Study develops Fayetteville shale reserves, production forecast

Topics Covered in the Webcast:

- Key influences in the global and US oil markets

- How past forecasts compared against actual historical data

- Forces influencing global oil demand, supply, and prices

- Major trends in US oil product markets

- How oil and gas from unconventional resources are reshaping markets in the US and around the world

View Industry Forecast and Review Webcast Now |

John Browning

Scott W. Tinker

Svetlana Ikonnikova

Gürcan Gülen

Eric Potter Qilong Fu

University of Texas

Austin

Katie Smye

Susan Horvath

Tad Patzek

Frank Male

Forrest Roberts

A study of reserve and production potential for the Fayetteville shale in north central Arkansas, forecasts a cumulative 18 tcf of economically recoverable reserves by 2050, with production declining to about 400 bcf/year by 2030 from the current peak of about 950 bcf/year.

The forecast suggests the formation will continue to be a major contributor to US natural gas production.

The Bureau of Economic Geology (BEG) at the University of Texas at Austin conducted the study, integrating engineering, geology, and economics into a numerical model that allows for scenario testing on the basis of an array of technical and economic parameters.

This is the second of four basins studied. The first was the Barnett (OGJ, Aug. 5 and Sept. 2, 2013). The third on the Haynesville and the fourth on the Marcellus have just been completed. Results of these four basin studies will help constrain forecasts of future economic US shale gas production.

Other key findings of the Fayetteville study include:

- Original free gas in place of 80 tcf for the 2,737-sq mile study area.

- Technically recoverable gas resources of about 38 tcf.

- Base-case total field estimated ultimate recovery (EUR) of 18.2 tcf, which includes 6.1 tcf EUR from the 3,689 wells drilled through 2011.

- Base-case drilling of 6,428 new wells through 2030, added to the 3,689 wells drilled through 2011, for a total of 10,117 wells drilled through 2030.

- Base-case field-wide production reaches a plateau of around 0.95 tcf/year and will slowly decline after most of the better locations are drilled.

- Wells drain the formation according to a linear transient flow model for the first 3-5 years, resulting in decline rates inversely proportional to the square root of time, later shifting to exponential decline as a result of interfracture interference within the well drainage volume.

- Adsorbed gas greatly contributes to production and is accounted for in well-decline modeling and in EUR calculations.

The BEG analysis is built on production data from all individual wells drilled 2005-11 in the Fayetteville shale. The study takes a "bottom-up" approach, starting with the production history of every well and then determining what remains to be drilled under various economic scenarios. The result is a publically available view of the field that is unprecedented in its comprehensiveness.

The study assesses natural gas production potential in six productivity tiers and uses those tiers to forecast future production. Well economics vary greatly across the basin as a function of productivity, well and other costs, and geology. The study's production forecast model accounts for this granularity, as well as for distributions around natural gas price, drilling cost, economic limit of each well, advances in technology, and many other geologic, engineering, and economic parameters, in order to determine how much natural gas operators will be able to extract economically from future wells in the field.

Integral to the project is a new method of estimating ultimate production for each well on the basis of the physics of the system, rather than mathematical decline-curve fitting. This method offers an accurate means of forecasting production declines in shale wells in other basins.1

For the purpose of tiering and decline-curve analyses, the study uses all 3,689 wells that produced through 2011. The production outlook model forecasts field development 2012-30 and then further extends production forecasts through 2050.

Although 2012 wells do not have a long enough production history to provide stable decline analysis for forecasting, they do allow us to benchmark our forecast against actual 2012 drilling and production results—an important vetting process. Although the model can run countless scenarios, we report on a base case assuming $4/Mcf natural gas and other relatively modest technical and economic assumptions.

Geologic characterization

We chose our study area to encompass the extent of previous drilling within the known geologic boundaries of the field. A total of 2,737 sq miles was included, although only 1,252 sq miles had been tested by drilling through 2011.

Following the steps outlined in the Barnett shale analysis (OGJ, Aug. 5, 2013, p. 82),2 we performed a log-based assessment of the key geological parameters influencing production in the Fayetteville shale. For the study, we digitized and utilized logs that were deep enough to reach the base of the Fayetteville (including gamma ray, density porosity (DPhi) and neutron porosity (NPhi) logs) and showed good log quality and caliper (measure of hole quality).

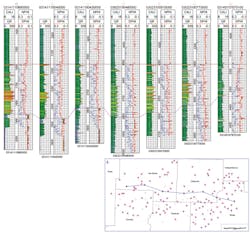

Our dataset consisted of logs from 153 wells chosen to maximize spatial coverage of the field. Major stratigraphic tops were picked in all wells (Fig. 1), and the analysis considered the effect of thrust-sense deformation and normal faulting, which lead to, respectively, thickening and thinning of the formation.

