Market, production conditions will prevent meeting RFS

John M. Mayes

Tom Hogan

Turner, Mason & Co.

Dallas

US refining industry's compliance with the current Renewable Fuels Standard (RFS) appears impossible in the near future and could result in massive fines by the US Environmental Protection Agency. Current market and production conditions make industry efforts much like trying to pour 20 gal of ethanol into a 10-gal bucket.

In creating the current RFS program, the Energy Independence and Security Act (EISA) of 2007 envisioned that ethanol would gradually be added into the base gasoline supply up to a level of 10% to produce E10; that level is referred to as the "blend wall."

As this was being achieved, it must have been assumed by Congress that additional gasoline grades (E15 or E85, for example) would be either introduced or promoted, which would cause ever-increasing volumes of ethanol to be blended, a process analogous to enlarging the bucket. No such development is happening, however, and unless new legislation revises the mandates (that is, unless the 20 gal are reduced), RFS targets cannot be met.

Recent trends

The current RFS requires the blending of up to 36 billion gal of renewable fuels by 2022, of which 15 billion gal is likely to be ethanol produced from corn or other renewable sources by 2015. As technology develops, producers will gradually phase in advanced biofuels (biodiesel, cellulosic ethanol, etc.). As a result, ethanol blending has risen dramatically in recent years before peaking in 2010 and for the last 2 years has remained around 9.6% of the gasoline supply (Fig. 1).

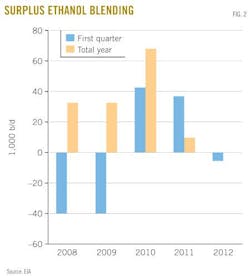

The crude oil and gasoline price spikes in 2008 increased the profitability of ethanol blending, and substantial amounts of discretionary blending that exceeded mandated levels began (Fig. 2). Despite the rapid rise in the volume of blended ethanol as production increased, production did not achieve maximum levels until second-half 2010. Discretionary blending continued through 2011, but the steadily rising yearly mandate volumes outlined in the original legislation gradually eroded the surplus volumes and are likely to surpass blending capabilities in 2012.

RINs, RVOs, and moreThe burden of meeting the RFS mandate falls upon "obligated parties"—producers or importers of gasoline and diesel fuel. Each company must meet the yearly renewable volume obligation (RVO) set by EPA to achieve the volumes specified by the mandate. An obligated party meets its RVO by retiring Renewable Fuel Information Numbers (RINs). An RIN is generated when the renewable fuel is shipped from the production site: 1 gal of ethanol yields one RIN, while 1 gal of biodiesel yields 1.5 RINs. Up to 20% of an obligated party's RVO can be met by RINs that were created in the previous year, thus allowing RINs to be stored and used in the following year. Obligated parties obtain RINs either by purchasing renewable fuels with attached RINs or purchasing RINs from other RIN owners. |

Complicating this imbalance between production and blending capabilities, however, the 2008 Great Recession reduced gasoline demand (Fig. 3), which also reduced the maximum amount of ethanol that could be added. This process is equivalent to pouring ever-increasing volumes into a shrinking bucket.

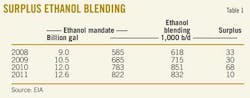

Because of the discretionary blending that occurred 2008-11, a large number of surplus RINs (see box above) was created that can be used to meet future RVO requirements (Table 1). While the ability to blend ethanol into gasoline has peaked and is gradually declining with total gasoline demand, the mandate requirements continue to rise, as specified by EISA.

The portion of the mandate met by corn ethanol in 2010 was 12.0 billion gal (783,000 b/d), and rose to 12.6 billion gal in 2011.1 This increase reduced the surplus ethanol blending to only 10,000 b/d from 68,000 b/d. With the 2012 mandate at 13.2 billion gal, it is unlikely that sufficient volumes of corn ethanol can be blended into the gasoline pool to meet the total RVO requirements; the bucket is now overflowing. This scenario assumes that corn will be available, despite this year's drought. The resulting shortfall will necessitate a drawdown of surplus RINs generated in previous years.

New grades

The only substantial opportunity to increase the ability to blend more ethanol (enlarging the bucket) rests with introduction and development of additional gasoline grades. Introduction of E15 has been approved by EPA, but implementation has stalled. Automobile manufacturers, skeptical of its safety, have warned consumers that engine damage from use of E15 will void vehicle warranties.

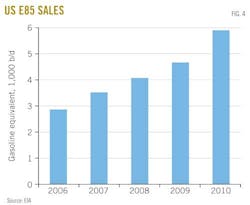

While E85 has been available in many states, sales have increased slowly (Fig. 4). The Renewable Fuels Association estimates slightly more than 2,900 retail stations sell E85 out of 160,000 stations in the US. In 2010, US sales of E85 were slightly less than 5,900 b/d of gasoline-equivalent fuel.2 There are currently around 11 million flex-fuel vehicles (FFVs) in the US that can run on E85 with GM, Ford, and Chrysler producing more than half their vehicles as FFVs beginning with the 2012 model year.

