BHI: Another double-digit decline for US rig count

The overall US drilling rig count dropped 12 units to 464 units working during a week ended Mar. 24 shortened by the Good Friday holiday, according to Baker Hughes Inc. data.

During this year’s first 12 weeks, the count has dropped by double digits in all but two weeks (OGJ Online, Mar. 18, 2016).

The overall count has now fallen for the 29th time in the past 31 weeks, continuing a slide that has resulted in new lows in recorded data (OGJ Online, Mar. 11, 2016).

Since a predrilling-dive peak of 1,920 on Dec. 5, 2014, the count has plunged 1,456 units (OGJ Online, Dec. 5, 2014).

New wells dominate US oil output

Last week, the US Energy Information Administration noted in an energy update that crude oil production from hydraulic fracturing now represents about half of overall US output.

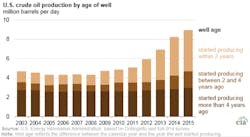

EIA reported this week that crude production in the Lower 48 from wells drilled since the start of 2014 made up 48% of total output in 2015, up from 22% in 2007.

Production in 2015 from tight formations—which include but are not limited to shale plays—accounted for more than 4 million b/d, or 50% of total US output. Output from tight formations increased from 500,000 b/d in 2009 to 4.6 million b/d in May 2015, at which point falling crude oil prices contributed to declines in production.

As of December 2015, oil production from tight formations was 8% lower than that of the previous May. More than 80% of oil output from tight formations originates from the Eagle Ford, Bakken, and Permian regions.

“Horizontal wells drilled into tight formations tend to have very high initial production rates, but they also have steep initial decline rates,” EIA explained. “With steep decline rates, constant drilling and development of new wells is necessary to maintain or increase production levels.”

The US oil-directed rig count is currently 372, compared with its peak in BHI data of 1,609 on the week ended Oct. 10, 2014.

EIA also noted, however, that inventories of drilled but uncompleted wells and the potential for recompleting and refracturing existing wells can boost output from already-producing wells without additional drilling. Those measures have resulted in less pronounced production declines during the current downturn.

Oil rigs resume decline

After posting its first increase last week in 13 weeks, the US oil-directed count resumed its year-and-a-half-long slide this week by losing 15 units. The new total of 372 is down 1,237 units since its peak in BHI data on Oct. 10, 2014.

Gas-directed rigs, which have continually hit lows not seen in decades since the downturn, gained 3 units this week to 92.

The onshore rig count subtracted 14 units to 432, down 578 units year-over-year.

Rigs engaged in horizontal drilling shed 10 units to 359, down 1,013 units since a peak in BHI data on Nov. 21, 2014, and their lowest count since Apr. 27, 2007. Directional drilling rigs, meanwhile, increased 3 units to 52.

Each of the offshore rig count and tally of rigs drilling in inland waters rose a unit to 28 and 4, respectively.

Canada’s steep drilling dive to begin the year continued with a 14-unit loss to 55, its lowest point in decades and down 195 units since Jan 22.

All but one of the rigs to go offline in Canada were oil-directed, bringing that count to 11, also its lowest point in decades and down 123 units since Jan. 22. Gas-directed rigs edged down a unit to 44.

Bulk of losses in Permian, Eagle Ford

Among the major oil- and gas-producing states, Texas—as usual—took the largest hit this week after posting its first increase of the year last week. With an 8-unit decrease to 209, the state’s count is down 749 units since a peak in BHI data on Aug. 29, 2008, and is at its lowest level since the 1990s.

The Permian resumed its decline with a 5-unit loss to 147, down 421 since a recent peak on Dec. 5, 2014. The Eagle Ford also continued its plunge, decreasing 4 units to 41, down 218 since a peak on May 25, 2012.

The Barnett, meanwhile, gained 2 units to 6.

Oklahoma lost 3 units to 63, down 146 units compared with when it entered 2015 and at its lowest point in BHI data that dates back to the 1990s. The Cana Woodford also dropped 3 units, settling at 31; and the Ardmore Woodford was cut in half to 1.

Alaska dropped 2 units to 10. Pennsylvania and Kansas each edged down a unit to 18 and 7, respectively. The Marcellus lost a unit to 30.

New Mexico posted its first increase of the year, rising a unit to 14. Louisiana led the states with a 2-unit increase to 51, reflecting, in part, one offshore rig starting up.

Contact Matt Zborowski at [email protected].