd. in the UK are spudding a well in late April on the Woodburn Forest prospect in onshore License P1/10 (Fig. 1). Data suggest the basin could contain up to 600 million bbl of oil and multiple tcf of gas.

Storage vs. production

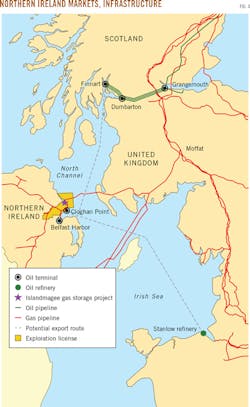

"Northern Ireland is dependent on natural gas for its power generation, home heating sector, and to respond to peaks in demand to support renewable sources," Horizon CEO Jonathan Rudney told OGJ. Because of its location, Northern Ireland is at the end of the line for gas shipments from Russia and Norway. In 2008, Islandmagee Storage Ltd. began developing a strategy to store natural gas in Permian salt beds beneath the Larne basin and was granted planning permission in October 2012. In June 2015, the consortium, which includes InfaStrata PLC and Moyle Energy Investments Ltd., drilled the Islandmagee-1 well in County Antrim under a mineral license to test the salt's storage potential (Fig. 2).

The well penetrated the Sherwood sandstone formation and in Permian limestones just below the Permian salt beds encountered gas shows that "could have only come from Carboniferous," Rudney said, adding, "Every Carboniferous basin in Europe has shown successful development."

The Woodburn Forest prospect is 7 miles from Islandmagee-1, and the close proximity has nearly doubled the chance of success of a hydrocarbon discovery in the Woodburn Forest test well.

The Permian salt was the primary target for the gas storage project. "There are two layers of salt-Triassic and Permian-which add to the exploration challenge but also helped present the opportunity, providing excellent seals," said InfraStrata CEO Andrew Hindle, whose company is participating in Woodburn Forest as operator.

The Woodburn Forest prospect is a three-way dip closed faulted structure with primary Triassic-Permian and secondary Carboniferous reservoir objectives located in the Larne basin. Combined P50 unrisked prospective resource is estimated at 25 million bbls of oil, with Triassic Sherwood sandstone accounting for 13 million bbl and the Permian Collyhurst sandstone with 12 million bbl.

The project partners have identified multiple structures at all three prospective reservoir levels, providing a gross license resource potential greater than 600 million bbl. The consortium has received drilling consent and will drill its Woodburn Forest-1 to a depth of 2,000 m (6,560 ft) in late April 2016. The conventional well will cost about £3.9 million.

Larne basin geology

The Larne basin was formed at the same time as the East Irish Sea, Midland Valley, and East Midlands basins in the UK sector, all of which have proven hydrocarbon systems.

The Larne basin is a southwest extension of the Midland Valley in Scotland and is separated from the Rathlin basin to the north by the Highland Border Ridge. In the Midland Valley, Permo-Triassic sediments have largely been eroded and it is Lower Carboniferous Dinantian sandstone, sourced by Dinantian oil shales, form the main play.

The Midland Valley is sparsely drilled for conventional exploration targets and focus has moved to its unconventional gas potential. The Permo-Triassic in the Larne basin is extensive and thick. Westphalian and Namurian coals have been mined at various locations.

The Lower Carboniferous is untested in the basin but Dinantian, Namurian, and Westphalian shales and coals are viewed as the likeliest source rocks. The Antrim Plateau fissure eruptions resulted in extensive basalt lava flows and dyke swarms in the area during the Palaeocene.

Near-surface basalt flows, up to several hundred meters thick, have historically limited seismic response from deeper structures, but recent advances in seismic processing techniques (by Calgary-based Kelman) have improved imaging of the Permo-Triassic.

New seismic acquired by InfraStrata PLC in 2011-12 showed the Larne basin as having similar structural architecture to the East Irish Sea basin, where tilted fault block traps are prevalent.

Exploration

To date only one exploration well has been drilled in the onshore PL1/10 block. Royal Dutch Shell's Newmill-1 was drilled in 1971 on a surface anticlinal feature with no seismic data coverage. The well reached a depth of 1,981 m (6,498 ft) and encountered several potential Permian and Triassic reservoirs and seals, but no hydrocarbons.

The well encountered the Sherwood formation at 2,279 ft and the Collyhurst at 5,159 ft. It was drilled off structure and failed to penetrate the Carboniferous under these formations.

Fynegold Petroleum Ltd. drilled its Ballytober-1 in 1990 on the margins of the basin, which came up as a dry hole. To the north of Lough Neagh, Annaghmore-1 was drilled in 1993 by Lough Neagh Exploration and encountered oil shows in the Permian Magnesian limestone. The follow-up well, Ballynamullen-1, drilled in 1995, was unsuccessful. Fault leakage was cited as the cause of failure in both it and Ballytober. In East Antrim, Cairncastle-2 was drilled by Antrim Resources in 2000 and penetrated the Triassic Sherwood sandstone. The well identified reservoir quality sand, but was abandoned as a dry hole.

