Barents Sea exploration provides opportunity for new investment

Stacey Quarles

Jana Rieck

Ed Shires

Petros Farah

StrategicFit

London

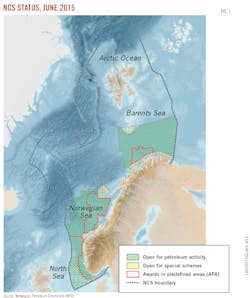

The northernmost area on the Norwegian Continental Shelf (NCS) is open for petroleum activity and presents opportunities for both veteran operators and new entrants to the region. Barents Sea exploration has produced four discoveries of more than 100 MMboe in the last 5 years and the Norwegian Petroleum Directorate (NPD) estimates yet-to-find hydrocarbon potential at 7.6 billion boe.

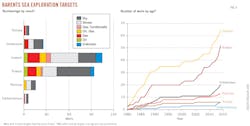

Norwegian Barents Sea exploration began in 1980, and operators have drilled about 100 wells across multiple basins in the region. As of yearend 2014, drilling targets ranged from Lower Carboniferous to Eocene.

Barents Sea exploration in 2015 has several advantages to earlier times. The previously disputed eastern area provides a new frontier basin for Norway, and committed exploration companies, especially majors with experience operating in Russia, can compete for this underexplored area. Partnering strategies also allow newer operators to build experience by working with companies that have already gained success in the region.

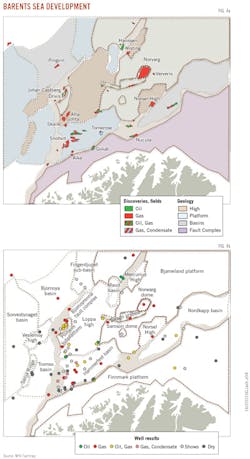

Norway's Barents Sea is bound by Russia's political border to the east and nonexploration areas to the south, west, and north. The region contains frontier and proven basins and intrabasin highs. The prospective geology spans west to east from Permo-Carboniferous through Jurassic, Cretaceous, and Lower Tertiary.

This article focuses on areas currently open for petroleum activity. New entrants can benefit from observing historic exploration well data as well as companies operating in specific plays, and the conditions of each play both above and below the surface (Fig. 1).

Recent success

Recent successes have stimulated interest in the Barents Sea. Drilling is at an all-time high, and in the last 10 years 60% of exploration wells have led to a discovery. Attractive fiscal terms and a stable political and regulatory climate also promote interest in the area.

The Jurassic and Triassic have been the main targets throughout the area's history. But in the last few years there has been success in the Cretaceous and Permian. These plays, which fell out of favor in the early 1990s, now have added potential.

The Barents has attracted a wide range of operators, from super majors to small independents. They've deployed several exploration strategies from focused to frontier or both, all of which have led to discoveries.

Commercializing Barents Sea discoveries is a challenge due to limited infrastructure with no spare capacity. Time from discovery to first oil should improve in the long term, but in the near term it is likely to remain 10 years. The Barents Sea operating environment-variable weather, extreme cold, and icing during the winter-poses additional obstacles.

The NPD's 23rd licensing round and awards in predefined areas (APA) 2015 will inform how the area evolves. Interest in both has been high, but will be tested by the low oil price climate. Companies seeking farm-in opportunities or bid placement in 2016 should observe the 2015 round.

Low maturity, high potential

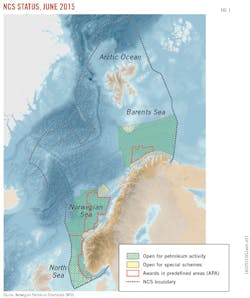

The Barents Sea is characterized by low exploration maturity and a high yet-to-find (YTF) resource (Fig. 2). To date, explorers have discovered an estimated 3.3 billion boe. The YTF potential more than doubles this at 7.6 billion boe, about two-thirds of which (5 billion boe) is expected to be gas and condensate.1

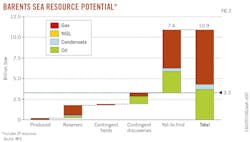

There were 48 discoveries in the Barents Sea as of yearend 2014. Of these, 26 discoveries are unlikely to be developed based on classifications and volume estimates from the NPD. This article adds Isfjell to the "not likely" group at an estimated 9 MMboe. Ten discoveries are included in "other discoveries." Remaining discoveries and NPD resource estimates are shown in Figs. 3 and 4.

