Oil and gas industry capital spending in the US will increase 5.2% in 2014 to $338 billion, according to Oil & Gas Journal's annual spending report. Capital expenditures also will climb in Canada this year, up 2.4% to $80 billion (Can.).

Upstream operations will contribute mostly to this rise in spending. After a slow drilling pace through 2013, drilling activity is expected to rebound this year in both the US and Canada, assisted by increases in drilling efficiency.

After experiencing a boom last year, pipeline spending in North America will take a pause this year due to decreases in planned construction.

Worldwide E&P spending is expected to continue solid growth this year, led by the Middle East, Latin America, and Russia, according to the most recent Barclays E&P Capital Spending Survey released Dec. 9, 2013.

US upstream spending

OGJ projects that spending in the US for upstream operations will increase 9.3% this year to $299 billion. This includes outlays for oil and gas exploration, drilling, production, and offshore lease payments to the US Bureau of Ocean Energy Management.

US exploration and drilling spending this year is estimated at $250 billion, up 9.3% from last year. Outlays for production this year will total $47.5 billion, up from $43.5 billion last year. From an oil and gas perspective, most of the spending growth to be on the oil side, given the current commodity price levels.

The 2013 spending estimates for the above two categories were revised downward due to slower drilling pace through the year. A total of 38,158 wells were estimated to have been drilled in 2013 in the US, down from an initial estimate of 42,156 (OGJ, July 1, 2013, p. 41).

The US well count is expected to rebound in 2014, as a result of a combination of factors including increased drilling efficiencies and the continued shift to horizontals in the Permian basin. The US land wells to rig ratio increased to 5.34 in fourth-quarter 2013 from 4.92 a year ago. The industry is allowed to increase the well count, even with a flat rig count.

RBC Capital Markets is expecting an increase of 48 land rigs in the US (+4%) in 2014 with total horizontal wells drilled increasing 8% to 20,061. A less-optimistic Baker Hughes Inc. noted that for US onshore, the rig count will be essentially flat compared with last year, reaching an exit rate of 1,710 rigs at yearend. Despite the flat rig count, the US onshore well count will increase 5% compared with last year because of continued drilling efficiencies.

The Permian basin will experience an uptick in horizontal drilling this year. OGJ expects that horizontal rigs in that basin to increase 35% and horizontal wells drilled overall to increase nearly 40% from current levels.

In the Gulf of Mexico, an additional 17 floaters have been slated for deployment thorough first-quarter 2015, says Barclays. This supports 58 contracted deepwater rigs in the area. RBC Capital Markets projected a total of 73 offshore rigs in the US and Canada in 2014, 26% higher than last year.

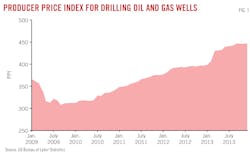

Drilling costs as measured by the Producer Price Index continue to climb, reaching an average of 434.3 in 2013. The index averaged 391.6 in 2012. OGJ expects higher drilling activity in 2014 will push up demands for professionals, services, and materials, giving rise to a further high index value.

Another component of US upstream spending is the total of bonus payments that BOEM collects from lease sales for tracts on the Outer Continental Shelf.

BOEM has three lease sales—225 (eastern gulf), 231 (central gulf), and 238 (western gulf)—slated for this year. OGJ estimates that a total of $1.6 billion will be generated by these three sales. BOEM last conducted two lease sales (227 and 233) and received $1.3 billion worth of bids.

Firms' spending plans

Chevron Corp. said it plans to invest $35.8 billion for E&P activities in 2014. Of the total, $7.9 billion will be spent in the US. Notable major capital investments in the US include developments in the deepwater gulf and the Permian basin.

ConocoPhillips announced a 2014 capital expenditures budget of $16.7 billion. About 55% of the budget is allocated for North America. The company's development drilling programs in the Eagle Ford, Bakken, and Permian will receive most of the investments. More capital will be allocated to Alaska in 2014 vs. 2013, reflecting increased spending on the CD-5 development and higher activity resulting from the passage of the More Alaska Production Act (SB21).

Hess Corp. reported a 2014 budget of $5.8 billion, down slightly from last year. Of this total, $2.85 billion will be dedicated to unconventional shale resources, of which $2.2 billion will be used for the development of the Bakken shale in North Dakota. The company also plans to increase expenditures in the emerging Utica shale play to $550 million from $455 million last year.

