Roadblocks remain to TAPI pipeline construction

Tridivesh Singh Maini

Independent Foreign Policy Analyst

New Delhi

Manish Vaid

Observer Research Foundation

New Delhi

The Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline, discussed for more than 20 years, would be welcomed by all participants, but numerous roadblocks to building it remain.

A growing power crisis, the steady drop in Krishna Godavari basin (KG-D6) natural gas production, and increased global petroleum prices have prompted Indian policy makers to revisit all possible alternatives for increasing its supply of natural gas. Pursuit of these alternatives included signing the TAPI pipeline deal.

This article explores various aspects of the pipeline's development, illustrating the economic benefits accruing to all participating nations, but particularly India. It also highlights TAPI's inherent logistical and geopolitical drawbacks, which are likely to hinder its development.

Background

For the week ended Jan. 20, 2013, KG-D6 produced 20.97 million cu m/day (MMcmd), of which 16.59 MMcmd was from D1 and D3 field and 4.38 MMcmd from MA field. KG-D6 production has fallen sharply since second-quarter 2010, when it stood at 60 MMcmd.1 KG-D6 produced 50 MMcmd in December 2010,2 47 MMcmd in June 2011,3 and 35.77 MMcmd in February 2012.4

Natural gas accounts for 10% of India's primary energy basket, compared to world's average of 24%.5 A growing dependency on imported crude (now in excess of 80% of consumption) and environmental concerns regarding emissions have, at the same time production is falling, increased pressure to use natural gas in a wide variety of sectors, including transportation as CNG.

The fall in KG-D6 production has resulted in a nearly proportionate increase in imports of more costly LNG, largely by the power and fertilizer sectors. LNG imports, which are three times more expensive than domestic natural gas,6 are likely to surpass domestic production in the next 2-3 years, worsening both India's natural gas supply flexibility and its fiscal deficit.7

The recently released report from the Federation of Indian Chambers of Commerce and Industry-PricewaterhouseCoopers forecast India's import dependency by 2031-32 at 91-94% for oil and 40-50% for both gas and coal.8 TAPI has the potential to both increase flexibility of natural gas supply and ease the fiscal deficit by providing a cheaper path through which to import gas. The project would also help meet India's objective of pursuing a low-carbon economic development path.

Gas Authority of India Ltd. (GAIL) May 23, 2012, signed a $7.6-billion gas sale and purchase agreement (GSPA) with TurkmenGas, thereby codifying its participation in TAPI. GAIL agreed to purchase gas at 55% of crude, or $9.17/MMbtu at $100/bbl.9 Transit fees and transportation charges would make the final TAPI gas price $12.99/MMbtu; competitive with term regasified LNG (RLNG) at $9.76/MMbtu and cheaper than spot RLNG at $16/MMbtu. India would pay Afghanistan and Pakistan transit fees of $0.50/MMbtu each.10

Term RLNG prices change every month on the basis of a formula agreed between seller and buyer. The price used is from March 2012. The spot RLNG price was for the most recent shipment fixed as of December 2012.

TAPI

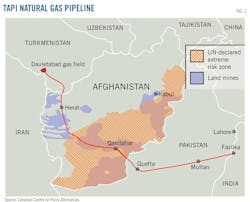

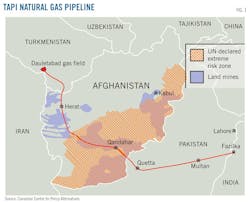

Of TAPI's total 1,680 km, 144 km will be in Turkmenistan, 735 km in Afghanistan, and 800 km in Pakistan, bringing it to the Indian border. Of the 90 MMcmd of gas pumped through it, India and Pakistan will get 38 MMcmd each and Afghanistan 14 MMcmd.

Turkmenistan's Galkynysh (previously South Yolotan Osman and also known as Dauletabad) field will supply the gas, with TAPI running from Yolotan-Osman to Guspi (Turkmenistan), through Herat, Lashkargah, and Kandahar (Afghanistan), and Quetta, GG Khan, Multan, and Pakpatan (Pakistan), to its end at the Indian border town of Fazilka (Fig. 1). GAIL will buy the Indian portion of gas and will have the option of being part of the consortium building the pipeline.

