OGUK: Investment in new North Sea projects plunges 90% in 2016

Sparking fears for the long-term future of the industry, the UK upstream segment is expected to approve fewer than £1 billion in spending on new North Sea projects compared with an average of £8 billion/year over the past 5 years, according to Oil & Gas UK’s 2016 Activity Survey published Feb. 23.

The report on the activities of exploration and production companies operating in the UK Continental Shelf (UKCS) charts the industry’s progress in the pursuit of competitiveness.

It reveals that while the industry’s drive to improve efficiency, reduce operating costs, and increase production has had marked success, exploration remains at an all-time low with no sign of improving.

The trade body is calling on the UK government for urgent reforms of the special taxes paid by the industry to attract investment back into the basin and minimize loss of capacity during the downturn.

Pressure mounts

OGUK notes that sector-wide action has pushed unit operating costs down by a third to an average of $20.95/boe in 2015 from $29.30/boe in 2014, aided by a 10% rise in oil and gas production—the first in 15 years. Costs are expected to fall a further 20% this year to $17/boe, a 42% improvement in just 2 years.

However, pressures on the sector have grown as prices have continued to fall. Despite the rise in production to an average of 1.64 million boe/d in 2015, revenues during the year fell 30% to £18.1 billion.

If the oil price remains around $30/bbl for the remainder of 2016, nearly half of all UKCS oil fields are likely to be operating at a loss, deterring further exploration and capital investment, and making additional cost improvement imperative, OGUK says.

“The UKCS is entering a phase of ‘super maturity,’” explained Deirdre Michie, Oil & Gas UK chief executive. “While the industry’s decades of experience provide great depths of knowledge and expertise which can be applied to recover the still significant remaining resource, the report highlights the challenges that the falling oil price poses in our capability to maximize economic recovery of the UK’s offshore oil and gas.”

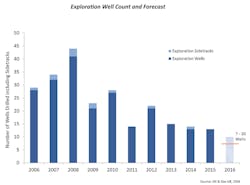

While success per exploration well drilled in 2015 was the highest for 10 years, the rate of exploration for new oil and gas reserves remains at an all-time low.

Just 13 exploration and 13 appraisal wells were drilled in 2015 and, as companies restricted capital even further, as few as 7-10 exploration wells and 6-9 appraisal wells are forecast to be drilled this year.

Capital investment falling

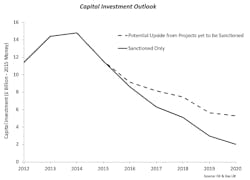

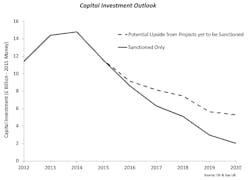

OGUK highlights that previously sanctioned capital investment that was being spent over a period of several years is tailing off. Total capital expenditure fell to £11.6 billion last year from £14.8 billion in 2014, and is expected to fall further this year to £9 billion.

The drop in activity is being felt through the supply chain, which contracted by one quarter in the last year and is expected to fall further in the coming year as current projects near completion, according to data from Rystad Energy. With demand for goods and services falling, ongoing job losses are expected.

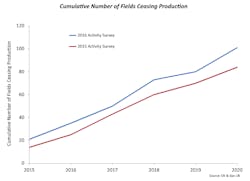

Over the past year, the number of fields expected to cease production during 2015-20 has risen by a fifth to more than 100. Reserves reported by companies for potential future development have fallen to 8.8 billion boe from 10 billion boe, as projects are deemed uncommercial in the current environment.

“The basin has to compete fiercely in the global market to attract price-constrained capital to the UK,” Michie said. “A coherent approach by the industry, regulator, and government will be critical to boost the industry’s competitiveness and its investors’ confidence.

Competitive tax regime needed

“Together we need to transform the basin into a highly competitive, low tax, high activity province, which is attractive to a variety of operators and sustains and supports the important supply chain based here. It is absolutely crucial that the recently announced Aberdeen City Region Deal and funding for the Oil and Gas Technology Centre, which will help support the industry in the longer term, is accompanied by the right signals in relation to the tax regime,” she said.

Michie noted that the industry currently pays special taxes at a headline rate of 50%. “A significant permanent reduction in those rates is now urgently needed, a move which would be consistent with HM Treasury’s ‘Driving Investment’ plan for fiscal reform,” she said. “This should be combined with additional measures to help unlock the late-life asset market and encourage exploration by permanently removing the special taxes from all discoveries made over the next 5 years.

“Finally, improving the effectiveness of the Investment Allowance would stimulate activity in the short term and attract fresh investment,” she said.

Michie asserted that the UKCS still holds up to 20 billion boe that can “support hundreds of thousands of jobs, generate several billion pounds in corporate and payroll taxes from the supply chain, and stimulate countless technological innovations.”