Snohvit, consisting of seven discoveries, is the only producing asset and Goliat, formed of three discoveries, is the only field nearing execution.

Stable regulation, beneficial terms

Several factors apart from its predicted resource potential make Barents Sea exploration attractive. The NPD is one of Europe's most effective regulators. It provides clear and stable rules to guide activity as well as organized and accessible data that promote a level playing field for offshore exploration.

Taxes have been stable since the introduction of the Petroleum Tax Act in 1975, which includes favorable conditions for exploration. Direct taxes are applied to profits of entities rather than assets and consist of an ordinary petroleum tax at 27% and a special tax at 51%. An extra deduction, uplift, is allowed in calculating special tax, where 5.5% of the investment can be deducted annually for 4 years from the year of investment.2 3 Losses can be carried forward indefinitely. License partners have the added advantage of offsetting 78% of exploration costs annually.

Operational difficulties

The Barents Sea has a fragile ecosystem and operating there comes with a concern for environmental stewardship. The Norwegian fishing industry and environmental NGOs monitor petroleum industry operations and either could oppose future operations. Water depths range from 100-500 m in the areas of exploration focus and gas hydrates can pose drilling hazards.4-6

The main operational challenges in the Barents Sea are rapid weather changes due to varying atmospheric pressures, low temperatures (-30 °C.), and consequential icing from sea spray in strong winds. But the majority of the region does not have winter sea-ice cover and there are no differences in wind strength between the Barents and other areas of the NCS. Conditions are comparable to those in Alaska's Beaufort Sea.

Discoveries in the last 10 years have averaged 60 drilling-days, compared to the West of Shetland's 88-day average. In the Barents Sea, drilling days ranged 11-149 days with three outliers taking less than 20 days. In West of Shetland, drilling days ranged 21-361 days with one well taking longer than 150 days.

Operatorship will likely only be awarded to companies with a proven track record of best practices for safety and operations in extreme conditions. In 2015, the Barents Sea Exploration Collaboration (BaSEC) project, a 3-year initiative, was started to explore common operational solutions with focused working groups. Current members include Statoil ASA, Eni SPA, Lundin Petroleum AB, OMV AG, and Engie. Additional members will be considered after the 23rd round awards. The criteria for participation is either to have made a discovery in the Barents Sea or have two or more operated licenses north of 73° N.

Time to first production

Snohvit came onstream 23 years after discovery and produces through subsea equipment. Gas is transported to Melkoya Island through a 143-km pipeline where it is processed at Hammerfest LNG, Europe's first liquefaction plant. Associated CO2 is captured and stored. Planned upgrades to the processing capacity were delayed indefinitely in 2012, citing insufficient gas resources in the area to warrant an expansion.

Goliat, discovered in 2000, will be produced to an FPSO with 100,000-boe/d capacity and 1-million bbl storage. Associated gas will be reinjected. Startup was planned for 2013 but delayed. The unit, manufactured in Korea, arrived in Norway in April 2015 and expected to be online before the end of 2015, however, Eni announced delays in late December back to early 2016.

None of the other discoveries have a clear plan for commercialization. Statoil's plans for Johan Castberg, more than 200 km from Melkoya, have been put on hold until the second-half 2016. Operators of Wisting (OMV), Gohta, and Alta (both Lundin Norway AS), are continuing exploration and appraisal activities in the area in an effort to increase resources and justify a potential new development. Producing and transporting hydrocarbons from this region requires complex engineering of subsea and surface installations, including those managing CO2. As the area matures, discoveries and infrastructure are added, and technology and market conditions advance, time from discovery to production should decrease from its 10-year average.

Gas or oil?

Viewed regionally, hydrocarbon fluid types as tested in discoveries or identified through shows do not yet reveal distinct and discernible geographic trends: i.e., basin-centered gas or a specific gas-prone basin (Fig. 4a, 4b). The hydrocarbon systems in the Barents are marked with complexities related to Cenozoic tectonics and Quaternary erosion that leave them less well understood than in the North Sea and Norwegian Sea.7

Of the 48 discoveries, 21 have been gas-only and 17 have discovered a mixture of gas and oil. Recently companies have had more success discovering oil, with three of the five oil-only discoveries occurring in the past 3 years.

