The US Energy Information Administration lowered its crude-oil price forecast and raised its US production outlook for 2018 in its latest Short-Term Energy Outlook. The lower price forecast reflects the possibility of a return to modest oversupply in global oil markets in 2018.

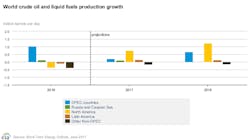

EIA expects that supply growth from the US, Brazil, and members of the Organization of Petroleum Exporting Countries in 2018 will contribute to world oil inventories increasing by 100,000 b/d in 2018, with the largest builds expected in that year’s second quarter. EIA also forecasts that implied global petroleum and liquid fuels inventories will decline by 200,000 b/d in 2017 and then increase by an average of 100,000 b/d in 2018.

The expectation of supply growth in 2018 could contribute to oil-price weakness in late 2017 and early 2018. The current forecast assumes OPEC extends its cuts beyond March 2018, but that noncompliance, which begins to grow in late-2017, increases somewhat in second-half 2018. Without a further extension of the OPEC agreement, EIA would expect larger inventory builds in 2018 than are included in this forecast.

IEA forecasts Brent spot prices to average $53/bbl in 2017, unchanged from a month ago, while the possibility of a return to modest oversupply in global oil markets contributes to the Brent spot price forecast averaging $56/bbl in 2018, $1/bbl lower than in the May STEO. West Texas Intermediate crude oil prices are forecast to average $2/bbl less than Brent prices in both 2017 and 2018.

However, some upward price pressures could emerge in the second half of 2018 if EIA’s forecast that global inventories will decline during that period materializes and if the market expects global oil inventory withdrawals into 2019.

OPEC, US production

OPEC crude oil production is expected to average 32.3 million b/d in 2017 and 32.8 million b/d in 2018, roughly 200,000 b/d and 400,000 b/d lower, respectively, compared with last month’s STEO. The lower forecast takes into account OPEC’s May 25 announcement regarding the extension of its production cuts.

With lower forecast production from OPEC, EIA expects global oil inventories to decline by an average of 200,000 b/d in 2017. The largest draws are expected during this year’s third quarter, when global oil inventories are forecast to fall by an average of 400,000 b/d.

According to EIA, if inventory draws of this magnitude materialize in the coming months and gross US refinery runs remain above 17 million b/d, the possibility exists for some upward pressure on crude oil prices. EIA expects Brent spot prices to average $54/bbl in this year’s third quarter, up from an average of $50/bbl in May.

However, because US tight-oil production is relatively responsive to changes in oil price, and given an estimated 6-month lag between a change in oil prices and realized production, higher crude oil prices in mid-2017 have the potential to raise US production in 2018.

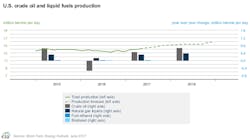

EIA forecasts US crude-oil production to average 9.3 million b/d in 2017 and 10 million b/d in 2018. Growth in US production has been the largest contributor to the 800,000 b/d of non-OPEC liquids supply growth from January through May.

Continued increases in drilling activity in US shale basins, particularly a recent resumption in production growth from the Eagle Ford region in Texas, support production growth throughout the forecast.

After reaching a trough of 316 oil-directed active rigs in May 2016, the US oil-directed rig count has more than doubled to 733 active rigs at the start of June. Rapid US crude oil production growth could be a contributing factor in lowering WTI compared with Brent crude-oil prices. The Brent premium to WTI closed at a 17-month high on May 19 at $2.94/bbl before falling to $2.03/bbl on June 1. A wide Brent-WTI price spread can open opportunities for US producers to export light, sweet crude oil.