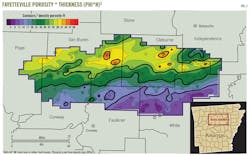

Net pay-zone thickness and density porosity maps were developed and combined to create a net porosity-thickness (DPhi*H) map (Fig. 2).3 When calculating free original gas in place (OGIPfree), we used industry-proprietary core porosities from 76 wells supplemented by calibrated density log porosity for about 20 additional wells to estimate the storage volume in the Fayetteville shale. The porosity-thickness map was found to provide a good correlation to well productivity, a key element in predicting future field production from undeveloped areas of the field.

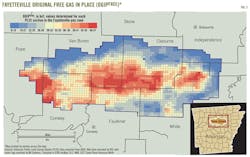

We calculated OGIPfree, excluding adsorbed gas, for the entire play on a section-by-section basis, utilizing a conventional volumetric approach (Fig. 3). Temperature and pressure were calculated as a function of reservoir depth. We assumed a constant water saturation of 25% and gas properties typical for similar reservoirs.

Total OGIPfree was estimated at 80 tcf, with 45 tcf underlying sections that were penetrated by at least one well by yearend 2011. Variation in depth of the Fayetteville shale leads to increasing formation pressure from north to south. In light of this, pressure was identified as another important element of OGIPfree. The Fayetteville OGIPfree map also includes interior faulting, taken from published structural maps.4

We recognize that the geologic description could have been enhanced greatly by analysis of seismic data to identify faulting and other anomalies. Seismic analysis was beyond the scope of the study, however, and Phi*H, together with pressure, appears to be adequate to explain the first-level geologic drivers of production and to predict productivity across the field. 3D seismic data would be more crucial at an individual prospect level.

Production decline; economic analysis

The study conducted decline analysis on all 3,689 wells drilled through 2011 in order to determine their individual EURs.1 Some of the key input variables in the study included:

- Base-well declines.

- Effects of late-life deterioration in decline, owing to interfracture interference within the well's drainage area.

- Effects of attrition, recognizing that a percentage of wells are lost each year for mechanical issues or economic limit below which wells are shut in.

- An assumed maximum 20-year life for all wells. The base case yields an expected lifetime EUR for 3,689 wells drilled through 2011 of 6.1 tcf.

The study utilized a well-production-decline method on the basis of linear transient flow in the reservoir.1 Linear transient flow results in per-well production decline inversely proportional to the square root of time for the first 5-8 years of well life (depending upon reservoir properties and completions), followed by exponential decline as interfracture interference begins to affect production.

The approach was supplemented by 3D reservoir simulation accounting for the effect of adsorbed gas. The adsorbed gas was found to contribute as much as 25% of wells' EURs, but this contribution varied across the play.

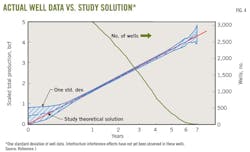

A theoretical solution of linear flow would yield a straight line increase of cumulative production vs. log time until interfracture boundary conditions were reached within the well fracture pattern, resulting in the predicted gentle downturn.

We normalized production from these 3,114 wells to the median EUR, then plotted cumulative production vs. log-time distribution, along with the study's theoretical solution (Fig. 4). The other 383 wells were found to be experiencing interfracture interference.

Reservoir quality tiering

Knowledge of the EUR and location for every well in the field allowed us to map the geographical distribution of productivity by individual section. A straightforward application of EUR would have been inappropriate because the well population contained a variety of completion technologies that affect EUR.

Therefore, we first analyzed the relationship between EUR and lateral well length, finding that EUR of a well increases with lateral well length, but that the average incremental EUR per unit of lateral length does not change significantly with length.

Using this information, we normalized EUR as if all wells had been drilled to a uniform length (we used 4,400 lateral ft in order to reflect current drilling practices). The normalized EURs for all wells were then split into 300-ft long horizontal segments along the well-drilling path.5

Directional surveys for all wells were plotted, and all length-normalized EUR/foot values for 300-ft-long segments within each section were averaged. The resulting average length-normalized EUR/foot for each section allowed for a productivity ranking of all sections penetrated by at least one horizontal well.

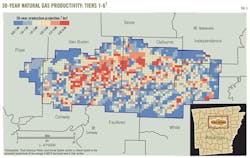

These drilled ranked sections were then divided into six productivity tiers. The undrilled sections were assigned tiers with mathematical interpolation in order to yield a full-field productivity-tier map (Fig. 5).