With proven gas reserves of 16 trillion cu m, Galkynysh would produce 411.173 billion cu m/year of gas over 30 years.11 On June 7, 2012, Reliance Industries Ltd (RIL), India's petrochemical giant, said it intends to source a sustained 60 MMcmd of additional gas supply in the next 3-4 years with the help of quick government and regulatory approvals. This timing coincides roughly with TAPI participants' targeted October 2017 in-service date.

Project push

Several factors have led to India's renewed sense of urgency regarding TAPI's development. Falling production in KG-D6 has increased dependency on costlier LNG imports, which are likely to overtake indigenous gas production as a portion of supply in next 2-3 years. Power companies question whether customers can bear the cost of power produced from gas offered at $9.5/MMbtu, the level proposed by LNG-based power plants such as India Gas Solutions (IGS), a joint venture of RIL and BP PLC.12

India's Integrated Energy Policy of 2006 also stresses the need to import gas from pipelines instead of LNG, in order to increase energy security.13 Pipeline gas is harder to divert, the policy reasoned, while still recognizing that sabotage could interrupt it altogether.14

The US also supports the TAPI project, having pressured first India and then Pakistan to withdraw from the Iran-Pakistan-India (IPI) pipeline project, despite Pakistan's on-going energy crisis.15 The Asian Development Bank has also played an active role in fast-tracking this project and may act as transaction advisor, responsible for raising the debt and equity necessary to meet project expenses.

Turkmenistan

Turkmenistan would benefit from directly linking 90 MMcmd of its gas reserves to a diversified South Asian market. The pipeline would also create job opportunities and give a boost to the country's economy. The opening of the TAPI route would also heighten Turkmenistan's role as Eurasian natural gas hub, opening another potential revenue stream.16

Afghanistan

Afghanistan would benefit from transit fees estimated at $300 million/year, according to the Ambassador of Afghanistan to Canada,17 roughly 8% of the consortium's total revenue. The project would also be a critical source of employment and contribute to Afghanistan's energy security.18 Afghanistan also has an option to sell excess gas both inside and outside the country. Revenue generated could be used for infrastructure development.

The Afghan government has taken measures to ensure TAPI's construction, including deployment of 5,000-7,000 security personnel to safeguard its route.19 It sees the pipeline's continuous operations as important not just as a revenue stream but also as a source of supply for the energy needed as Afghanistan continues to rebuild itself.

Pakistan

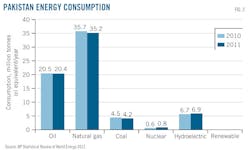

Natural gas already makes up the largest segment of Pakistan's energy consumption (Fig. 2). The country would benefit from transit fees of $0.50/MMbtu to be paid by India, but of even greater importance, the 38 MMcmd delivered would help address Pakistan's severe energy shortage.

A report by Pakistan's central bank said the country's gas deficit could hit 3 bcfd by 2015-16 if new sources of supply are not found. Its current supply deficit is 1.2-1.4 bcfd. Pakistan President Asif Ali Zardari described TAPI as extremely important in helping the country's economy to further integrate with others both inside and outside the region.20

India

India would get 38 MMcmd of gas through TAPI, displacing costlier LNG as part of meeting projected demand of 473 MMcmd by 2016-17.21 As part of the TAPI consortium India can also negotiate transportation tariffs and monitor project costs. Bangladesh has also expressed interest in joining TAPI as its own production falls, potentially providing India with a source of transit fees as well.11

Indo-Pak ties

TAPI is a crucial step in ongoing confidence building between India and Pakistan, with Pakistan guaranteeing the pipeline's security through its territory. Pakistan has already granted most-favored-nation trade status to India and the two have opened their Wagah border to road traffic.

