EIA: Permian increases DUC inventory, projected oil output

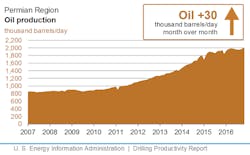

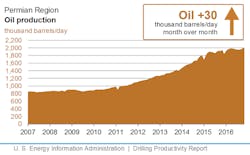

The rising rig count in the Permian basin is being accompanied by a higher tally of drilled but uncompleted (DUC) wells and a higher crude-output forecast, estimates from the US Energy Information Administration show.

The basin of West Texas and southern New Mexico gained 52 DUC wells during September to bring its total to 1,378, the highest in EIA’s data that dates back to December 2013 and debuted in the agency’s Drilling Productivity Report last month. As with its August estimate, the Permian was the only major US oil- and gas-producing region to record a monthly increase (OGJ Online, Sept. 13, 2016).

Between the weeks ended May 13 and Sept. 2, the Permian’s rig count grew by 68 units to 202, accounting for three quarters of the entire US rig count increase during that time, according to Baker Hughes Inc. data. Since then, however, the basin’s count has been relatively stagnant, totaling 201 as of the week ended Oct. 14 (OGJ Online, Oct. 14, 2016).

EIA also forecasts the Permian’s November crude oil production to rise 30,000 b/d to 2.012 million b/d and natural gas output to increase 58 MMcfd to 7.054 bcfd.

US exploration and production firms have flocked to Permian’s Delaware and Midland basins in recent months to take advantage of the regions’ favorable economics. Reports of planned acreage acquisitions and subsequent rig count increases have dotted industry headlines, the most recent of which is RSP Permian Inc.’s purchases of Silver Hill Energy Partners LLC and Silver Hill E&P II LLC for $2.4 billion (OGJ Online, Oct. 14, 2016).

Other major regions

The combined DUC well count of the seven major US oil and gas producing regions fell by 27 during September to 5,069, down 507 compared with its January 2016 peak in EIA’s data. The agency forecasts the regions' overall November crude production to drop 30,000 b/d to 4.429 million b/d, and gas production to lose 178 MMcfd to 45.958 bcfd.

At the opposite end of the spectrum from the Permian is Texas’s other major hub of oil and gas operations, the Eagle Ford, where the DUC inventory is estimated to have dropped by 36 during September to a still-healthy total of 1,276. During November, the shale region’s oil production is projected to fall 35,000 b/d to 947,000 b/d and gas output is seen losing 183 MMcfd to 5.625 bcfd.

Oil production from the Bakken is forecast to be only 1,000 b/d lower than that of the Eagle Ford in November. At 946,000 b/d, the region is projected to be down 21,000 b/d compared with its October average. EIA estimates its DUC count declined by just 4 during September to 820.

The Niobrara’s estimated tally of DUC wells dropped by 18 in September to 670. November oil output from the shale region is forecast to fall just 3,000 b/d to 374,000 b/d, while its gas output is seen decreasing 48 MMcfd to 4.094 bcfd.

The Marcellus recorded 15 fewer DUC wells in September compared with its August estimate, bringing its count to 650. EIA, however, forecasts November gas production from the region to rise 73 MMcfd to 18.194 bcfd.

The Marcellus also has been the site of a recent BHI rig count rally, adding 13 units between Aug. 12 and Oct. 14 to total 34 active units. The overall US tally of gas-directed rigs last week posted its biggest increase in 2 years.

Contact Matt Zborowski at [email protected].