Operators increase stakes in Marcellus

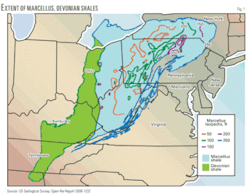

Operators have rushed to add acreage, expand leaseholds, and submit applications to drill the Marcellus shale. This middle-Devonian-age black organic shale underlies New York, Pennsylvania, Ohio, Virginia, and Maryland (Fig. 1).

Devonian shales in the Appalachians are the oldest gas play in the US.

In 2007, 18% of all US wells were spud in Appalachia—3,134 gas wells. Much of the drilling activity in Appalachia crosses multiple pay zones and types, including coalbed methane.

Shales are one-stop hydrocarbon shops, consisting of source, seal, trap, and reservoir. Shales have low permeability but shale gas wells generally have low decline rates, 2-3%/year, and long producing lives.

The Marcellus shale has been a known gas reservoir for 75 years but has only recently become newsworthy because the industry has new technology and new price incentives that make this regional gas play economic.1

According to the US Department of Energy, land drilling produces 72% of natural gas produced in the US, with only 13% coming from offshore US wells and about 15% from net imports.

Gas prices have been on a sustained high, averaging more than $7/Mcf for the past 3 years. In the last few months, prices have peaked at $13-14/Mcf. Despite recent softening, analysts believe gas prices will remain strong. NYMEX pricing suggests $8.40-9/Mcf for fourth-quarter 2008 and all 2009, which will spur drilling.

Natural gas drilling

Since 2002, US land drilling activity has increased along with gas prices, with about 1,900 rigs working in the US in August 2008, up from about 700 rigs in mid-2002.

Drilling companies have consolidated. Based on 2007 results, The Land Rig Newsletter noted that the five largest drilling contractors now drill most (72%) wells in the US:

- Patterson-UTI Energy Inc., 25%.

- Nabors Industries Ltd., 18%.

- Helmerich & Payne International Drilling Co., 13%.

- Unit Drilling Co., 8%.

- Grey Wolf Drilling Co., 8%.

About 10% of US natural gas currently comes from unconventional shale gas plays.

At the Lehman Bros. conference in September, Douglas Wall, CEO of Houston-based Patterson-UTI, said he expects natural gas from shales to increase to 20% of US gas production over the next 3 years.

The shale plays are not all the same and can require different types of rigs to drill vertical or horizontal wells. Most of Patterson-UTI’s recently announced newbuild rigs will go to drill the Fayetteville and Marcellus shales.

Shale has naturally occurring fractures, enhanced by hydraulic fracture stimulation, which improves drainage. In some cases, horizontal drilling can benefit recovery.

According to Equitable Resources Inc., Pittsburgh, a company that focuses on Appalachian natural gas operations, a typical Appalachian well is 2,500-7,500 ft deep; drilled horizontally; into a reservoir section 200-2,000 ft thick; at low reservoir pressure (500-3,400 psi); and costs about $1.2 million to drill. Equitable Resources uses air drilling (no mud) and EM-MWD tools.

Infill drilling in shales is low risk with high yield (e.g., easily provable and auditable reserves). Shales lend themselves to exploitation-style development

Weatherford estimated about 31 rigs drilling in the Marcellus in April 2008. Well depths ranged 2,500-8,000 ft and well costs ranged $1.5 million to $3 million.

Issues

Increased drilling brings new issues to Appalachian states.

In August, Chesapeake Energy Corp. CEO Aubrey McClendon cautioned gas market observers not to “expect the Barnett-style ramp up of gas production from the Marcellus. There are way too many regulatory, topographic, water, and infrastructure issues that will keep the Marcellus from making a meaningful contribution to our country’s gas production until at least 2013-15.”2

In New York and Pennsylvania, governmental bodies update legislation and citizens’ watchdog organizations have formed task groups and raise awareness of potential environmental effects.3 4

New York recently passed legislation adjusting well-spacing requirements and setbacks for horizontal wells and started a review of environmental impact statement requirements.

Two interstate watershed protection commissions are faced with new applications to drill.

New York

According to the New York State Department of Environmental Conservation (NYSDEC), operators have drilled about 75,000 wells in the state since the late 1800s; about 14,000 wells are still active.

In June, the New York State Assembly and Senate voted to approve NY State Senate Bill S08169, amending Article 23 of the State’s Environmental Conservation Law and Title 5 of the Oil, Gas, and Solution Mining Law.5

On July 23, New York State Gov. David A. Paterson signed the bill, which specifically amends Title 5 of the oil and gas law, expanding the definition of statewide spacing to address oil wells and horizontal wells.

The new provisions include a uniform well-spacing system to accommodate horizontal wells and update the 16-year-old law.

Public review

NYSDEC’s Lori O’Connell told OGJ, “Separate permits are not required for hydraulic fracturing. The department reviewed hydraulic fracturing as part of the action of drilling a well within the context of a generic environmental impact statement (GEIS) that was finalized in 1992. Past hydraulic fracturing has been consistent with the GEIS, so no further environmental review was required. Because of the scale of anticipated Marcellus operations, the department is beginning a public process to supplement the GEIS.”

