EIA: US shale oil output to drop 80,000 b/d in October

Crude oil production in October from seven major US shale plays is expected to drop 80,000 b/d to 5.21 million b/d, according to the US Energy Information Administration’s latest Drilling Productivity Report (DPR). That’s less than projected declines for each of the previous 4 months (OGJ Online, Aug. 10, 2015).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US oil production increases and all US natural gas production increases during 2011-13.

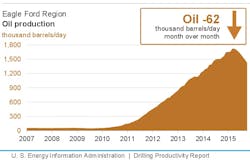

The Eagle Ford has represented a bulk of the overall declines since output from the plays began trending downward during the spring. EIA projects October production from the South Texas play to decline 62,000 b/d to 1.42 million b/d. The Bakken is expected to fall 21,000 b/d to 1.18 million b/d, while the Niobrara is expected to fall 19,000 b/d to 380,000 b/d.

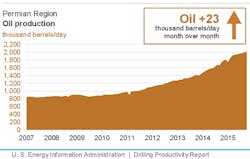

Despite losses in the other major oil-producing plays, the Permian has continued its growth over the past few months, according to the DPR. Output from the basin is expected to jump 23,000 b/d in October to 2.02 million b/d.

New-well oil production/rig across the seven plays is again projected to increase by a rig-weighted average of only 1 b/d, reaching a total of 449 b/d in October. The Utica leads the way, rising 14 b/d to 353 b/d. It’s followed by the Niobrara at 12 b/d to 572 b/d, Permian at 5 b/d to 370 b/d, Eagle Ford at 3 b/d to 795 b/d, Bakken at 2 b/d to 694 b/d, and Marcellus at 1 b/d to 60 b/d.

Natural gas production from the plays in October is expected to fall 208 MMcfd to 44.79 bcfd. The Eagle Ford again leads the way, losing 117 MMcfd to 6.81 bcfd. Other substantial decreases are seen occurring in the Marcellus, down 82 MMcfd to 16.29 bcfd; and Niobrara, down 50 MMcfd to 4.32 bcfd.

The Haynesville, meanwhile, is projected to increase 39 MMcfd to 6.52 bcfd, while the Permian is projected to gain 8 MMcfd to 6.48 bcfd.