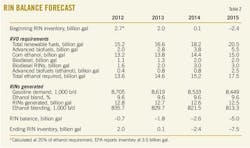

Despite numerous plausible scenarios for the immediate future, Table 2 depicts the RIN balance forecast by Turner, Mason & Co. EPA currently estimates that 3.5 billion RINs have been stored, but only 20% of any year's RVO can be met by a previous year's RINs, making the effective beginning 2012 RIN balance 2.7 billion (20% of 13.6 billion gal).3

The total renewable fuels mandate for 2012 is 15.2 billion gal, of which 2 billion gal must be advanced biofuels. TM&C estimates there will be 1.1 billion gal of biodiesel produced, which will yield 1.6 billion RINs. This will leave 0.4 billion RINs that must be satisfied by ethanol advanced biofuels (cellulosic or derived from Brazilian sugarcane).

This balance produces a total ethanol blending requirement of 13.6 billion gal. With declining gasoline demand and a constant ethanol blending percent, only 12.8 billion RINs will be generated in 2012. The 0.7-billion RIN shortfall will reduce the RIN inventory at the end of 2012 to 2 billion.

The same condition will occur in 2013 with the year's production falling short by 1.8 billion RINs and the ending 2013 inventory declining to only 0.1 billion RINs. With no legislative relaxation of the requirements or major expansion of E15 or E85 sales, the industry will run out of stored RINs in 2014. By 2015, the yearly deficit rises to 5 billion gal, or the equivalent of an additional 326,000 b/d of ethanol being blended into the gasoline pool.

Solutions?

The dilemma in which industry now finds itself has no clear solution. Introduction of E15 would be the easiest path to compliance, but consumer acceptance of a product whose use could void vehicle warranties is highly unlikely. If the current mandates are not modified, ethanol levels will eventually rise above 15%, making E15 only a temporary solution and the investments in its introduction very questionable.

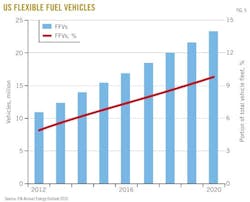

Expansion of E85 sales is viable but will be limited by the availability of FFVs. The US Energy Information Administration (EIA) projects the 11 million FFVs in 2012 will increase to 15.5 million in 2015 (Fig. 5), but this will only represent 6.8% of the automobile and light truck fleet.4

Selling the required additional 5 billion gal of ethanol in 2015 would require virtually all FFV owners across the US to purchase E85 exclusively. In addition, the capital investment would be substantial. To satisfy the forecast shortfall of 5 billion RINs in 2015, the number of E85 stations would have to increase to about 33,000 from the existing 2,900, and the average station sales would have to increase by a factor of 5 (through price subsidy).

Manuscripts welcomeOil & Gas Journal welcomes for publication consideration manuscripts about exploration and development, drilling, production, pipelines, LNG, and processing (refining, petrochemicals, and gas processing). These may be highly technical in nature and appeal or they may be more analytical by way of examining oil and natural gas supply, demand, and markets. OGJ accepts exclusive articles as well as manuscripts adapted from oral and poster presentations. An Author Guide is available at www.ogj.com, click "home" then "Submit an article." Or, contact the Chief Technology Editor ([email protected]; 713/963-6230; or, fax 713/963-6282), Oil & Gas Journal, 1455 West Loop South, Suite 400, Houston TX 77027 USA. |

And so…

From current market conditions and the near-term forecast, several conclusions emerge:

• The preexisting surplus of RINs will allow the industry to meet its RVO requirements for 2012 and 2013 but also creates a condition in which, when the surplus is exhausted at the end of 2013, the yearly RIN balance will become negative by a substantial amount.

• Use of E15 has been approved by EPA, but significant growth in sales is unlikely.

• The continued low level of FFV saturation makes use of E85 only a partial solution even with a massive expansion in the number of retail outlets.

• Ethanol RIN prices should rise substantially during this transition period as the market adjusts to a potential shortfall.

• If the gasoline blending pool is not increased, either ethanol production will be impeded by the lack of sufficient blending opportunities or exports must increase.

• Any breakthrough or increase in cellulosic ethanol production will only exacerbate the problem by increasing ethanol production into an already oversupplied market.

• Expansion of biodiesel sales could enhance RVO compliance by increasing the generation of RINs and has few limitations on the amount that can be blended into the diesel pool.

Given the lack of available solutions, TM&C believes RFS compliance through use of RINs is no longer possible near term. A likely solution could have EPA selling credits similar to those for cellulosic ethanol when the mandate exceeded production levels. While this step may solve the immediate compliance problem, it would represent another substantial tax on the transportation fuels industry.

References

1. Energy Independence and Security Act of 2007.

2. EIA, Alternatives to Traditional Transportation Fuels, 2010.

3. EPA, 2011 EMTS Data, http://www.epa.gov/otaq/fuels/rfsdata/2011emts.htm.

4. EIA Annual Energy Outlook 2012 Early Release, Table 58.

The authors

John Mayes ([email protected]) is a senior consultant with Turner, Mason & Co., Dallas, and specializes in studies and support for the refining industry and other downstream activities. He holds a BS in chemical engineering from Texas A&M University and was previously employed in various refining, supply, and marketing positions with Fina, Ultramar, and BP.

Tom Hogan ([email protected]) is a senior vice-president with Turner, Mason & Co., Dallas, and specializes in fuels compliance issues for refiners, importers, and others in the fuels distribution system. He was previously employed by Mobil Oil, Energy Cooperative Inc., and Husky Oil. Hogan holds a BS in chemical engineering from Michigan State University.