EIA: DUC well count in major US oil, gas regions up 58 in October

The count of drilled but uncompleted (DUC) wells in the seven major oil- and gas-producing regions of the US grew by 58 in October to 5,155, with increases in the Permian basin more than offsetting declines in the neighboring Eagle Ford shale, the US Energy Information Administration reported Nov. 14.

The Permian’s DUC tally jumped by 85 during the month to 1,467, while the Eagle Ford’s dropped by 30 to 1,309. The two regions have by far the most DUC wells of the seven major onshore oil and gas producing regions in the US that are monitored by EIA.

The data is part of the agency’s Drilling Productivity Report, which considers “the total number of drilling rigs in operation, along with estimates of drilling productivity and estimated changes in production from existing oil and natural gas wells.” In addition to the Permian and Eagle Ford, it covers the highly productive Bakken, Haynesville, Marcellus, Niobrara, and Utica.

Separate data from Baker Hughes Inc. indicate the Permian’s rig count has added 84 units since May 13, which has represented a bulk of the overall US rig count rebound during that time (OGJ Online, Nov. 14, 2016).

Four other regions recorded slight increases in their respective DUC well tallies during October. The Haynesville rose 4 to 164, the Bakken 2 to 821, the Niobrara 1 to 635, and the Utica 1 to 115. Despite recent rig count gains, the Marcellus dropped 7 DUC wells to 643.

Permian output to rise again

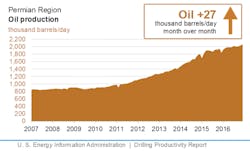

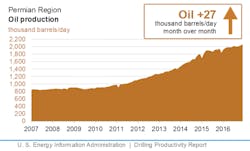

Given the recent ramp up of drilling in the Permian, EIA expects the basin’s crude oil production to record a third consecutive monthly increase in December, rising 27,000 b/d to 2.065 million b/d. Natural gas output is anticipated to climb 52 MMcfd to 7.324 bcfd.

However, the Permian’s resurgence won’t be enough to offset oil and gas production declines from other major regions, EIA forecasts. Combined crude production from the seven regions in December is expected to fall 20,000 b/d to 4.498 million b/d. Gas output is projected to drop 94 MMcfd to 46.951 bcfd.

Eagle Ford oil production is expected to fall below 1 million b/d for the first time since April 2013, shedding 33,000 b/d in December to 978,000 b/d. The South Texas shale play also is seen leading the pack in gas-output losses with a 196-MMcfd decline to 5.561 bcfd.

Bakken oil flow during the month is expected to drop 14,000 b/d to 918,000 b/d. Gas production from the North Dakota shale play is seen dropping 17 MMcfd to 1.595 bcfd.

The Niobrara is the only other region expected to add barrels during the month, with a 2,000-b/d increase to 404,000 b/d. Its gas production, however, is projected to fall 32 MMcfd to 4.16 bcfd.

Among the major shale gas regions, the Marcellus is seen carrying most of the upward momentum with a 130-MMcfd jump in December to 18.301 bcfd. The Haynesville is expected to fall 19 MMcfd to 5.915 bcfd, and the Utica is anticipated to drop 12 MMcfd to 4.094 bcfd.

EIA notes the seven regions covered by the DPR accounted for 92% of US oil production growth and all US gas production growth during 2011-14.

Contact Matt Zborowski at [email protected].