US oil, overall rig counts creep upward; firms plot second-half activity

Thanks to another rise in oil-directed units, the US drilling rig count barely held on to its recent upward momentum during the week ended July 29. The modest increase comes during a week in which many US exploration and production firms outlined second-half drilling plans in second-quarter earnings reports.

The overall count edged up 1 unit to 443 rigs working, marking the eighth time in the last 9 weeks in which the count has risen, data from Baker Hughes Inc. indicates.

Including last week’s year-long-high 15-unit jump, the count is now up 59 units since May 27 (OGJ Online, July 22, 2016). Since the overall drilling dive commenced following the week ended Dec. 5, 2014, the count has fallen 1,457 units.

US crude oil production, meanwhile, posted another weekly gain last week, rising 21,000 b/d to 8.515 million b/d, according to estimates by the US Energy Information Administration. Up 33,000 b/d, Alaska output again offset losses from the Lower 48, which fell 12,000 b/d. Overall US output was down 898,000 b/d year-over-year.

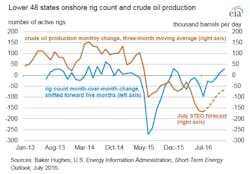

EIA and research and consulting firm Wood Mackenzie last week separately noted the reduced impact of the lower US rig count on production, including that of tight oil.

“People expected that overall tight oil production would collapse when companies stopped drilling. However, it hasn’t collapsed—it’s only declined,” said Jeanie Oudin, WoodMac senior research manager, Lower 48, in an analysis on the recent deep cuts in capital expenditures within the Lower 48.

As rig contracts have expired, operators have shifted their focus to completions within their large backlogs of drilling but uncompleted (DUC) wells (OGJ Online May 19, 2016; June 23, 2016). Operators have also benefited from improvements in well productivity, with estimated ultimate recovery (EUR) steadily rising over the last 18 months in key US tight oil regions.

Optimized completion techniques such as longer laterals, greater use of water and proppant, and increased frac stages continue to bolster production, WoodMac says.

EIA, meanwhile, highlighted the improved average productivity of rigs in light of the recent rig-count increases, as seen in the agency’s Drilling Productivity Report.

New-well oil production per rig through July averaged 796 b/d in the Bakken, 983 b/d in the Eagle Ford, and 470 b/d in the Permian. Compared with the 2015 averages for the regions, those averages represent productivity increases of 155 b/d, 226 b/d, and 111 b/d per well, respectively.

Oil rigs continue warm streak

Also up in 8 of the last 9 weeks, US oil-directed rigs added 3 units this week to reach 374 rigs working, an increase of 58 units since May 27. Compared with its peak in BHI data on Oct. 10, 2014, the count is now down 1,235 units.

Partially offsetting that rise was a 2-unit decline in gas-directed rigs to 86. Three rigs considered unclassified remain operating within US boundaries.

Land-based rigs ended their recent hot streak by sitting unchanged at 440. Rigs engaged in horizontal drilling lost 3 units to 354, but are up 40 units since May 27. Directional drilling rigs jumped 4 units to 48.

One rig drilling in inland waters came online, bringing that tally to 4. Offshore rigs were also unchanged, remaining at 19 units working. One unit started operations off Texas, canceling out 1 unit that stopped work off Alaska.

The offshore count remains at its lowest level since late 2010, in part reflecting the industry’s ambivalence toward pricey and risky deepwater exploration and development. In its effort to fully exit deepwater exploration, ConocoPhillips said this week that it has agreed to terminate its final Gulf of Mexico drillship contract.

Topping last week’s big US rig count jump, Canada gained 17 rigs during the week to 119, up 83 units since May 6. Most of the weekly increase again came from oil-directed rigs, whose tally collected 12 units to 60, up 52 units since Apr. 8. Gas-directed rigs rose 5 units to 58.

Texas takes first loss in 2 months

After posting its largest increase in nearly 2 years last week and bolstering the overall US count, Texas recorded its first decline in 9 weeks, dropping 3 units this week to 214. Compared with its May 27 total, the count is still up 40 units.

The Barnett, which has shown to be something of a volatile place for drilling in recent weeks, lost 3 units to 5. The Eagle Ford decreased 2 units to 33. The Haynesville edged down a unit to 15. The Permian, meanwhile, increased for the seventh straight week, rising 4 units to 172, up 38 units since May 13.

Including its 1 offshore rig going offline, Alaska fell 2 units to 4. West Virginia also dropped 2 units, landing at 8. The Marcellus lost a unit to 22. Utah declined a unit to 2.

Oklahoma, Colorado, Pennsylvania, and Ohio each gained a unit to respective totals of 60, 21, 15, and 13. The Cana Woodford, DJ-Niobrara, and Utica each were up a unit as well, respectively reaching 29, 19, and 13. The Mississippian decreased 2 units to 4.

Each with 2-unit gains, Louisiana and New Mexico led the states and now total 46 and 28, respectively. New Mexico has risen in 4 consecutive weeks, adding 9 units over that time.

US E&P firms’ drilling activity

Second-quarter earnings reports from E&P firms, many of which have struggled financially during the downturn, show an optimistic but cautious approach to second-half drilling activity in light of recent oil-price increases.

Anadarko Petroleum Corp. says it has continued its delineation program in the Delaware basin of West Texas, running 6 rigs to further its understanding of both the vertical and horizontal potential across its 600,000-gross-acre position in the heart of the play (OGJ Online, July 27, 2016).

QEP Resources Inc. expects to add 2 horizontal units on its recently acquired Midland basin acreage by yearend, with 3 horizontal units operating on the new acreage by yearend 2017 (OGJ Online, June 22, 2016).

At the end of the second quarter, QEP had 1 operated rig in the Permian drilling horizontal wells, 1 operated rig working on its South Antelope acreage in the Williston, and 1 operated rig running in Pinedale.

Halcon Resources Corp. is running 1 operated rig in the Fort Berthold area of the Williston and plans to keep it running through the remainder of the year. Halcon has no other operated rigs running, but anticipates adding a rig back to the El Halcon area of the Eagle Ford when oil prices improve.

Consol Energy Inc. plans to add 2 horizontal units to resume drilling in the Utica and Marcellus beginning in August. The company expects to drill 8 dry Utica wells in Monroe County, Ohio, and 2 Marcellus wells in Washington County, Pa.

Whiting Petroleum Corp. has entered into a 30-well participation agreement in its Pronghorn area of the Williston, and plans to add a rig in October to begin drilling the program (OGJ Online, July 28, 2016). Bolstered by stronger commodity prices and higher cash flow, the company also plans to complete 16 gross (12.5 net) DUC wells in the Williston during the second half.

Hess Corp. said it operated an average of 3 units in the Bakken during the second quarter and brought 26 gross operated wells online.

Range Resources Corp., which operates in the Marcellus and Midcontinent region, expects to average 3 rigs running in the second half. Baytex Energy Corp., whose assets lie in the Eagle Ford and Western Canadian Sedimentary Basin, has reduced its rig count to 3 from a first-quarter total of 6.

Also in the Marcellus, EQT Corp. has 4 units working while Cabot Oil & Gas Corp. is operating 1 unit and recently added a second completion crew.

Last week, Southwestern Energy Co. said it plans to increase its companywide rig count to 5 by the end of the third quarter. The firm has already reinitiated drilling with its first rig in Northeast Appalachia. Of the 5 units, 2 will be in Northeast Appalachia, 2 in Southwest Appalachia, and 1 in Fayetteville.

Contact Matt Zborowski at [email protected].