Exploration activity

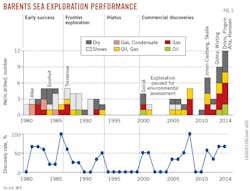

After Norway opened the Barents to exploration in 1979, activity was concentrated almost entirely in the Hammerfest basin and on the southern edges of the Loppa High, with 25 wells drilled by 1986. The discovery rate was high at 44%, 11 of the 25 (Fig. 5), bolstering hopes for the Hammerfest basin. Targets were primarily in the Triassic and Jurassic, but some well commitments required drilling to the Devonian. In addition to the Mesozoic reservoirs at discoveries such as Snohvit, shows were encountered in wells in the deeper Paleozoic section.

Operators stepped into new frontiers 1987-94, drilling 22 wells in total. Broader drilling across the region saw a drop in the discovery rate to 32%. With fewer commercial discoveries and falling oil prices through the late 1980s and early 1990s, drilling activity went on hiatus 1994-99.

In 1997 the NPD initiated The Barents Sea Project to encourage exploration. New production licenses and seismic areas were awarded and drilling restarted in 2000. The country imposed an additional hiatus 2002-04 to carry out environmental evaluations, which informed a thorough management plan for how to phase future licensing and drilling. Since 2005, 45 exploration wells have been drilled (as of yearend 2014), with 60% leading to a discovery, the highest success rate in the basin's history (Fig. 5).

Geotechnical background

Looking back at the target age over time shows the prolonged focus on the Triassic and Jurassic reservoirs (Fig. 6). Within the last 5 years the lesser tested Cretaceous and Permian have also been targeted with some success.

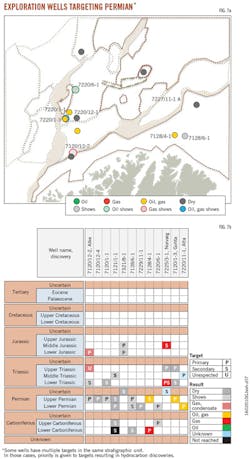

Exploration wells targeting the Permian initially had low levels of success. Of the first eight wells that targeted the zone 1981-94, only one led to a discovery. But these initial wells did provide hope for the section.

Drilled in 1981 by Norsk Hydro, 7120/12-2 targeted primarily the Mesozoic but also sought to test a seismic marker believed to be a Permian carbonate. Gas was discovered in the Jurassic and Triassic primary targets. Gas shows were also indicated in Permian sandstones which proved to have poor permeability on reservoir flow tests.

In 1985 Norske Shell drilled the first well on the Loppa High. With a commitment to drill to the Devonian, the 7120/1-1 was aimed to test Palezoic carbonates and clastics. The secondary target was early Triassic sandstones. The late Permian encountered proved to be carbonate with limited porosity indicated on the logs but with oil shows throughout.

The operator performed production testing, but found no flow of pore fluids even after acid stimulation. The shows provided encouragement for oil potential in the Permian section, but appropriate reservoir quality was still elusive. Of the four wells with primary or secondary targets in the Permian following 7120/1-1, only 7128/6-1 had shows in the Permian. The remaining wells were dry.

The first Permian discovery came 14 years after first targeting the formation when Statoil completed the 7128/4-1 well in the frontier Finnmark Platform in 1994. The operator sampled gas and oil from tight carbonate intervals during tests. Two zones were perforated and tested with minimal flow coming only after stimulation of the interval.

These initial wells were followed by a long pause in Permian-targeted exploration drilling, with only the 7220/6-1 well drilled between 1993 and 2011. This well encountered residual oil with good oil shows in the Early Permian and Late Carboniferous.

A turning point came in 2013. Lundin, continuing its Loppa High campaign after success at Skalle, had the first possibly commercial oil and gas discovery in the Permian, with 7120/1-3 on the Gohta prospect (OGJ Online, Oct. 2, 2013). Primary targets included the lower Triassic and uppermost Permian, where explorers anticipated reservoir quality would be promoted by karstification due to phases of uplift and exposure.

