Resource plays could help refill trans-Alaska pipeline

Mohamed A. Abdel-Rahman

Royale Energy Inc.

San Diego, Calif.

Can Alaska match some of the other emerging oil plays in the Lower 48, namely the Eagle Ford shale and the Bakken?

Alaska's Department of Natural Resources has compiled source rock and thermal maturity data of the most prominent non-Alaskan source rocks and found that they compare favorably with the known Alaskan rocks that sourced Prudhoe Bay, Kuparuk, Alpine, Endicott, Point Thomson, Tarn, and Badami fields.1

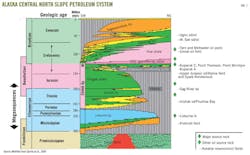

These Alaskan source rocks belong to three distinct chronostratigraphic units that span some 150 million years from Permo-Triassic Shublik to Upper Cretaceous Brookian (Fig. 1).

Need to refill the pipeline

In June 2012, Alaska's monthly contribution to total US oil production has plummeted to 7.9% or 14,790 thousand bbl as compared with a US total of 187,803 thousand bbl from a March 1988 peak of 24.91% or 64,668 thousand bbl as compared with a US total of 259,587 bbl. To the surprise of many, North Dakota's oil production recently surpassed that of Alaska for the first time.

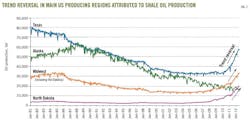

Alaska's economy is heavily dependent on its oil and gas revenue. Alaska's production is at an all time low (Fig. 2), and less than 25% of the Trans-Alaska pipeline capacity of 2.1 million b/d is being utilized.

Since shale production is typically characterized by steep rate decline over the first year or 2 and flattens to a steady low rate for many years, the available spare pipeline capacity (equivalent to twice current Bakken production) is probably more than sufficient to accommodate any shale oil production on the North Slope for the foreseeable future.

North Slope stratigraphic relationships

Magoon and Claypool2 among others identified two families of North Slope oils.

Triassic Shublik oils tend to have notable sulfur content and be of lower API gravity mostly due to the presence of asphaltenes. The other family (non-Shublik) corresponds to all other oils that tend to have no sulfur, be of higher API gravity, and are low in asphaltenes.

The most notable non-Shublik source rocks (Fig. 1) are comprised of the Pebble shale, Hue shale, GRZ (gamma ray zone)/HRZ (highly radioactive zone), and Lower Kingak.

Although these oils are distinguishable on the gas chromatograph and gas chromatograph-mass spectrometer when mixed, they cannot be easily traced back to their original components. Because of the prevalence of oil mixing on the North Slope and the likely lateral and vertical changes in litho- and organofacies over long distances, they are all lumped here under non-Shublik sources following Magoon and Claypool's 1981 classification.

No matter what geochemical parameters are used to classify North Slope oils, there are clear indications of notable mixing of crudes in various percentages in various strata. Different authors invariably arrive at different ratios using different parameters.

The only time when there is consistency of opinions as to the ratios that are being mixed is when non-Shublik and Shublik oils are mixed, as is the case in supergiant Prudhoe Bay oil field. There is a common agreement that 70% of Prudhoe oil is Shublik sourced and the remainder is a non-Shublik mix of Lower Kingak and Brookian (Pebble shale/Hue shale/HRZ/GRZ).

For the Ivishak sandstone, the main reservoir at Prudhoe Bay field, to contain oil that came from such mixing makes sense because of the stratigraphic position of the reservoir being relatively adjacent to the Shublik and Lower Kingak sources.

To the contrary, giant Kuparuk oil field with 2.9 billion bbl of recoverable reserves is somewhat of an oddity in terms of the location of the reservoir in relation to the source. Kuparuk A and C sands (Fig. 1) are the reservoir sands of the field and stratigraphically are located very close to the top of Lower Cretaceous and, therefore, to the LCU (Lower Cretaceous unconformity).

Kuparuk A sands lie below the unconformity whereas Kuparuk C sands represent a postunconformity transgressive facies. The Kuparuk oil is a Shublik oil despite the fact that the Kuparuk reservoirs are surrounded by non-Shublik source rocks.

North of Kuparuk lies the tested Ivishak trap of the Mukluk structure that appears to be breached by the LCU, which is directly overlain by the Foran sand that is age-equivalent to Kuparuk C sand. The Mukluk structure was full with Shublik oil before it migrated from its Ivishak south along the LCU and its transgressive Foran sands in response to a significant Tertiary uplift that was more pronounced at the Kuparuk area.