Five other wells drilled in the province between the late 1950s and 1981 mainly sought coal or geothermal recources. Together with the oil and salt exploration wells, these have provided stratigraphic data on the Permo-Triassic succession, and two of these wells encountered oil or gas shows in the Permian.

Prospective reservoirs, risks

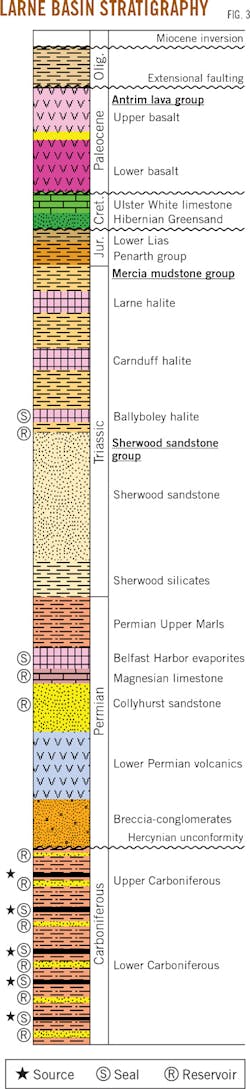

The main reservoir target is the Triassic Sherwood sandstone, which thickens from 100 to 1,500 m (300 to 5,000 ft) west to east across the area (Fig. 3). The overlying Mercia mudstones, which form a top seal, vary in thickness from 150 to 1,100 m (500 to 3,500 ft) and have significant salt content to the east. Cores from Newmill-1 show 18-25% porosity in the Sherwood sandstone and permeability between 28 md and >1 darcy.

The Newmill-1 well also encountered a Lower Permian Collyhurst-equivalent fluvio-aeolian sandstone up to 400 m (1,310 ft) thick. Cores from Newmill-1 show as much as 23% porosity with an average permeability of 200 md. Peripheral wells Annaghmore-1, Ballynamullan-1, Ballymacilroy, and Ballytober all encountered good reservoir intervals at the top of the Lower Permian. Top seal is provided by the Magnesian limestone, which is about 20 m (65 ft) thick. The overlying Upper Marl formation contains up to 300 m (984 ft) of Belfast Harbor evaporites in the license area's eastern portion.

Dinantian and Namurian Carboniferous sands and shales are secondary objectives in the license, with analogues in the East Midlands basin, home to numerous fields.

The new seismic also identified Permo-Triassic structures not imaged on vintage seismic. The Sherwood sandstone horizon suffers from low fold coverage, resulting in broken up reflectors. The deeper Collyhurst sandstone horizon has greater fold coverage in the stack, with improved signal to noise resulting in better reflectivity and amplitude characteristics. In common with the East Irish Sea basin, Permo-Triassic structures consist of tilted fault blocks with varying throws.

A total of six Sherwood and five Collyhurst discrete structures, and four stacked Sherwood-Collyhurst structures, have been mapped in the onshore license area. The central zone has greater coverage and is therefore better defined. Peripheral areas require further seismic data to evaluate drill locations. Pending success at Woodburn Forest-1, InfraStrata and its partners plan to acquire 3D seismic data in the region.

Even with the limited number of wells in the province, results show good distribution of a high-quality reservoir within the Triassic Sherwood group. The presence of salt in the Triassic and Permian intervals provides a top seal in the eastern portion of the basin, lowering exploration risks. To the west, salt is only present in the Triassic.

While previous shows evidenced the source rock, its extent and viability within the Larne basin remain unknown. Hydrocarbons have only been recorded as gas shows in the area of interest. The nearest oil encountered is in the Rathlin basin to the north, where Ballinlea-1 recovered oil from Carboniferous sandstone in 2008.

Exploration for now is focused on the onshore license. "We've identified several leads in the offshore area, but these will require further evaluation," Rudney told OGJ.

Market ready

The Larne basin has access to export options. The existing gas pipeline infrastructure within the onshore license area is within 5 km of any of the identified prospects (Fig. 4). Production from oil discoveries can be transported to Belfast Lough for export to refineries in the UK.

Current unrisked oil reserves are 7-13-30 million bbl (P90-P50-P10) for the Sherwood Sandstone and 5-12-20 million bbl for the Collyhurst sandstone. Gas resources are estimated to be 7-11-17 bcf (Sherwood) and 6-14-26 bcf (Collyhurst). The Woodburn Forest prospect has upside potential with stacked reservoir objectives.

The Larne basin is a frontier area with limited seismic data and historical drilling. "Large companies typically search for 100+ million bbl fields with the goal of replacing reserves," Rudney said. This dynamic forces large operators into frontier areas that often lack infrastructure, markets, and stable fiscal regimes.

Commercial risks can be impediments when the timeframe to first production can often be 5-6 years. "Smaller companies cannot accept this level of exposure," Rudney said. These risks involved in finding and developing large hydrocarbon accumulations internationally do not exist in Northern Ireland. A discovery would likely find a rapid path to market, stimulating the local economy.