IEA: Global oil market likely to be oversupplied through 2016

A projected marked slowdown in oil demand growth next year and the anticipated arrival of additional Iranian barrels—should international sanctions be eased—are likely to keep the market oversupplied through 2016, the International Energy Agency said in its October Oil Market Report.

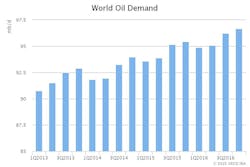

According to IEA’s most recent estimates, global demand growth is expected to slow down from its 5-year high of 1.8 million b/d in 2015 to 1.2 million b/d in 2016. These figures compare with 1.7 million b/d in 2015 and 1.4 million b/d in 2016, respectively, from last month’s OMR. Revised global oil demand now stands at 94.5 million b/d in 2015 and 95.7 million b/d in 2016.

The demand outlook for next year is looking softer mainly due to recent downgrades to the macroeconomic outlook and expectations that crude oil prices will not see repeats of the heavy losses of 2015.

The International Monetary Fund (IMF), in its latest World Economic Outlook, cut 0.2 of a percentage point from 2015 and 2016 economic growth, with big markdowns in oil-dependent economics, such as Canada, Brazil, Venezuela, Russia, and Saudi Arabia.

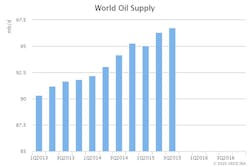

Global oil supplies held steady near 96.6 million b/d in September, as lower production from non-members of the Organization of Petroleum Exporting Countries was offset by a slight increase in OPEC crude output.

The continued strong performance from OPEC’s two biggest producers—Saudi Arabia and Iraq—left the group’s overall output in September running 940,000 b/d higher than the previous year. Since March, OPEC has pumped in excess of 31 million b/d—raising its year-to-date average to 31.2 million b/d vs. 30.2 million b/d in the first 9 months of 2014.

“Iraq and Iran are critical low-cost OPEC producers when it comes to determining how the global oil market balance evolves in 2016,” IEA said.

Iraq is currently the world’s fastest source of supply growth: average output of 4.2 million b/d during this year’s third quarter was 1 million b/d above a year ago. But “oil’s collapse and Iraq’s severe financial crisis have forced the government to curb spending, hence output next year is likely to remain broadly flat versus 3Q 2015 levels,” IEA said. Iran, on the other hand, could see upside potential of some 600,000 b/d—provided international sanctions are eased.

“Non-OPEC supply growth is clearly eroding.” For September, non-OPEC supply fell by 180,000 b/d to 58.3 million b/d on lower North American output.

“From 2.2 million b/d at the start of the year, and as much as 2.7 million b/d in December 2014, [year-over-year] growth had fallen to below 0.7 million b/d in September. The sharpest slowdown is in the US, where onshore crude and condensate production has started to drop,” IEA said.

After a brief recovery in active oil rigs in the US over July and August, producers pulled 70 rigs out of service in September and early October, reducing the total number of rigs to only 605 in the week ended Oct. 9.

“The sector could be tested further in October as banks reevaluate credit lines that are crucial to operators with little or negative free cash flow. For the time being, it looks as though banks are maintaining lines, not cutting them, as they need the heavily indebted sector to maintain production to service their debt,” IEA said.

IEA forecasts that lower oil prices and steep spending curbs will cut nearly 500,000 b/d from non-OPEC output next year, with the US, Russia, and Norway hit hard. For now, however, record supply from Russia and Brazil and a faster-than-expected rebound in Canada have led to a 150,000 b/d upward revision to 2015 and an 110,000 b/d lift for 2016 since last month’s OMR.

Commercial inventories from members of the Organization for Economic Cooperation and Development extended recent gains and rose 28.8 million bbl in August to stand at 2,943 million bbl by the month’s end. Since this was nearly double the 15 million bbl 5-year average build for the month, inventories’ surplus to average levels widened to 204 million bbl.

The onset of seasonal turnarounds is estimated to have curbed global refinery runs by 1.9 million b/d in September to 79.4 million b/d. The OECD and the former Soviet Union accounted for the bulk of the decline, while runs remained remarkably strong in Asia and the Middle East.