The Mukluk oil as it migrated to Kuparuk left behind a 200-ft section of stained Ivishak reservoir with asphaltene rich tar/heavy residual oil that is typically present near the bottom of the oil column (as in Prudhoe), whereas at Mukluk it was present near the top of the breached reservoir.

Another oil-to-stratigraphy misfit involves the Ugnu and West Sak heavy oil deposits that are reservoired in the Upper Cretaceous rocks of the Brookian sequence, yet they contain Shublik oil that must have migrated upwards from Prudhoe through faulting.

Source rock facies

Clastics input results in the dilution of organic matter creating a less favorable source rock facies with lower generative potential.

Many authors have documented areal variations in the source rock richness throughout the North Slope of Alaska. For example, the Shublik and Lower Kingak are richest to the south, the Pebble shale to the east, and the Hue shale to the northeast.3

Shublik richness

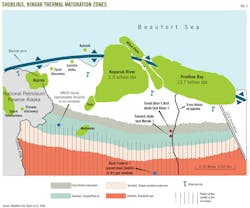

The present day east-west trending Barrow arch (Fig. 3) represented the proximal locale for sediment provenance during the Ellesmerian sequence deposition.

Proximal facies with high terrigenous component are deposited to the north at or near the present-day Barrow arch. Distal marine facies of shale, limestone, marls, and phosphorites were deposited farther south in anoxic conditions. It is therefore expected that organic richness of the Shublik increases the farther south it is deposited from the present-day Barrow arch.

The lithological variations of the Shublik could be a contributing factor to developing sweet spots within the Shublik for higher brittleness and fracture propagation (optimum Young's Modulus and Poisson's Ratio). The lithological heterogeneity will also cause areal variations in thermal conductivity and therefore in the intricate details of the thermal maturity regime.

Non-Shublik sources

It was noted that organic contents of the various shales change over large areas in response to their depositional settings (for example, Houseknecht and Bird, 20043) and vertically within the same formation (Lower Kingak has higher TOC and Hydrogen Index than Upper Kingak).

Throughout the area between Colville River and Canning River variations in the thickness and organic richness of the Pebble shale, GRR/HRZ, and Hue shales have also been addressed and documented by many authors. Alpine, Tarn, Point Thomson, and Point McIntyre fields have all been attributed to charges from non-Shublik sources.

Thermal maturity of source rocks

Bird4 and Peters et al.5 have published a comprehensive summary of Alaska North Slope source rocks.

According to their work the most prospective part of the shale play area is located on the central North Slope, which falls on state land. It is bounded on the east by the Canning River and on the west by the Colville River.

The Shublik and Lower Kingak account for the vast majority of the North Alaska oils discovered to date. The Pebble shale, HGZ/HRZ, and Hue shale are responsible for sourcing the remainder of the oils.

Peters et al.5 published their oil window maps across the entire North Slope.

Fig. 3 is a modification of a part of their map that was altered to focus only on the Central North Slope. The modifications also include depicting a volatiles/condensates and low maturity categories. To schematically represent the uncertainties inherent in the map, the transitions from one zone to another are represented by jagged edges since detailed lithological composition, when it becomes available, will play an important role in outlining the thermal zones' boundaries.

As Fig. 3 indicates, to date there are only two penetrations in the entire Central North Slope within the Shublik kitchen.

Different types of organic matter have different kinetics of transformation to oil and gas, and the boundaries of oil and gas generation are not fixed but differ according to the type of kerogen. Typically oil generation starts within the range of Ro of 0.5-0.7% and reaches a peak between Ro of 0.8-1.1%.6

If the Shublik/Lower Kingak shales behave like the Eagle Ford, the entire maturation windows for oil and gas could be productive. Dry gas window will develop in the south near and at the Brooks Range foothills and oil window farther north. Wet gas and condensate window would develop in between and could prove to be the most lucrative, where the hydrocarbons are in the liquid state in the reservoir but when brought to the surface (below the bubble point) form gas/condensate/light oil. This is also sometimes referred to as the volatiles zone which, in the Eagle Ford, appears to enjoy enhanced production characteristics and better pricing.

In partnership with Halliburton, Great Bear Petroleum made history. On its Alaska North Slope acreage, Great Bear drilled and cored Alcor-1, the first well to be purely planned and designed to test and quantify production characteristics of North Slope source rocks.

