Refiners add 2.7 million b/d of crude refining capacity in 2005

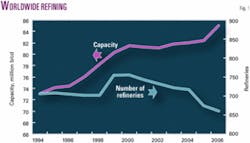

The worldwide refining industry added crude processing capacity in 2005, despite a decrease in the total number of operating refineries. For the fourth year in a row, worldwide capacity is at a record level.

Click here to view the Worldwide Refining Survey in pdf. (40 pages)

Last year’s refining report showed a worldwide capacity of 82.409 million b/cd in 675 refineries as of Jan. 1, 2005. This year, OGJ’s survey reflects a total capacity of 85.127 million b/cd in 661 refineries, an increase of 2.718 million b/cd.

The gain is the largest net addition of refining capacity since the early 1990s.

Fig. 1 shows the trend in operable refineries and worldwide capacity. The large jump in number of refineries in 1999 was due to improved information from China.

Capacity creep, expansions, and restated capacities in existing refineries fueled the increase in capacity for the latest survey.

Asia-Pacific showed the largest increase in the amount of refining capacity, up 1.51 million b/cd or 7.3%. The Middle East experienced the largest percent increase in capacity, rising 8.7% or 562,200 b/cd.

North America, Western Europe, and South America showed smaller changes, increasing 350,900 b/cd, 248,800 b/cd, and 38,400 b/cd, respectively.

Other regions were relatively flat. Eastern Europe increased capacity 7,800 b/cd and Africa showed no net increase. No region’s capacity decreased in 2005.

Four refineries shut down since the last survey, and three refineries had shut down previous to 2005 but were not reflected in last year’s survey. One refinery was acquired by a nearby refiner and is now listed as part of the acquiring refinery. Finally, two refineries in Germany owned by the same company are now listed as one plant.

New crude capacity

This year’s survey does not list any new refineries. All the increases in refining capacity occurred in existing facilities.

The largest single-facility increase occurred in Saudi Arabian Oil Co.’s (Saudi Aramco) Ras Tanura refinery, which nearly doubled capacity, growing to 550,000 b/cd from 300,000 b/cd. Saudi Aramco reported increases in four of its refineries, adding a total of 380,000 b/cd of capacity.

In the US, the largest expansion occurred in Citgo Petroleum Corp.’s Lake Charles, La., refinery. The plant added 132,000 b/cd for a total capacity of 440,000 b/cd. The $293-million project involved installation of a crude vacuum distillation tower-the largest in the world set in one piece (OGJ, Apr. 26, 2004, p. 26).

Refinery closures, delistings

Minimal refinery closures occurred throughout the world. The plants were all relatively small; the largest plant had a capacity of 35,000 b/cd.

Arabian Oil Co. Ltd.’s 30,000-b/cd refinery in Ras Al Khafji was reportedly shut down.

Also in the Middle East, two refineries in Lebanon have shut down. Tripoli Oil Installation’s 20,000-b/cd refinery and Zahrani Oil Installation’s 17,500-b/cd refinery are no longer operating.

In April 2004, Toho Oil Co. Ltd. shut down its 25,000-b/cd refinery in Owase, Japan. This closure was reported to Oil & Gas Journal in late 2004-too late to include in last year’s survey. This year’s survey therefore reflects the updated information.

The 6,000-b/cd refinery owned by Parkland Refining Ltd. has also been shut down for some time. The Bowden, Alta., Canada plant has been closed since 2001, the company reported.

Galana Raffinerie has reportedly shut down its 15,000-b/cd Toamasina, Madagascar, plant through 2006. The company reportedly closed the plant in August 2004 and did not say if or when the plant would restart.

The 1,425-b/cd refinery owned by Inland Oil Refiners Pty. Ltd. has also been shut down. The plant is in Australia.

Two refineries are no longer listed as stand-alone plants.