Tiering indicates areas of higher productivity. We refer to this map as a "rock quality" map because of this close correspondence. That said, the map indicates that the reservoir has considerable heterogeneity, with better performing blocks interspersed with poorer performing blocks. In some cases, better performing wells and poorer performing wells exist next to each other in the same block. The field flanks, where the reservoir thins, have relatively low productivity.

Well recovery, drainage area

Reservoir volumetrics are calculated with the following:

- PhiH.

- An assumption of 25% connate-water saturation.

- Reservoir pressure and temperature for each well as a function of well depth using normal gradients.

- Typical gas properties in order to derive the gas expansion factor (Bg).

Original OGIPfree is mapped by section. Total OGIPfree for the 2,737-sq mile study area is 80 tcf, with about 45 tcf in sections drilled by yearend 2011.

We then use EUR calculated for every well, combined with reservoir volumetrics, to quantify the volume of reservoir drained by each well. We call the surface expression of this volume "drainage area" and represent it with a rectangle.

We recognize that actual drainage areas are not ideal rectangles and that the combination of hydraulic and natural fractures can extend production reach farther than one location away, but rectangles provide a shape that is somewhat consistent with microseismic results, as well as a means of accounting for the drained volume.

Initially, it is unclear whether wells drained a large volume with a small recovery factor (RF) or a small volume with a large RF to achieve the EUR calculated for a given well. Adsorbed gas contribution also affects the calculation of drainage area.

To determine RF, we first observed closely spaced wells that appeared to interfere with each other based on changes in the original well-decline pattern as nearby wells are added.

We found that many closely spaced wells exhibit some interference, indicating that drainage areas were about equal to current well spacing in closely spaced sections. Calculated solely on a free-gas basis, the drainage areas appear to be much larger than what can be assumed on the basis of current well spacing.

We next developed 3D well simulations of specific closely spaced sections and adjusted recovery factor and adsorbed gas contribution until the recovery factor, drainage area, and predicted well declines matched actual well performance. On the basis of the simulation results, we incorporated adsorbed gas to match declines across the field.

From drainage-area calculations for every well, we were able to approximate the amount of drained and undrained acreage for each section (about 1 sq mile) across the reservoir. Then, assuming that we know the acreage left undrained by the wells in each section, we created an inventory of future feasible drilling locations based on expected recovery factors, expected EUR, and estimated OGIPfree by tier for every location (Fig. 6). The better tiers are more developed, and the lower tiers remain uneconomic at almost any foreseeable gas price.

Well economics

We analyzed the production history of every well in each tier to determine average well profiles in each productivity tier. As discussed, the EUR of every well was determined with linear transient-flow-decline equations and including the effect of interfracture interference and adsorbed gas. An average production profile for a 4,400-ft horizontal well is developed for each tier on the basis of estimates for wells in that tier. This procedure lays down the foundation for future production modeling.

The study looks at average EUR/well/tier, assuming a 20-year well life (Table 1). For the top five tiers, about 65% of EUR is recovered during the first 5 years, roughly 85% in first 10 years, and 94% in first 15 years. The actual average EUR for all wells is likely to be lower because attrition and economic limits will prevent some wells from producing for the full 20 years.

The study's production model includes the effect of historical attrition rates, which are found to increase as the rock-quality tier decreases. This finding indicates the importance of understanding the distribution of rock quality for economics of future drilling and production forecasts and the risks of using a single fieldwide average.

The average well profile in each tier is used to estimate average well economics. A representative set of well economic parameters was validated with input from operators in the Fayetteville field (Tables 1, 2).

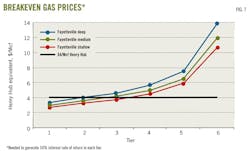

A comprehensive well–cash-flow model to determine the internal rate of return (IRR, %) for an average well in each tier for three depth ranges in the field was used to account for the impact on drilling costs (Fig. 7).

Production outlook

On the basis of the productivity tier map, inventory of future well locations available in each tier, and an understanding of the economics of an average new well in each tier, we model the pace of future development activity in the field. An activity-based model allows for prediction of new drilling on the basis of available-location inventory and well economics. The pace of activity is adjusted annually in the model, constrained by the economics of the average well in a given tier.

With respect to economic incentives to drill, our model distinguishes six productivity tiers and three TVD depth ranges. The historical pace of drilling is used to help scale the model's reaction to changing price in the future. The model tracks the number of wells drilled in each tier each year and totals the production effect with average well profiles by tier.

The production impact of new drilling activity is then layered on top of the extrapolated production decline of all historical wells drilled. In other words, the model accounts for the observed inertia of drilling to predict how the pace of drilling will increase or decrease as a function of price incentive (change in IRR) and size of the remaining well inventory, based on reservoir quality.