Great Bear's drilling rig has already moved to its second well location (Fig. 3). According to Duncan,7 the third well location will be south of the second and the fourth will be south of the third but remaining on the west side of the Dalton Highway. Information on the results of these wells, according to the State of Alaska, can be kept confidential for at least 25 months.

East and west of Great Bear's 500,000 acres lies Royale Energy's 100,000 acres that are situated within the peak oil generating and volatiles windows of the Shublik and Lower Kingak shales.

Size of the resource

Most wells drilled on the North Slope are on or near the Barrow arch outside the thermal maturity windows of all shales.

Any oil observed in shale near the Barrow arch is probably either migrated oil or very early generated oil. The vast majority of traps in the conventional pools are exploiting migrated oils in a structural or combination structural/stratigraphic traps.

Shale source rocks sampled in these wells provide good approximation to the geochemical parameters before thermal maturity is reached. Thus total organic carbon original and HI original can be approximated from immature source rocks found in those drilled wells and therefore, extrapolation into the deeper parts of the basin have to rely heavily on basin modeling.

Thermal maturity zones (Fig. 3) can be detailed and refined once several wells have penetrated the thermally mature Shublik and exploration has progressed sufficiently.

There are sufficient uncertainties when predicting the thermal maturity of rocks at any specific location without knowing its detailed lithological makeup (since lithology affects the thermal conductivity and heat flow), as compared to thermal maturity that is measured directly from source rock samples by either Tmax or vitrinite reflectance.

Discovered oil in place volumes typically represent only a fraction of the oil volume that was generated from its source rock, and the North Slope is no different. According to Peters et al.,5 all calculations of volumes of expelled oil from each of the various sources far exceed estimates of the in place oil of the North Slope.

Magoon et al.8 estimated that the in place discovered Shublik oil amounts to 57 billion bbl. Estimating the amount of generated oil, Peters et al.5 calculated a range of 783-1,181 billion bbl using RockEval pyrolysis and 578 billion bbl using hydrous pyrolysis.

Referring to the huge gap between the proven oil in place that has Shublik signature and those calculated by using RockEval or hydrous pyrolysis as having been generated, Peters concluded that "losses of expelled petroleum by dispersion, leakage and adsorption during migration through carrier beds and other processes, such as biodegradation, must be enormous." A significant portion of that unaccounted for oil still resides, no doubt in the source rocks themselves waiting to be exploited.

2012 USGS resource estimate

Based on estimates of the ultimate recovery per well, cell size, and success ratios derived from the Lower 48 shale oil and shale gas analogs, the US Geological Survey published an assessment of the technically recoverable shale oil and shale gas resources of the North Slope.9

The USGS estimates are zero to 2 billion bbl of oil and zero to 80 tcf of gas. The survey's modeling acknowledges the large range of uncertainty, particularly in view of the fact that no attempt was made in the past to produce hydrocarbons from the shale. Once true shale oil production values are established, these modeled estimates would move significantly to the upside.

Risk factors, challenges, and considerations in establishing a working resource play in the North Slope include:

• The Shublik is not known to be overpressured like the Bakken and Eagle Ford shale. This introduces an element of risk related to the productivity of the unconventional Shublik wells. In order to mitigate this potential shortcoming, Royale Energy selected its acreage at the peak oil to the condensate range of thermal maturities, expecting that the presence of some gas will improve the reservoir energy and well productivities.

• A characteristic of the oil generated from the Shublik is that it is asphaltene-rich and contains sulfur. Asphaltenes can possibly clog pore spaces and impact the productivity of this shale even after fracturing. Sulfur can cause the thermal maturity to occur earlier and thus early mature oil may result. And therefore, a modeled thermal maturity window can be less accurate than otherwise expected.

• Oil production from a single resource play typically varies considerably from one location to another. Sweet spots might not be identified by the first few wells and industry should not jump into early conclusions.

• Tertiary uplift might have caused dormancy in the oil generation, capping or reducing reservoir energy.

• Existing Shublik well penetrations within the thermal maturity window are limited. Most of the penetrations are at or near the Barrow arch where thermal maturity is lower. Therefore, the thermal modeling of oil generation is much less calibrated to the south than it is to the north.

• Planning shale developments on the North Slope that adhere to the existing guidelines and complies with all permitting and environmental demands will require timely cooperative efforts from the state and local authorities within the realms of lease duration.

• Only Great Bear Petroleum and Royale Energy pursued acreage that mainly focused on shale plays. All others were after conventional reservoirs although some of their acreage might also be prospective for shale.

