Parsley Energy to add mineral rights in Southern Delaware basin

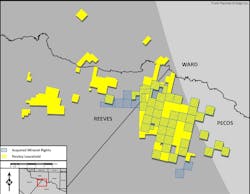

Parsley Energy Inc., Midland, Tex., has agreed to acquire mineral rights on 29,813 acres in the Southern Delaware basin with an average royalty interest of 17.5% for $280.5 million in cash.

Residing in Pecos and Reeves counties in Texas, 82% of the mineral acreage represents Parsley leasehold, with the balance leased and operated by other companies. Parsley also acquired surface rights on 80% of the acreage. Current net production on the total acreage is 280 boe/d.

The firm notes the rights boost net revenue interest (NRI) on 186 gross-net horizontal drilling locations in the upper Wolfcamp interval, assuming one flow unit and 660-ft between-well spacing. Parsley is assessing the potential for additional flow units in the Wolfcamp complex and the Bone Spring interval on acreage associated with the acquired rights, where the overall average NRI on horizontal drilling locations will increase from to 92.5% from 75%.

The firm expects to complete 5-7 wells in the Southern Delaware this year. Of those, Parsley expects 3-5 wells to be completed on the acquired mineral acreage. The deal, scheduled to close by July 14, is expected to be financed through debt and equity issuances.

Separately, Parsley acquired additional working interests in the firm’s Southern Delaware leasehold in Pecos and Reeves counties totaling 885 net acres for $9 million in cash. The deal closed on May 10. All of the incremental working interests are associated with mineral acreage, bringing Parsley’s working interest to 100% and NRI to 87.5% in the properties.

Assuming just one flow unit in the upper Wolfcamp target interval, the acquired working interests translate to an additional 10 net horizontal drilling locations with an average lateral length of 7,250 ft.

Parsley in 2014 agreed to buy from “multiple sellers” undeveloped and productive acreage in Reagan County, Tex., for $252 million (OGJ Online, Aug. 26, 2014).