Increased supplies of pipeline gas will also help India and Pakistan diversify their energy trade and industrial bases.22 India has offered to build a pipeline to the Wagah border to ship 50 million tpy of petroleum products, with lower transportation costs allowing delivery at prices 30% below what Pakistan currently pays.23 The fall in Pakistan's natural gas production since 2010 has prompted it to ask India for immediate heating oil imports.24 Asian Development Bank's Outlook 2012 describes Pakistan's energy crisis as one of the primary structural problems affecting its economy.25

Geopolitical perspective

TAPI has unequivocal US support for a number of reasons, including interest by US oil majors in participating.26 The US has also offered to finance TAPI to drive Pakistan away from the Iran-Pakistan line.27 TAPI will bypass the Russian pipeline network without Chinese or Russian involvement, another stated US goal.28 The US also believes TAPI will help revive Afghanistan's economy.

Apprehensions

Recent developments augur well for TAPI, but roadblocks remain.

India has concerns regarding project security after the 2014 withdrawal of US forces from Afghanistan. More immediately, the GSPA between Afghanistan and Turkmenistan is still pending, despite the two having signed MoUs addressing long-term cooperation in the gas sector and providing full security to TAPI.

Only once the GSPA has been signed can commercial partners to build, finance, and logistically support the pipeline be attracted. At least one Turkmen energy analyst doesn't think a GSPA will be signed anytime soon,29 delayed in part by that country's own concerns regarding post-2014 security in Afghanistan.

Concerns also exist regarding Pakistan's ability to ensure TAPI's safety. Sections of the Pakistan armed forces and intelligence remain sympathetic to the Taliban and could conspire to attack the pipeline, particularly in light of tepid popular support for the project. Pakistan, however, plans to place security forces along the pipeline and also create settlements near its route.

To the degree the security of TAPI—which will run through the Herat and Kandahar regions of Afghanistan and Baluchistan province in Pakistan—cannot be ensured, ADB's ability to support the project will wane.

Economics, supply

Cost estimates between $7.6 billion and $10 billion require strict spending controls, particularly since these estimates do not include security costs. Changes to the gas market, including the possibility of cheaper LNG and the emergence of shale gas production in India, could also make it difficult to advance the project. Turkmenistan already has gas supply agreements in place with China and Russia, and concerns exist as to whether it can supply India as well.

Engineering, finance

Seismic activity and the rugged mountainous terrain in South Afghanistan could pose design difficulties for the TAPI pipeline. No creditworthy partners have so far emerged to help finance the project.10 International oil companies remain more interested in Turkmenistan's upstream assets than in the TAPI pipeline project.

A TAPI Steering Committee meeting in Ashgabat, Sept. 22, 2012, following road shows, described the Gas Pipeline Framework Agreement (GPFA) as not feasible. India disagreed, with all parties currently mulling potential options.

TAPI vs. IPI

India has said it will ignore US threats to sanction its financial institutions helping import Iranian crude30 and that it is uncomfortable with the US strategy of isolating Iran. Being a traditional ally of Iran, India has not openly condemned Iran's civil nuclear program31 and only accepts sanctions imposed by the United Nations.32 India has not ruled out joining the IP pipeline.

References

1. Press Trust of India, "Reliance Gas Output from KGD6 to go up to 60 mmscmd," The Economic Times, Jan. 11, 2011.

2. "Reliance KG-D6 Gas Output Down by 5.5 mmscmd," The Indian Express, Jan. 25, 2011.

3. Press Trust of India, "Reliance Industries Ltd. see 27% drop in KG-D6 output in June," The Economic Times, Aug. 6, 2011.

4. "RIL, BP Win Approval to Develop 3rd Largest Gas Find in KG-D6," The Business Standard, Feb. 22, 2012.