• Leftover resources. Is now a window of opportunity for Alaska shale development to proceed while the oil price is high? Continually improving technology and the sheer magnitude of shale oil developments worldwide could cause the long-term price of oil to stabilize or even decline, particularly in view of the world's relative political stability and economic slowdown. As a corollary, one would have to question whether all known coal reserves will ever be mined? Has a large portion of the remaining coal reserves missed the boat? Any chance, with the fast paced developments of green energy, oil will become no longer fashionable in the long term? What would the Saudis do if they feel that oil is going out of favor while they are sitting on huge reserves? Would they panic and sell more and more, only to further depress prices.

• Shale development in Alaska is likely to be price sensitive. Future prices and fiscal terms may not support delaying its economic development. Timing is everything; this is the time to exploit and develop this shale oil resource.

• The State of Alaska offers generous credits for certain exploration activities, but legislators are yet to finalize a plan that could make oil production on the slope more lucrative to producers.

Manuscripts welcomeOil & Gas Journal welcomes for publication consideration manuscripts about exploration and development, drilling, production, pipelines, LNG, and processing (refining, petrochemicals, and gas processing). These may be highly technical in nature and appeal or they may be more analytical by way of examining oil and natural gas supply, demand, and markets. OGJ accepts exclusive articles as well as manuscripts adapted from oral and poster presentations. An Author Guide is available at www.ogj.com, click "home" then "Submit an article." Or, contact the Chief Technology Editor ([email protected]; 713/963-6230; or, fax 713/963-6282), Oil & Gas Journal, 1455 West Loop South, Suite 400, Houston TX 77027 USA. |

The shale paradigm

In the hunt for resource plays, geologists go to where the oil is. They target source rocks of the conventional oil and gas fields that produced the hydrocarbons we have been consuming over the past 100 years.

In general, the larger the conventional accumulation is, the larger the source rock's potential for yielding more oil and gas unconventionally.

In both the US and worldwide, energy companies have been sifting through the list of conventional plays to come up with ideas for new resource plays that are yet to be exploited. Obviously, identifying the target source rocks just comprises the first step in the search. The suitability of the geomechanical properties of these rocks to hydraulic fracturing (Young's Modulus and Poisson's Ratio) comes in as a close second.

Most geologists in the US are familiar with the stratigraphy of onshore plays in Texas and Louisiana, where the majority of domestic oil and gas production has occurred. Consequently, it is not surprising some of the first significant and productive unconventional oil and gas plays were identified in those states.

On the other hand, few companies have participated in exploration and production in Alaska. This relative unfamiliarity among geologists with the North Slope's stratigraphy and oil plays may have been a contributing factor that made Alaska a forgotten frontier when it came to resource plays.

Resource play revolution

In the early1990s, Mitchell Energy Corp. made a significant contribution to the oil and gas industry that is having a profound worldwide impact on oil production.

The company was the first to prove that commercial production of hydrocarbons can be achieved by creating artificial fractures in the Barnett shale in Texas. Others later adopted, refined, expanded, and applied Mitchell's methodologies.

Large water fracture stimulations, often in multiple stages, long reach horizontal wells, and multilaterals have become the techniques of choice when unlocking the potential of resource plays.

Perfection in the application of these techniques and the popularity of resource plays in general, have dramatically altered the outlook for US oil and gas production for many years to come (Fig. 4).

It is commonly stated by those who work on multiple resource plays that no two shale plays are identical. Each play usually has its own set of well completion challenges. Operators typically work diligently to address these challenges in multidisciplinary approaches until production optimization is achieved.

Despite their technological arsenal and financial means, many of the majors and large independents have taken a backseat, allowing smaller independents to spearhead refinement, experimentation, and application of various completion technologies to unproven resource plays. Those smaller companies are the ones who have been proving the concept in most new resource plays.

Since small companies' financial resources are usually limited, they typically seek venture capital funding. Once shale productivity is confirmed and the specifics of fracture stimulation and completion parameters have been worked out, the majors and large independents would typically buy their way into the plays.

Surprisingly, financially capable oil and gas companies have been more risk-averse when it came to experimenting with "out of the norm" completion concepts. This seems to be a clear contrast to their willingness to taking on huge risks in speculative frontier exploration plays at a cost of hundreds of millions of dollars (offshore US Atlantic, as an example).

Shale oil's impact on US production

US monthly oil production has been on a steady decline since November 1978 when it peaked at 301,320 thousand bbl.

