FOCUS: UNCONVENTIONAL OIL & GAS: Industry optimistic on Cline shale liquids potential

US independents, particularly Devon Energy Corp. and Apache Corp., are examining the potential of the Cline shale oil play in the Midland basin.

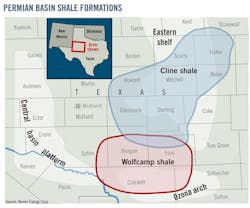

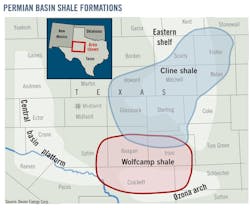

Operators drilling the Wolfcamp and Wolfberry trends see the Cline as offering another pay zone among numerous formations in the Permian basin. The Pennsylvanian-aged Cline shale underlies the Permian-aged Wolfcamp shale.

The Cline yields 40-45° gravity crude. The namesake formation of the emerging unconventional play is 9,250 ft below the surface of 10 West Texas counties with Mitchell County being in the center of the play (see map). The Cline reservoir is believed to be 200-550 ft thick.

Devon, Apache, and others are optimistic about the formation's potential.

Meanwhile, government leaders in various West Texas counties are trying to prepare for a potential oil boom. Mitchell County economic development officers visited the Eagle Ford shale play area in South Texas to discuss the logistics and needs, such as hotels and restaurants, to support a growing industry presence.

Water supply and other logistics were discussed during a recent meeting in Snyder, which is in Scurry County. Another Cline shale meeting is scheduled for Feb. 8 in Colorado City, which is in Mitchell County. The Sweetwater Enterprise for Economic Development in Nolan County also is participating in regional meetings about the Cline shale.

Centurion Pipeline LP, a subsidiary of Occidental Petroleum Corp., said it plans to reactivate and expand its existing pipeline system in the Cline shale. The crude oil pipeline will have the capacity to transport as much as 75,000 b/d and can be expanded. It's scheduled to be brought into service in multiple phases starting in the second quarter.

The Cline shale pipeline system will transport crude oil from the Texas counties of Irion, Tom Green, Sterling, Coke, and Mitchell to Centurion's terminal in Colorado City. From Colorado City, shippers could transport oil to Cushing, Okla., via the Centurion Pipeline and to Gulf Coast refiners via the BridgeTex Pipeline, expected to be in service in July 2014.

Operators explore Cline

Devon Pres. John Richels told analysts that Devon's expected type curve value is 570,000 boe for a Cline well with 85% being oil and natural gas liquids. Devon suggests the 9,800-sq-mile Cline formation contains 3.6 million bbl/sq mile. The Oklahoma City independent holds 500,000 net acres.

In September, Devon closed a joint venture agreement with Sumitomo Corp. of Japan covering 500,000 acres in the Cline and 150,000 acres in the Wolfcamp (OGJ Online, Aug. 2, 2012).

Sumitomo agreed to invest $1.4 billion for a 30% interest with $980 million of the total to be a drilling carry financing 70% of Devon's expenses.

The biggest acreage holder in the Cline is Apache with 520,000 net acres. Last year, Apache drilled six wells there.

John J. Christmann, Apache vice-president, Permian region, told a Bank of America Merrill Lynch energy conference in November 2012 that Apache believes the Lower Cline has an average thickness of 350 ft gross with net-to-gross shale pay of 40%.

Porosity averages 7%, total organic carbon averages 3%, and original oil in place is 23.4 million boe/section. Apache has identified 2,321 Cline drilling locations, of which 3% are proved undeveloped.

Christmann said it costs Apache $7.6 million on average to drill and complete a Cline well based on a 6,800-ft lateral and 15 hydraulic fracturing stages. The anticipated rate of return is 28%. The EUR is 423,000 boe, of which 87% is liquids.

The Barracuda 45-2H well spudded in June 2012 had a peak initial potential rate of 810 boe/d with a 30-day average of 623 boe/d. Barracuda 45-2, deemed Apache's best Cline well so far, had a 3,800-ft lateral and was completed using 11 hydraulic fracturing stages.

Multiple shale targets

The Permian basin offers multiple shales that are going to be productive horizontally, Christmann said.

"We've got the ability to stack shales later," he said of horizontal targets in the Lower Wolfcamp and Atoka-Barnett shales.

Laredo Petroleum of Tulsa has completed 33 gross horizontal wells in the Cline, and planned to test laterals of more than 7,000 ft.

Its activities are in Glasscock, Howard, Reagan, and Sterling counties. Exploration and drilling efforts in the southern half of its acreage have been centered on the Spraberry, Dean, and Wolfcamp formations while the emphases in the northern half been on deeper intervals, including the Wolfcamp, Cline shale, Strawn, and Atoka formations.

"We have expanded our drilling program to include a horizontal component targeting the Cline and Wolfcamp shales," Laredo said on its web site. The independent has an extensive technical review including coring and testing the Cline separately in multiple vertical wells.

"We believe the Cline shale exhibits similar petrophysical attributes and favorable economics compared to other liquids-rich shale plays operated by other companies, such as in the Eagle Ford and Bakken shale formations," Laredo said. "We have acquired 3D seismic data to assist in fracture analysis and the definition of the structural component within the Cline shale."

Laredo has multiple targets in the vertical Wolfberry along with horizontal targets in the Wolfcamp and Cline shales.

For the Cline, it reports an average thickness of 200-350 ft with 2-7.5% TOC, thermal maturity of 0.85-1.1% RSO, total porosity of 3-12%, and pressure gradient of 0.55-0.65 psi/ft. Laredo estimates OOIP of 25-40 million boe/section for its Cline holdings.

Energen Corp. of Birmingham plans to spend $465 million in the Midland basin during 2013 of which $420 million will be spent in the Wolfberry and $65 million in the Wolfcamp-Cline. Energen plans to run one rig in the Wolfcamp-Cline, drilling six wells this year.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.