As predicted, the Permian karstified carbonates were hydrocarbon bearing. The operator confirmed a 34-m gas column and 75-m oil column, which became the first successful drill stem test in Permian carbonates on the NCS. Earliest oil shows were recorded in the lowest Jurassic, but the Triassic sands encountered were water wet. Further appraisal drilling confirmed the additional presence of condensate.

Alta, another Permian oil and gas discovery by Lundin, followed on the southwest Loppa High with 7220/11-1 in 2014. Further appraisal has been made, with wells drilled in 2015 and two more appraisal wells planned for 2016 to validate the predicted resource range (OGJ Online, Oct. 14, 2014) (Fig. 7).

Long term planning

The high yet-to-find potential, preferential tax regime, stable regulatory framework, and falling operational costs, make the Barents Sea an attractive region for those willing and able to explore. A focus on exploration now could help companies reach a position to exploit any future upturn in oil prices.

Statoil, with years of experience and committed investment in the territory, may have the home field advantage in the Barents Sea. But Lundin, Eni, OMV, Engie, and Total SA have succeeded here as well.

New entrant's strategic plans should clearly understand and account for the time needed to build and test a portfolio. Additionally, operatorship is not awarded freely by the NPD. Companies will need a proven track record of operating in extreme conditions coupled with sustained commitment in the area.

Looking ahead

Forty companies took part in nominating blocks for the 23rd round in January 2014, with multiple companies nominating the same blocks. There are three distinct areas of blocks on offer:

• Just north of Alta and Gohta.

• Near the Wisting discovery.

• In the newly ratified eastern region on the border with Russia.

In spite of oil prices tumbling by more than half from the time of nominations, 26 companies applied for new exploration acreage. License awards are expected before summer 2016. Interest in acreage in pre-defined areas in the Barents has also remained resistant to oil price changes and has increased compared to the previous year.

The next opportunity to enter licensing rounds is in APA 2016 with applications expected in Q3 2016. But with current oil prices, farmin opportunities could provide the best entry route into the Barents for investors eager to move quickly.

At the time of this writing, the Barents licensing round was continuing to unfold. Some operators will increase commitment in the area, and some will likely exit. Veterans may continue to lead the pack, or new investors could change the exploration dynamics for Barents Sea operations.

Editor's note: At the time this article was processed for publication, the APA2015 Awards were not yet announced and were expected to be made public in late January 2016.

References

1. Norwegian Petroleum Directorate website (www.npd.no/en/)

2. Norsk Petroleum, (www.norskpetroleum.no/en/framework/petroleum-tax/), updated Aug. 10, 2015.

3. Davis, L. "Fiscal Regimes: UK vs Norway," Petroleum Review, June 2012, p. 22.

4. "BARENTSwatch," Bioforsk Soil and Environment, Svanhovd, 2006, p. 40.

5. Matishov, G., Golubeva, N., Titova, G., Sydnes, A., and Voegele, B., "The Barents Sea Report," United Nations Environmental Program, Barents Sea: Global International Waters Assessment 11, Aug. 24, 2004, p. 118.

6. Ims, B., "Emergency preparedness in Arctic oil and gas exploration," master's thesis, May 27, 2013, p. 150.

7. NPD, "CO2 Storage Atlas: Norwegian Continental Shelf," May 20, 2014.

The authors

Stacey T. Quarles ([email protected]) is a principal at StrategicFit, London. She has also served as team lead West of Shetlands and northern North Sea at Nexen UK and as senior geophysicist at Nexen USA. She holds an MS in geology from The University of Texas at Austin and a bachelor's from Bryn Mawr College in Pennsylvania. She is a director of the Association for Women in Geoscience Foundation and a fellow of the Geological Society of London.

Jana Rieck ([email protected]) is a senior consultant at StrategicFit, London. She has also worked for Quintain, a property investment and development company. She has a BA in physics from Oxford University.

Ed Shires ([email protected]) is a senior consultant at StrategicFit, London. He has also served as a research scientist in the emissions control technology group at Johnson Matthey. He holds an MS in chemistry from the University of Bristol.

Petros Farah ([email protected]) is a consultant at StrategicFit, London. His background is in science and technology, with a PhD in nanophotonics from the University of Cambridge and an MS in physics from the University of Bristol.