By September 2008 it reached a low at 119,477 thousand bbl. The last 4 years, however, witnessed a reversal of that decline and by March 2012 the US monthly production had increased by 63% to 195,219 thousand bbl thanks mainly to the contribution of the numerous resource plays (Fig. 4).

Shale oil development using horizontal wells and hydraulic fracturing have resulted in the reversal of production decline in most major petroleum regions in the Lower 48 and is about to be attempted for the first time on Alaska's North Slope (Fig. 2).

Geochemical analysis of source rocks

As organic matter (kerogen) is thermally cracked, oil and gas are generated, volume increases, and oil and gas are expelled and migrate through a carrier bed to reside in the ultimate conventional traps.

Not all generated oil is expelled from source rock. A big portion of it remains in the source rock as unconventional resource and will require fracturing to improve host rock's permeability to allow it to flow and be recovered. This is akin to S1 in RockEval pyrolysis.

Pyrolysis is probably the best routine tool for determining the type and thermal maturity of the organic matter at the same time. RockEval pyrolysis is also typically used by explorers to analyze and understand the generative potential of the source rocks. Organic matter present in the source rock samples that converts to oil through heating in the laboratory by pyrolysis is called S2.

Organic matter that was naturally converted to hydrocarbons but locked within the matrix framework of the rock is released in the lab at the initial heating and is called S1.

Explorers, the author included, who were after conventional plays, have typically ignored S1. For resource plays, however, S1 is more relevant at assessing the volume of hydrocarbons present in the source rock that have not been expelled, whereas S2 measures the capacity of the source rock to generate when subjected to the optimum thermal regime.

Gas chromatography and mass spectrometry are common methods of characterizing the chemical makeup of the crude oil and provide a fingerprint that can be used when correlating crude oils to source rocks or in comparing one crude oil to another. Mixing of crudes, however, presents somewhat of a challenge for this methodology.

References

1. Decker, P.L., "Source-reservoired oil resources, Alaskan North Slope," Alaska Department of Natural Resources, Division of Oil & Gas presentation, Sept. 15, 2011.

2. Magoon, L.B., and Claypool, G.E., "Two oil types on the North Slope of Alaska—Implications for future exploration," AAPG Bull., Vol. 65, 1981, pp. 644-52.

3. Houseknecht, D.W., and Bird, K.J., "Sequence stratigraphy of the Kingak shale (Jurassic-Lower Cretaceous) National Petroleum Reserve in Alaska," AAPG Bull., Vol. 88, 2004, pp. 279-302.

4. Bird, K.J., "Alaska: A twenty-first-century petroleum province" in Downey, M.W., Threet, J.C., and Morgan, W.A., eds., "Petroleum provinces of the twenty-first century," AAPG Memoir 74, 2001, pp. 137-65.

5. Peters, K.E., Magoon, L.B., Bird, K.J., Valin, Z.C., and Keller, M.A., "North Slope, Alaska: Source rock distribution, richness, thermal maturity, and petroleum charge," AAPG Bull., Vol. 90, 2006, pp. 261-92.

6. Tissot, B.P., and Welte, D.H., "Petroleum formation and occurrence—A new approach to oil and gas exploration," Springer-Verlag, Berlin, 1978, 538 pp.

7. Duncan, E., "Update from the field—Great Bear Petroleum's drilling program and upcoming activities," a presentation at the K&L Gates shale conference, Anchorage, July 31, 2012.

8. Magoon, L.B., and Claypool, G.E., "Alaskan North Slope petroleum systems," USGS Open File Report 03-324, 2003.

9. Houseknecht, D.W., Rouse, W.A., Garrity, C.P., Whidden, K.J., Dumoulin, J.A., Schenk, C.J., Charpentier, R.R., Cook, T.A., Gaswirth, S.B., Kirschbaum, M.A., and Pollastro, R.M., "Assessment of potential oil and gas resources in source rocks of the Alaska North Slope," US Geological Survey Fact Sheet 2012-3013, 2 pp.

The author

Mohamed A. Abdel-Rahman ([email protected]) is vice-president of exploration and production at Royale Energy, San Diego, Calif. He started working for Shell USA on Anadarko basin and offshore Atlantic, was with Sohio Petroleum as Alaska district geologist and later as new ventures manager, and with BP America, BP Egypt, and Pennzoil. His geoscience and chemistry education includes a BSc and MS from Ain Shams University and an MS and PhD from the University of Sheffield.