The model allows for variation of many parameters in addition to the price of natural gas. For example, we can restrict the developable area, i.e., due to surface limitations or spacing inefficiencies such as leasing obstacles, and make many other such realistic adjustments. The result is a forecast of future completions from the field through 2030 and a resulting full-field EUR through 2050 for any set of assumed parameters.

The model is driven by key assumptions that include:

- Average well declines.

- Effects of late-life deterioration in decline.

- Effects of attrition.

- Maximum 20-year life for all wells.

In the base-case scenario, we allow development of a maximum of 80% of the acreage in currently producing sections but only 40% of the acreage in undeveloped sections. We also set minimum activity levels in each tier, reflecting past performance in low price periods and incorporate several other assumptions (Table 3).

Minimum completions are based on historical drilling patterns in each tier across three depth intervals 2005-11.

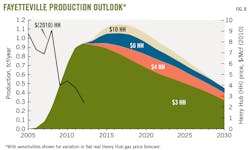

Given the base set of modeling assumptions, we generate a production forecast (Fig. 8).

In the environment of a $4/Mcf natural gas price at Henry Hub (HH), production reaches a plateau in 2012-15 and begins a gradual decline as annual well count decreases as a function of limited higher quality drilling locations.

These better locations in Tiers 1 through 3 are developed, and the lower tiers do not justify development at this price. The outlook yields a full-field EUR of 18.2 tcf, which includes the 6.1 tcf expected from 3,689 wells drilled through 2011.

The production outlook and resulting EUR are only moderately sensitive to natural gas price (Fig. 8). Higher prices will extend the buildup and plateau period. Natural gas price is only one of several variables considered. We developed low and high cases around the base to capture the impact of other key variables.

We then use a stochastic simulation analysis to vary an array of input variables over reasonable distribution ranges, accounting for correlations between variables. This stochastic approach provides a range of EUR outcomes and accompanying risking that can be expected from the Fayetteville play. The mean of the resulting distribution is 18 tcf.

"Uneconomic"

Finally, there is public discussion that some shale gas basins are "uneconomic." The rigorous technical and economic analysis described here shows that it makes little sense to label an entire basin as "economic" or "uneconomic" because the high degree of heterogeneity within any play or basin makes such generalizations misleading.

Some regions in the Fayetteville and Barnett are indeed uneconomic, some are marginally economic, and some are very profitable.6 Conventional reservoir plays exhibit a distribution of economic results, and unconventional reservoir plays are no different. As such, assessments on the basis of an "average well" or "average economics" within a shale gas play are not useful when forecasting future production and reserves.

Our work provides boundaries for the areas where future drilling is likely to occur, when and under what economic conditions drilling will occur, what the resulting drilling and production profile will look like, and the reserve additions that will result.

Acknowledgements

This research was conducted within the Bureau of Economic Geology (BEG), Jackson School of Geosciences, the University of Texas at Austin. This study is part of "Role of shale Gas in the US Energy Transition: Recoverable Resources, Production Rates, and Implications," a larger program funded at the BEG by the Alfred P. Sloan Foundation as the second of several basins to be analyzed using consistent, detailed, bottom-up methodologies. The authors thank IHS and DrillingInfo for access to their databases.

The Fayetteville shale study team consists of geoscientists, engineers, and economists. The workflow was developed to allow iterative input from all disciplines, ultimately leading to a rigorous production outlook model.7

References

1. Patzek, T. W., Male, F. and Marder, M., "Simple models for gas production from hydrofractured shales," AAPG Bulletin, in press.

2. Fu, Q., Horvath, S., Potter, E., Roberts, F., et al. "Log-based thickness and porosity mapping of the Barnett shale Play, Fort Worth Basin, Texas: A proxy for reservoir quality assessment," AAPG Bulletin, publication date to be announced.

3. Ver Hoeve, M., Meyer, C., Preusser, J., and Makowitz, A., "Basin-wide delineation of gas shale ‘sweet spots' using density and neutron logs: Implications for qualitative and quantitative assessment of gas shale resources," poster presented at AAPG Hedberg Conference, Dec. 5–10, 2010, Austin, Tex.

4. Fault layer originally sourced from the Arkansas Oil & Gas Commission, compiled and prepared by the Arkansas Geological Survey: http://www.aogc.state.ar.us.

5. Ikonnikova, S., Browning, J., Horvath, S., and Tinker, S.W., "Well Recovery, Drainage Area, and Future Drill-well Inventory: Empirical Study of the Barnett shale Gas Play," SPE Reservoir Evaluation & Engineering, under review.