Marathon Oil Corp. reported a $5.9 billion capital investment and exploration budget for 2014, more than 60% of which is directed toward the company's high-growth, liquids-rich North America resource play assets.

Occidental Petroleum Corp.'s capital spending plans call for $10.2 billion in outlays in 2014, up from $8.8 billion last year, of which 81% go to oil projects.

US downstream outlays

OGJ forecasts that capital competition from new logistic infrastructure plans and weakness in 2013 refining earnings will affect investments directed to refining and marketing. However, products export demand growth and comparative advantage on US light crude oil prices are still supporting long-run US refining and marketing expansions, especially after logistics systems catch up.

Capital spending this year for refining and marketing will total $12.9 billion in the US, up slightly from $12.8 billion last year. Leveraging light crude oil processing, increasing distillate yield and conversion capacity and growing export capacity are strategies adopted by many operators. Turnaround costs will be moderated this year.

Valero Energy Corp., the largest US independent refiner-marketer, has allocated $3 billion for its capital spending plan, up from 2013 outlays of $2.76 billion, with growth investments comprising about half of the total.

This year's strategic projects related to processing light crude oil will receive a major boost with spending surging to $412 million from $88 million a year ago. The company's plans include adding a 70,000 b/d unit at its Corpus Christi, Tex., refinery at an estimated cost of $340 million, and a 90,000 b/d topping unit in Houston at a cost of $390 million by yearend 2015. This compares with a $252 million reduction in 2014 hydrocracking growth investment.

Phillips 66 reported a consolidated capital spending estimate of $1.14 billion for refining and marketing in 2014, compared with $1.16 billion last year.

Marathon Petroleum Corp. plans for refining and marketing capital expenditures of $864 million, up from $802 million last year. The company is increasing existing capacity to run light sweet crude and capitalizing on global growth on diesel demand, in efforts to enhanced margins in refining operations.

Plentiful and affordable natural gas and natural gas liquids from US shale formations are spurring North America petrochemical capital expenditures. OGJ forecasts US petrochemical spending to increase 51% to $5.6 billion in 2014 and also revised up estimates for the previous 2 years.

According to the American Chemistry Council, incremental US chemical industry capital expenditures through 2023 arising from shale gas-induced renewed competitiveness reached $100 billion (in 2012 dollars). Petrochemical spending comprises the bulk of new capital investment.

Chevron Phillips Chemical will be investing in the construction of a 1.5 million tonne/year ethane cracker as well as two polyethylene facilities on the US Gulf Coast, each with an annual capacity of 500,000 tonnes.

Oxy's 2014 petrochemical budget will increase more than $100 million because of the Mexichem joint venture reported last year. The company's Johnsonville chlor-alkali plant is expected to come online early this year.

Pipelines, other transportation

This year OGJ adopts a better way in capturing cost per mile of pipelines by distinguishing constructions from urban and rural areas. This leads to downward revisions of 2013 and 2012 pipeline spending figures.

After an investment boom in 2013, pipeline expenditures will decline this year in the US due to decreases in planned pipeline construction.

OGJ's most recent Worldwide Pipeline Construction special report identified plans for the construction of 3,357 miles of crude and products lines and 1,323 miles of gas pipelines in the US this year (OGJ, Feb. 3, 2014, p. 88). Plans in 2013 called for construction of 4,121 miles of crude and product lines and 2,216 miles of gas lines (OGJ, Feb. 6, 2013, p. 98).

Capital expenditures for oil and product pipelines, including pump stations, will total $9.2 billion. This represents a 42% plunge in capital outlays from 2013. Spending for gas pipelines and associated compressor stations will slip 60% from the previous year to $3.7 billion.

Despite the decline in pipeline spending, capital continues to pour rapidly into other midstream and transportation sectors this year, expecting a growth of 53%.

According to the Association of American Railroads, US freight railroads are estimated to have carried more than 400,000 carloads of crude oil in 2013, compared with 230,000 carloads in 2012. This trend will continue this year.

Canadian E&P, oil sands

Capital expenditures for exploration, drilling, and production in Canada will rise 4% to $39.4 billion (Can.), following a 4.6% decline in 2013.

OGJ expects a return of Canadian drilling activity as well this year. The number of wells drilled will climb above 11,800 after falling to 11,317 last year (OGJ, July 1, 2013, p. 41). There were 12,087 well completions in Canada in 2012, according to the Canadian Association of Petroleum Producers.

The increase in drilling activity in Canada is driven primarily by Duvernay shale plays, LNG exports, and the coming online of logistic systems.

