EIA continues to revise up US crude oil production forecast

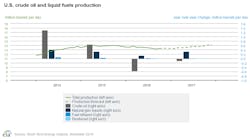

In its latest Short-Term Energy Outlook, the US Energy Information Administration revised the US crude oil production forecast upward from last month’s STEO, based on slower declines in Lower 48 production.

US crude oil production in 2017 is now expected to average 8.73 million b/d in 2017, more than 100,000 b/d higher than in last month’s forecast. In its October report, EIA also revised upward its forecast production in 2017 from the previous forecast, as a result of changes in modeling methodology applied to the Lower 48 excluding federal Gulf of Mexico.

US crude oil production in 2016 is now expected to average 8.84 million b/d, up from 8.73 million b/d in last month’s report.

“Recent increases in drilling activity in the Permian region are expected to lead to an increase in production in that area in 2017, partially offsetting declines in other areas of the Lower 48 states,” EIA said.

According to EIA’s Drilling Productivity Report, the Permian region is the only region expected to show increases in oil production in October and November. Companies added 81 active oil rigs to the Permian since the end of May, with the region now holding almost as many active rigs as the rest of the US, onshore and offshore combined.

Merger and acquisition spending has recently increased in West Texas. Denver-based SM Energy sold $785 million worth of Williston basin assets to fund its $1.6-billion acquisition of 35,700 net acres in the Midland basin of the Permian region.

Despite the forecasted decline in US crude oil production in 2017, overall US liquids fuels production is forecast by EIA to increase 200,000 b/d next year, as the decline in crude oil production will be more than offset by increases in hydrocarbon gas liquids production.

Liquid fuels production outside the US and the Organization of the Petroleum Exporting Countries is forecast to increase by 100,000 b/d in 2017, following a decline of almost 300,000 b/d in 2016. The increases are driven by increasing production in Canada, Russia, and Kazakhstan that is partially offset by declining production in the North Sea, China, and Mexico.

Overall, OPEC crude oil supply is expected to average 32.5 million b/d in 2016 and to increase to 33.3 million b/d in 2017, according to EIA.

Crude oil demand, exchange rates

Global crude oil demand growth in the November STEO was revised upward from the October STEO, with global oil demand expected to rise 1.3 million b/d in 2016 and rise 1.5 million b/d in 2017. China is expected to contribute the most to that growth, with its liquid fuels consumption forecast to increase nearly 400,000 b/d in 2016 and by 300,000 b/d in 2017.

Recent movements in exchange rates seem to confirm the overall strong economic data in emerging market economies and imply robust oil demand growth, according to EIA.

“The value of the US dollar, as measured by the spot US Dollar Index, has appreciated in recent months. Typically, a strengthening [dollar] signifies weaker expectations for the oil demand outlook, as occurred in 2014-15. The [US Dollar Index], however, is heavily weighted toward developed economy currencies, and the recent [dollar] appreciation is not occurring against emerging market currencies,” EIA said.

As measured by the JP Morgan Emerging Market Currency Index, the Dollar Index has appreciated 1.6% against developed market currencies since July 1, whereas it has depreciated 0.4% against emerging market currencies. Brent crude oil prices fell 7.9% over this period, but adjusting for different currencies, they are down only 6.5% in developed market currencies compared with a decline of 7.6% in emerging market currencies.

The dollar’s appreciation against developed market currencies mainly reflects a significant decline in the value of the British pound since the UK voted in June to leave the European Union and expansions to monetary easing programs by the central banks of other developed economies in Europe. Stronger economic data in emerging markets such as India and Brazil are likely contributing to some appreciation of these currencies against the dollar.

“Because oil demand tends to be more price sensitive in emerging markets than in developed economies, the appreciation of the [dollar] against the pound and the euro is unlikely to strongly affect global oil demand, absent other economic developments,” EIA said.

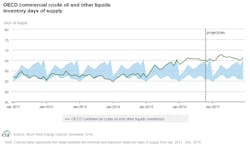

EIA expects global petroleum inventories to build through second-quarter 2017, but “there is significant regional variation in that forecast.” In the US, total oil inventories are expected to decline in this year’s fourth quarter and in first-quarter 2017. However, these US draws are more than offset by inventory builds in other countries in the Organization for Economic Cooperation and Development and in the rest of the world, contributing to expected global inventory builds through the first half of 2017.