6. Gülen, G., Browning, J., Ikonnikova, S., and Tinker, S.W., "Well economics across ten tiers in low and high Btu (British thermal unit) areas, Barnett shale, Texas," Energy, http://dx.doi.org/10.1016/j.energy.2013.07.041.

7. Browning, J., Ikonnikova, S., Gülen, G., and Tinker, S.W., et al. "Barnett shale Production Outlook," SPE Economics & Management, Vol. 5 (2013), No. 3, pp. 89-104. SPE-165585-PA. http://dx.doi.org/10.2118/165585-PA.

The authors

Scott W. Tinker ([email protected]) is the director of the Bureau of Economic Geology at the University of Texas at Austin, the State Geologist of Texas, a professor holding the Allday Endowed Chair, and acting Associate Dean of Research in the Jackson School of Geosciences at the university. He spent 17 years in the oil and gas industry before joining UT in 2000. He is past president of American Association of Petroleum Geologists, Association of American State Geologists, and Gulf Coast Association of Geological Societies. He is a Geological Society of America Fellow and holds appointments on the National Petroleum Council and Interstate Oil and Gas Compact Commission among other boards. Tinker holds a PhD in geological sciences from the University of Colorado, an MS in geological sciences from the University of Michigan, and a BS in geology and business administration from Trinity University.

John Browning ([email protected]) has been a senior research fellow since 2010 at the BEG, having retired from ExxonMobil after 33 years. He holds a BS (1977) in mechanical engineering from the University of Tennessee.

Svetlana Ikonnikova ([email protected]) is a research associate and energy economist in the BEG. She holds an MS (2003) in applied mathematics and physics from the Moscow Institute of Physics and Technology, Moscow, and a PhD (2007) in economics from Humboldt University of Berlin.

Gürcan Gülen ([email protected]) is a research associate and energy economist at the BEG in Houston. He is a member of the United States Association of Energy Economics (USAEE), the International Association of Energy Economics, and the Society of Petroleum Engineers. He holds a PhD (1996) in economics from Boston College and a BA (1990) in economics from Bosphorus University in Istanbul.

Tadeusz Patzek ([email protected]) is the Lois K. and Richard D. Folger Leadership Professor and chair of the Petroleum and Geosystems Engineering Department at the University of Texas at Austin. He also holds the Cockrell Family Regents Chair No. 11. He was professor of geoengineering at the University of California, Berkeley, 1990-2008, and before that was a researcher at Shell Development for 7 years. Patzek is a member of the Ocean Energy Safety Advisory Committee for the US Department of Interior's Bureau of Safety and Environmental Enforcement and of the SPE. Patzek holds an MS (1974) and PhD (1980) in chemical engineering from the Silesian Technical University in Poland.

Eric Potter ([email protected]) is program director for energy research at the BEG, joining in 2001 after 25 years with Marathon Oil Co. as an exploration geologist and as geoscience technology manager at Marathon's technology center in Denver. He holds a BA (1972) in earth science from Dartmouth College and an MS (1975) in geology from Oregon State University.

Qilong Fu ([email protected]) is a geologist with the BEG, joining in 2008. He holds a BS in geology from the Changchun College of Geology (Jilin University) in China, an MS in geology from the Institute of Geology, Chinese Academy of Sciences, and a PhD in geology from the University of Regina, Sask.

Katie Smye ([email protected]) is a postdoctoral fellow at the BEG, joining in 2013. She holds BS (2008) degrees in geology and chemistry from the University of Oklahoma, and a PhD (2012) in earth sciences from the University of Cambridge. She is a member of AAPG.

Susan Horvath ([email protected]) is a research scientist associate at the BEG. Previously, she worked as a GIS analyst for the Arkansas Geological Survey. She holds a BS (2002) and an MSc (2007) in geographic information systems from Eastern Michigan University. She is a member of AAPG, the Urban and Regional Information Systems Association, and Supporting Women in Geography and GIS.

Frank Male ([email protected]) is a graduate student in the Center for Nonlinear Dynamics and the Department of Physics at the University of Texas at Austin. Before joining the university in 2010, he worked with the Max Planck Institute for Dynamics and Self-Organization in Göttingen, Germany, as a computational microfluidics researcher. Male holds a BS in physics and BA (2009) in political science from Kansas State University.

Forrest Roberts ([email protected]) is a graduate research assistant at the BEG, working on an MS in geology. He worked as a geology intern with Apache Corp. in Houston during summer 2012. He holds a BS (2011) in geological sciences from Brigham Young University and is a member of the AAPG and the Society of Exploration Geophysicists.