STEO: Annual non-OPEC oil production to decline in 2016

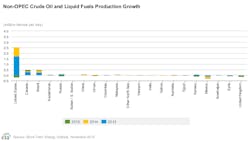

Oil supplies from countries outside the Organization of Petroleum Exporting Countries is forecast to decline by 300,000 b/d in 2016, after an increase of 1.1 million b/d in 2015, according to the most recent Short-Term Energy Outlook from the US Energy Information Administration. This would be the first annual decline in non-OPEC production since 2008, EIA said. In last month’s STEO, non-OPEC production was forecast to increase 100,000 b/d in 2016.

“The shift in expectation from non-OPEC production growth to declines in 2016 is mostly because of lower expected growth in Canada and larger expected declines in US onshore production,” EIA said.

Production growth in Canada is expected to average 100,000 b/d in both 2015 and 2016—levels that are 100,000 b/d and 200,000 b/d, respectively, lower than in last month’s forecast.

“The reduction in forecast growth in Canada reflects persistently low oil prices resulting in announced delays or cancellations of projects previously scheduled to come online during the forecast period, including Shell’s October announcement canceling the 80,000 b/d Camron Creek project,” EIA said (OGJ Online, Oct. 28, 2015).

OPEC crude oil production is forecast to rise 900,000 b/d in 2015, led by production increases in Iraq, and to increase 200,000 b/d in 2016, with Iran forecast to increase production once international sanctions targeting its oil sector are suspended. EIA estimates that OPEC crude oil production averaged 30.1 million b/d in 2014.

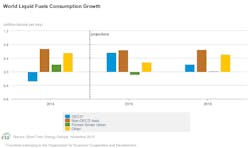

In this month’s STEO, EIA expects global oil consumption to rise 1.4 million b/d in both 2015 and 2016, compared with a growth of 1.2 million b/d in 2014.

Consumption in countries outside the Organization for Economic Cooperation and Development increased 1.4 million b/d in 2014 and is projected to rise 800,000 b/d in 2015 and 1.2 million b/d in 2016.

After falling 300,000 b/d in 2014, OECD petroleum and other liquids consumption is expected to rise 600,000 b/d in 2015 and 200,000 b/d in 2016, reaching an average of 46.5 million b/d—the highest annual average level of OECD consumption since 2010.

EIA estimates that OECD commercial crude oil and other liquids inventories totaled 2.7 billion bbl at yearend 2014, equal to roughly 59 days’ consumption. Forecast OECD inventories rise to 2.95 billion bbl at yearend and then to 2.98 billion bbl at yearend 2016.

US market

Gasoline consumption in the US increased 2.7% during the first 8 months of 2015 compared with same period during 2014, reflecting strong growth in employment and lower gasoline prices.

In October, regular gasoline retail prices fell across all regions except in PADD 2 (Midwest), where high levels of planned and unplanned refinery outages reduced gasoline supplies. US average regular gasoline retail prices fell from $2.37/gal in September to $2.29/gal in October.

According to EIA’s latest forecast, total US liquids fuels consumption will increase 330,000 b/d (1.7%) in 2015, led by motor gasoline and up from an increase of 140,000 b/d (0.8%) last year. Total liquid fuels consumption growth in 2016 is forecast at 120,000 b/d (0.6%).

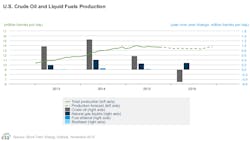

US crude oil production is projected to increase to 9.3 million b/d in 2015, up from an average of 8.7 million b/d in 2014, and then decrease to 8.8 million b/d in 2016. Forecast crude oil production in 2016 is 100,000 b/d lower than in last month’s STEO, reflecting lower crude oil prices and rig counts in 2016 than projected in last month’s STEO.

Monthly crude oil production started to decrease in this year’s second quarter, led by Lower 48 onshore production. From March through October, Lower 48 onshore output has fallen from more than 7.6 million b/d to about 7.1 million b/d, according to survey-based production estimates.

EIA estimates total crude oil production has declined almost 500,000 b/d since April, averaging 9.1 million b/d in October. EIA expects US crude oil production declines to continue through September 2016, when total production is forecast to average 8.5 million b/d.