5. BP Statistical Review of World 2012.

6. Press Trust of India, "LNG Imports to Surpass Domestic Production in 2 yrs," The Economic Times, Dec. 5, 2012.

7. Merchant, M., "How India Can Beat the Oil Crisis," The Economic Times, Apr. 7, 2012.

8. FICCI-PWC, "Rising Above the Sub-optimal: Exploring Ways to Find Energy Solutions," December 2012.

9. Press Trust of India, "India to Guarantee Safe Gas Transit From TAPI," The Economic Times, May 22, 2012.

10. Press Trust of India, "No International Pipeline Firm Ready to Implement TAPI Gas Project," The Economic Times, Dec. 21, 2012.

11. Pakistan News Service, "Bangladesh decides to Join TAPI Gas Pipeline Project," PakTribune, June 7, 2012.

12. Reddy, B.D., "Power Companies Question Feasibility of LNG-based Projects," Business Standard, Aug. 22, 2012.

13. Planning Commission of India, "Integrated Energy Policy," p. 95, 2006.

14. Press TV, "Militants Blow Up Gas Pipeline in Troubled NW Pakistan, retrieved Dec. 19, 2012, from http://presstv.com/detail/233542.html.

15. The Nation, "India Opted Out of IPI Project on American Pressure: ICCI," Dec. 18, 2012.

16. Mahapatra, D.A., "TAPI is a Peace Pipline," Russia & India Report, Nov. 20, 2012.

17. Daly, J., "On Again, Off Again Trans-Afghan Natural Gas Pipeline Revives," Oil Price, Jan. 30, 2012.

18. Blake, R.O., remarks on "US Policy Towards Central Asia," July 30, 2010, http://www.state.gov/p/sca/rls/rmks/2010/145463.htm.

19. Daily Times, "Afghanistan to Deploy 7,000 Troop to Guard TAPI Pipeline," Dec. 13, 2010.

20. INP, "TAPI Gas Pipeline Project is Most Important for Pakistan: Zardari, The Nation, June 11, 2012.

21. Press Trust of India, "ONGC Natural Gas Output Likely to Jump 75% in 5 years: Oil Ministry," The Economic Times, Nov. 3, 2011.

22. Vaid, M. "Oil Trade Helps Fuel Peace Engagements," Tehelka Magazine, July 26, 2012.

23. Press Trust of India, "Oil Pipeline to Wagah on the Cards: Report," The Financial Express, May 30, 2012.

24. Jayaswal, R., "Pakistan Is Willing to Import Furnace Oil, Diesel, and Natural Gas from India," The Economic Times, July 18, 2012.

25. Asian Development Bank, http://www.adb.org/sites/default/files/ado2012-pak.pdf, visited Aug. 17, 2012.

26. Reuters, "Two Major US Oil Companies Interested in TAPI Pipeline," The Economic Times, Mar. 23, 2012.

27. Bhutta, Z., "Wielding Soft Power: US Offers to Finance TAPI Gas Pipeline," The Express Tribune, Dec. 19, 2011.

28. Coyle, J.J., "TAPI Being Discussed, Not Built," European Energy Analysis, June 27, 2011.

29. Hammond, J., "Caspian Tensions Reveal Turkmenistan's Rising Confidence," Diplomatic Courier, Dec. 3, 2012.

30. Jacob, J. and Yashwant Raj, "Unofficially, India, US relieved at Iranian oil waiver," Hindustan Times, June 12, 2012.

31. Burns, R.N., "India Lets US Down on Iran," The Diplomat, Feb. 20, 2012.

32. Dadwal, S.R., "India Struggling To Cope With Sanctions on Iran," Issue Brief, June 26, 2012.

The authors

Tridivesh Singh Maini ([email protected]) is an independent foreign policy analyst based in New Delhi. He has also served as associate fellow with the Observer Research Foundation, New Delhi, and research associate with the Institute of South Asian Studies, Singapore. He holds an MS in international development (2004) from The School of International Service, American University, Washington DC.

Manish Vaid ([email protected]) is research assistant at Observer Research Foundation, New Delhi. He has also served as an accounts executive at other companies. Vaid holds a post-graduate diploma in petroleum management–executive, focused on oil and gas (2010) from Pandit Deendayal Petroleum University, Gandhinagar, Gujarat, India.