Valero Energy Corp. acquired the Corpus Christi 100,000-b/cd refinery from Coastal Corp. Valero integrated the acquisition with its existing 152,000-b/cd refinery. The company reported that the two plants are operating as one refinery with a capacity of 205,000 b/cd.

Royal Dutch Shell PLC told OGJ that it is operating as one plant the two refineries previously listed as DEA Mineraloel AG in Wesseling and Deutsche Shell AG in Godorf. The 140,000 and 162,000-b/cd refineries are now listed in the survey as Deutsche Shell AG in Rheinland, Germany, with a combined capacity of 345,861 b/cd.

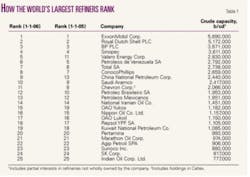

Largest refining companies

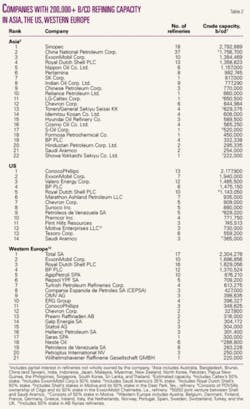

Table 1 lists the top 25 refining companies that own the most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve Valero, Premcor Refining Group Inc., Saudi Aramco, Marathon Oil Corp., Shell, Total AS, Crown Central Petroleum LLC, Sinopec, and China National Petroleum Corp. (CNPC).

Valero closed its acquisition of Premcor on Sept. 1, 2005, making Valero the largest refining company in North America with 18 refineries.

Bill Greehey, chairman and chief executive officer, said Valero bought Premcor’s four refineries for $8 billion, significantly less than their replacement cost

Premcor’s assets were a 175,000-b/cd, high-conversion refinery of heavy, sour crude in Delaware City, Del.; a 190,000-b/cd, high-conversion refinery of sweet crude in Memphis, Tenn.; a 237,500-b/cd refinery of heavy, sour crude in Port Arthur, Tex.; and a 165,000-b/cd refinery of sweet crude in Lima, Ohio.

Premcor had acquired the Delaware City facility in May 2004. Valero is the third owner of the refinery in as many years.

The acquisition moved Valero to the fifth largest refiner in the world and the largest in the US. Last year’s survey listed the company as eleventh largest in the world and third largest in the US. Premcor was the 26th largest refiner in the world before the acquisition.

The previously mentioned expansions in Saudi Aramco’s refineries allowed it to jump over Chevron Corp. in Table 1. It dropped a spot, however, because Valero and CNPC passed it.

Saudi Aramco’s other expansions occurred in its Yanbu refinery, which increased capacity to 235,000 b/cd from 190,000 b/cd; its Jeddah refinery, which expanded to 85,000 b/cd from 60,000 b/cd; and the Saudi Aramco-Mobil refinery, co-owned with ExxonMobil Corp., which increased capacity to 400,000 b/cd from 340,000 b/cd.

Marathon Oil Corp. completed the buyout of Ashland Inc.’s 38% share in the Marathon Ashland Petroleum LLC joint venture. The total value of the deal, which includes other complementary Ashland businesses, was $3.7 billion, and closed in mid 2005.

The joint venture owned seven refineries in the US: 70,000 b/cd in St. Paul Park, Minn.; 72,000 b/cd in Texas City, Tex.; 73,000 b/cd in Canton, Ohio; 100,000 b/cd in Detroit; 192,000 b/cd in Robinson, Ill.; 222,000 b/cd in Catlettsburg, Ky.; and 245,000 b/cd in Garyville, La.

The Detroit facility recently completed a $300 million expansion and clean fuels project. The plant previously had a crude capacity of 74,000 b/cd.

Early in 2004, Shell announced that it would shut down its 65,000-b/cd Bakersfield, Calif., refinery. In September, however, the company said that it would continue to operate the refinery until Mar. 31, 2005, and is evaluating bids from companies interested in purchasing the refinery.