Two days after Gov. Paterson signed the bill, Commissioner Pete Grannis of the NYSDEC announced that the DEC would hold a series of public hearings to discuss drilling for oil and natural gas in New York. This public process will supplement the generic environmental review of horizontal natural gas drilling activities stipulated by Gov. Paterson.

New York drilling

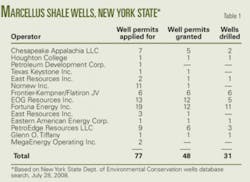

Fourteen different operators have filed 77 permits to drill wells targeting the Marcellus shale in New York state. The state approved 48 of these permits and nine different operators have drilled 31 Marcellus shale wells (Table 1).

Fortuna Energy Inc., based in Horseheads, NY, has applied to drill 19 wells and has drilled 11 of them, more than any other operator. EOG Resources Inc. has applied to drill 13 wells and has drilled 5 of them. A joint venture between Frontier-Kempner and Flatiron has drilled six Marcellus wells. The six other operators have each drilled only one to three Marcellus shale wells in New York, although some have experience drilling Black River shale.

Three companies have already applied for permits to drill horizontal Marcellus wells in New York:

- Chesapeake Appalachia LLC, a subsidiary of Oklahoma City-based Chesapeake Energy Corp.

- Houston-based Nornew Inc.

- Fortuna Energy Inc.

Chesapeake has filed 527 permits to drill in New York, 7 of which target the Marcellus shale (5 vertical, 2 horizontal wells). The company drilled two vertical wells in 2007, in Broome and Chemung Counties (Table 2), but recently moved several rigs out of state.

Watersheds

Two interstate commissions are involved in planning and development and have regulatory responsibility in two large catchment areas underlain by the Marcellus shale.

The Delaware River Basin Commission (DRBC) was formed in a federal-interstate compact in 1961 between President John F. Kennedy and the governors of the four basin states forming the watershed of the Delaware River: Delaware, New Jersey, New York, and Pennsylvania (www.state.nj.us/drbc).

Marcellus shale underlies about 36% of the Delaware River basin. The DRBC identified three major points of concern:

- Gas drilling projects in the Marcellus shale or other formations may have a substantial effect on the water resources of the basin by reducing the flow in streams and aquifers used to supply the significant amounts of fresh water.

- Drilling operations may potentially add, discharge, or cause the release of pollutants into the ground water or surface water.

- Recovered frac water must be treated and disposed of properly.

In June, the DRBC notified operators that water used in drilling operations requires approval.6

Susquehanna River Basin Commission (SRBC) is a governing agency established under a 100-year compact signed on Dec. 24, 1970, by the federal government and the states of New York, Pennsylvania, and Maryland “to protect and wisely manage the water resources of the Susquehanna River Basin.” The Susquehanna River starts in Cooperstown, NY, and flows 444 miles to Havre de Grace, Md., where the river enters Chesapeake Bay.

More than 72% of the tristate Susquehanna watershed is underlain by the Marcellus and other organic-rich shale formations (www.srbc.net).

In June, the SRBC notified 23 companies that they needed approvals to use water in developing natural gas wells in the Susquehanna basin. In August, the SRBC notified natural gas well operators of a new regulation, effective Oct. 15, requiring advance approval for any amount of water “withdrawn or consumptively used” to develop wells in the Marcellus, Utica, or other shale formations in the Susquehanna watershed (18 CFR, Section 806.5).

Pennsylvania operators

The Pennsylvania Department of Environmental Protection oversees drilling permits. A review of the wells database shows that permit applications have been increasing since 2005, with particular activity in the Marcellus shale.

Earlier this year, Prof. Gary Lash, Fredonia State College, said vertical wells cost about $750,000 to drill and horizontal wells can cost $3.5 million to drill. He said that a well operated by Texas-based Range Resources Corp. near Pittsburgh produces 5.8 MMcfd.3

Lash said that some operators offer landowners as little as $25/acre royalty, but $3,000/acre is prevalent throughout northeastern Pennsylvania.

According to Jeffries analyst Subash Chandra, Houston-based Carrizo Oil & Gas Inc. picked up 850 acres in Clearfield County, Penn., for $1,500/acre, 15% royalty, and 5-year lease term.7 Chandra said Western Maryland is also “in the Marcellus mix.” Fort Worth-based Lodge Energy LP recently leased 36,000 acres in western Maryland for $1,150/acre and 16% royalty.7

Houston-based Seneca Resources Corp, a subsidiary of Williamsville, NY-based National Fuel Gas Co., was the most active driller in the region last year. According to the company’s website, Seneca operates about 2,500 wells in western New York and northwestern Pennsylvania, and owns about 720,000 acres of fee minerals, 270,000 acres of leased minerals, and 100,000 acres of surface and timber rights throughout the region.

During the 6 months ending Mar. 31, 2008, Seneca spudded 6 exploratory wells and 75 development wells. During the same period, it completed 5 exploratory wells and plugged 1, and completed 103 development wells.

Seneca Resources formed a joint venture with EOG Resources in 2007 to develop the Marcellus shale and the JV planned to drill 18 wells in 2008.

