EIA: Crack spreads higher due to low oil prices, rising gasoline demand

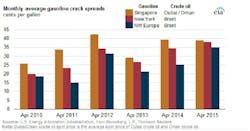

Gasoline crack spreads in the US, especially on the East Coast, have reached several-year highs in recent months, according to a recent report from the US Energy Information Administration. In April, for example, wholesale conventional gasoline in New York Harbor averaged $1.79/gal, and the Brent crude oil spot price averaged $1.41/gal, resulting in a crack spread of 38¢/gal—the highest for the month of April since 2007.

Gasoline crack spreads outside the US also have been strengthened. In the European gasoline market, the Northwest Europe gasoline-Brent crack spread averaged 35¢/gal in April, the highest since at least April 2010. In Asia, the Singapore gasoline-Dubai/Oman crack spread averaged 39¢/gal in April, similar to levels last year and 3¢/gal below the recent high in April 2012.

“The main factors contributing to the global rise in gasoline crack spreads this year are the lowest crude oil prices in several years, robust US gasoline consumption and exports, and higher-than-expected demand for liquid fuels in Europe and some countries outside the Organization for Economic Cooperation and Development (OECD),” EIA said.

Refiners in many regions of the world have been processing larger volumes of crude oil to take advantage of these higher gasoline crack spreads. On the US East Coast, average gross inputs to refineries in April were the most for that month of the year since 2010. Refineries in Europe, where, for years, the refining sector had low profitability, now have increased refining utilization rates amid improving margins.

“Although April gasoline crack spreads in Asia did not exceed recent record highs, Asian refineries have been processing more crude oil compared to the same time last year as margins from gasoline and other petroleum products in that region have remained strong since the first quarter of 2015,” EIA said.