In January 2005, Shell announced that its subsidiary, Shell Oil Products US, had signed an agreement to sell its refinery to a Big West Oil LLC, a subsidiary of Flying J Inc. Terms of the sale were not disclosed. Shell’s plans to close the refinery had encountered resistance from Californian political leaders concerned about product supply.

The refinery began operation in 1932 as the 1,500-b/d Mohawk Refinery in California’s Central Valley.

Shell will continue to own and operate certain pipelines serving the refinery. Also, it will continue to own the nearby Bakersfield Products Terminal, but Flying J will operate it under a long-term lease. Shell will have an offtake agreement to receive products from Flying J and will continue to meet its supply obligations to branded customers and contracted diesel customers in the Central Valley through the Bakersfield Products Terminal and its West Coast supply network.

Flying J also operates a 25,000 b/d refinery in North Salt Lake, Utah.

Table 2 shows a newcomer for the US. An expansion in Total’s Port Arthur, Tex., refinery allowed it to meet the minimum 200,000-b/cd requirement for inclusion in the table. The refinery increased capacity to 231,452 b/cd from 174,575 b/cd in last year’s survey.

Crown Central Petroleum has exited the refining business with the sale of its two Texas-based refineries.

In January 2005, the company sold its 100,000-b/cd refinery to Pasadena Refining System Inc., a subsidiary of Astra Oil Co. Details of the deal were not announced.

In March 2005, Crown sold its 60,000-b/cd refinery to Delek US Holdings Inc. The purchase price for the LaGloria, Tex., refinery was about $78 million.

Updated data from China National Petroleum Corp. showed that the company increased its company-wide capacity to 2.44 million b/cd from 1.78 million b/cd that appeared in last year’s survey. Sinopec likewise increased overall capacity to 3.61 million b/cd from 2.79 million b/cd in last year’s survey.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity.

Largest refineries

Table 3 lists the world’s largest refineries with a minimum capacity of 400,000 b/cd.

Refineries moving up the list due to capacity expansions include ExxonMobil Corp.’s Baytown, Tex., and Baton Rouge refineries.

The Baytown refinery increased its capacity to 563,000 b/cd compared to last year’s reported rate of 557,000 b/cd. Its Baton Rouge plant increased capacity to 501,000 b/cd from 493,500 b/cd last year.

Neither plant moved up or down in the rankings, however.

Table 3 includes four new listings. Two are in Saudi Arabia and the other two are in China and the US.

Saudi Aramco expanded the capacity of its Ras Tanura refinery to 550,000 b/cd from the 300,000 b/cd listed in last year’s survey. The company also expanded its Yanbu plant to 400,000 b/cd from 340,000 b/cd.

Sinopec increased the capacity of its Zhenhai refinery to 403,000 b/cd from 345,000 b/cd listed in last year’s survey. And as previously mentioned, Citgo completed an expansion of its Lake Charles, La., plant in April 2005, which increased capacity by about 132,000 b/cd to 440,000 b/cd.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2006. As previously mentioned, the largest increase in crude capacity occurred in Asia.

Asia growth was due to large capacity increases in China. Middle East growth was due to capacity increases in Saudi Arabia and United Arab Emirates. A smaller increase occurred in Bahrain.

North America and Western Europe both increased capacity about 1.7% in this year’s survey.

Increases in North American capacity were due to expansions in the US and Aruba. Western Europe capacity gains occurred in Belgium, France, Germany, and the UK.

The other regions were flat or had small increases.

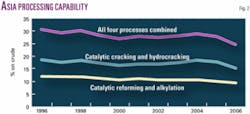

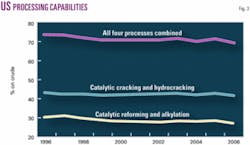

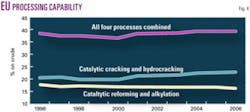

Processing capabilities

Figs. 2-4 show the processing capabilities of Asia, the European Union (EU), and the US for the past 10 years. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels producing processes (catalytic reforming and alkylation) divided by crude distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK. ✦