In 2007, Patterson-UTI moved three rigs to drill the Marcellus in Pennsylvania. By the end of 2009, Doug Wall said the company will have a fleet of 16 fit-for-purpose rigs working in the Marcellus shale, where they are drilling horizontal wells.

Chesapeake Appalachia is drilling actively in Pennsylvania, using rigs from Yost Drilling, another Chesapeake Energy subsidiary (Fig. 2).

Earlier this year, Houston-based Southwestern Energy Production Co. announced it would “invest $26 million in various exploration and new ventures projects, including drilling as many as three vertical wells targeting the Marcellus shale in Pennsylvania” (OGJ, June 2, 2008, p. 43).

Anadarko Petroleum Corp. holds about 625,000 gross acres in the Marcellus shale play and anticipates drilling 5-10 wells in five pilot areas this year.8

Anadarko spud and cored two vertical wells in first-quarter 2008, in Bradford and Clinton Counties, in Pennsylvania. In July, the company spud two more Marcellus wells in Bradford County.

Fort Worth-based Range Resources Corp. reported on its Marcellus operations on Sept. 1. The company is using three rigs in its 2008 Marcellus development project in Pennsylvania, and the 40-well horizontal program “is progressing with encouraging results.” Range plans to steadily increase drilling operations to 8 rigs by yearend 2009.

The company reported in July that it had drilled more than 100 wells in the Marcellus, including 20 horizontal wells, and increased its high-graded acreage position to 850,000 net acres out of 1.4 million acres total (OGJ, July 21, 2008, p. 10).

Range is building pipelines and processing plants and continues to acquire acreage.

In June, Rex Energy Corp., based in State College, Pa., announced it had amassed 88,000 gross (57,000 net) acres in the Marcellus play. The company completed hydraulic fracture stimulation of its second Marcellus vertical well in western Pennsylvania. James Watson is vice-president of drilling for Rex Energy’s Appalachian basin region (OGJ, May 19, 2008, p. 35).

West Virginia

In August 2008, 15 operators were running 77 rigs in West Virginia.

Chesapeake Appalachia, based in Charleston, WV, has drilled “two very nice horizontal Marcellus wells” in that state, according to CEO McClendon in a second-quarter conference call. As of Aug. 1, the wells were producing a total of 7 MMcfd. McClendon said Chesapeake believes the wells “have a combined EUR of about 11 bcf” equivalent. Chesapeake is running two rigs in the state.

Other operators in West Virginia include: Equitable Resources; Atlas America; Fortuna; XTO Energy Inc.; Dominion E&P; Columbia Gas; Northcoast/EXCO; PC Exploration; Daugherty Petroleum Inc.; Vinland energy Operations-Nami Resources Co. LLC; Samson Resources Co.; Anadarko Petroleum; Penn Virginia Oil & Gas Corp.; and Marathon Oil Corp.

Future drilling?

About 150 rigs are drilling the Marcellus and other shales in Pennsylvania and West Virginia, according to Weatherford, which expects the number to increase slightly in 2009

In addition to several companies that have already drilled hundreds of wells each, many smaller players are drilling just a few wells each.

Some service companies have had local offices for many years. BJ Services Co.’s district office in Dunbar, WV provides hydraulic fracturing and cementing services to Chesapeake, Equitable Resources, Cabot Oil & Gas, and others. BJ also services the region from a district office in eastern Kentucky.

The demand for hydraulic fracturing services in the Appalachian basin is causing some delays in Marcellus production. Weatherford Technology Solutions is building two new facilities in Del Barton and Buckannon, W.Va. The company has already opened a new directional drilling facility in Elkview, W. Va., providing EM-MWD tools needed to support air-drilling operations (mud-pulse telemetry being ineffective without fluid in the wellbore).

Why drill now? Gas prices are higher and expected to remain so. New technologies and tools are increasing drilling efficiency. New price incentives make hydraulic fracturing more affordable in the Appalachian basin, as stimulation services become commoditized.

References

- Harper, John A., “The Marcellus Shale—An Old “New” Gas Reservoir in Pennsylvania,” Pennsylvania Geology, Vol. 38, No. 1, Pennsylvania Bureau of Topographic and Geologic Survey, Spring 2008.

- Chesapeake Energy Corp., second-quarter 2008 earnings conference call, Aug. 1, 2008.

- Bertola, David, “Natural gas rock formation fuels landholders’ questions,” May 16, 2008, Buffalo Business First, http://buffalo.bizjournals.com.

- Kane, Tom, “Gas drilling companies take three PA townships to court,” Green Party of Chenango County, Local Control Issues, June 29, 2008, http://chenangogreens.com.

- New York State Senate Bill S08169, passed June 23, 2008, http://assembly.state.ny.us/leg

- Rupert, Clarke, “DRBC notifies company that water used for developing natural gas wells in Delaware river basin needs approval,” June 9, 2008, www.drbc.net.

- Jeffries Energy Log, Jefferies & Co. Inc., Sept. 28, 2008.

- Anadarko Petroleum Corp., Operations Report: Second-Quarter 2008, www.anadarko.com