Oil sands capital spending, which includes funds for in-situ extraction, mining, and upgraders, will increase 5% from a year ago to about $33.5 billion. This follows an increase of 17% last year.

CAPP reported that oil sands capital expenditures totaled $27.2 billion in 2012, the latest year for which the association has reported such data.

Two major Canadian oil sands projects, including Shell Canada Ltd.'s Carmon Creek project and Suncor and partners' Fort Hill project, will proceed.

Suncor's spending on oil sands will increase to $4.45 billion this year, up from an estimated 2013 outlay of $4.2 billion.

Canadian Natural Resources Ltd. will allocate $4.47 billion to oil sands projects, 16% more than last year.

Canadian Oil Sands Trust, the largest joint venture owner of Syncrude, reported that its capital costs will total about $1.09 billion in 2014, down from $1.3 billion last year. The spending cut comes as long-term projects like the relocation of production trains at its Aurora North Mine and a tailings management project completed in 2013, the company said.

Companies likely to reduce oil sands expenditures also include MEG Energy and Cenvous Energy.

Other Canadian capital outlays

Refining and marketing spending in Canada is set to increase to $3.1 billion (Can.) from $2.3 billion last year.

The North West Redwater Partnership's bitumen refinery project has been delayed as the initial cost estimate of $5.7 billion to build the refinery has risen to $8.5 billion. The government of Alberta has recently approved up to $1 billion in financing for the delayed refinery project.

Suncor plans capital spending of $960 million on refining and marketing, a 32% increase from last year. Cenvous will spend $150 million, up from $100 million last year.

Petrochemical outlays are expected to climb to $1.2 billion from $800 million last year, driven by low gas costs and abundant feedstock supplies.

Nova Chemicals plans for strategic petrochemicals expansion in Ontario and Albert, assisted by increased ethane supplies. The company has decided to move forward with the next phase of the Nova 2020 growth strategy, which will lead to continued capital spending.

Williams has been building an $850 million propane dehydrogenation plant in Alberta.

Capital spending this year for pipelines will decline after last year's boom, as a result of reduced construction plans. Pipeline spending estimates for the previous 2 years have also been revised down, reflecting a new cost per mile parameter. Other transportation spending, including LNG, is expected to increase substantially.

Spending outside US, Canada

Upstream spending outside the US and Canada is forecast to continue solid growth this year, particularly in the Middle East, Latin America, and Russia, according to the aforementioned Barclays E&P spending survey.

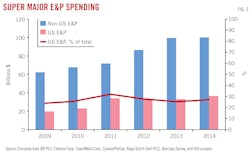

The survey expects international E&P spending to reach a record of $524 billion in 2014, 6% higher than last year. Sustained high oil prices, the sanctioning of major projects, and the delivery of a large number of offshore rigs in both 2014 and 2015 are driving the increase in spending. This is partially offset by transitory Chinese spending slowdown and limited growth by the majors.

Led by strong growth in Saudi Arabia and Kuwait, E&P spending in the Middle East is expected to climb 14% this year, Barclays said. Expenditures in Latin America and Russia will register increases of 13% and 11%, respectively.

Mexico's state-owned Petroleos Mexicanos (Pemex) plans to spend $27.7 billion in 2014, up from $26 billion in 2013 and $23.6 billion in 2012. Of the total, 85% will be spent on upstream operations.

Brazil's Petroleo Brasileiro SA (Petrobras) is expected to take a pause in spending (-2%) this year, attempting to lower leverage levels and increase cash flow returns, according to Barclays. The company has reported a $236.7 billion budget over its 2013-17 business plan, with 62.3% allocated to E&P.

Many European oil companies, including Statoil, Royal Dutch Shell PLC, BP PLC, and Centrica, have indicated the will to keep a lid on capital spending in the short to medium term in efforts to drive capital efficiencies and improve returns.

After a major profit warning, Shell will reduce spending including acquisitions by 20% to $37 billion this year. Statoil from 2014-16 will invest an average $20 billion/year, a reduction of 8% from previous estimates.

Some US-based companies have also released details of their capital budget plans outside North America. ConocoPhillips reported that in Europe, Asia Pacific, and other international businesses, its E&P capital program this year will be $7.5 billion, compared with a budget of $6.3 billion last year. Chevron's $54 billion Gorgon project in Australia has been under construction for 4 years and is three-fourths completed. This year will represent the peak year for spending on the company's Australian LNG projects as they move closer to first production.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.