EIA: Monthly average Brent price up for first time in 8 months

North Sea Brent crude oil prices averaged $58/bbl in February—up $10/bbl from the January average—representing the first monthly average price increase since June 2014, according to the US Energy Information Administration’s latest Short-Term Energy Outlook (STEO).

EIA says the price increase reflects news of falling US crude oil rig counts and reported reductions in capital expenditures by major oil companies, along with lower-than-expected Iraqi crude oil exports. Baker Hughes Inc.’s latest US oil rig count is down 653 units compared with the Dec. 5 total (OGJ Online, Mar. 6, 2015).

EIA forecasts that Brent prices will average $59/bbl in 2015, $2/bbl higher than projected in last month’s STEO, and $75/bbl in 2016 (OGJ Online, Feb. 10, 2015).

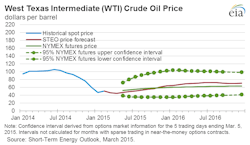

West Texas Intermediate prices in 2015 and 2016 are expected to average $7/bbl and $5/bbl, respectively, less than Brent. The Brent-WTI spread for 2015 is more than twice the projection in last month's STEO, reflecting continuing large builds in US crude oil inventories, including at the Cushing, Okla., storage hub.

The current values of futures and options contracts continue to suggest very high uncertainty in the oil price outlook, EIA says. Although WTI futures contracts for June delivery traded during the 5-day period ending Mar. 5 averaged $54/bbl, the market’s expectations for monthly average WTI prices in June range $33-81/bbl.

The band widens over time, with lower and upper limits of $32/bbl and $108/bbl for the broadly held December 2015 contract.

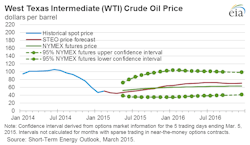

Total US crude oil production, meanwhile, averaged an estimated 9.4 million b/d in February. Given EIA’s price forecast, projected total crude oil production averages 9.3 million b/d in 2015 and 9.5 million b/d in 2016, close to the 9.6 million b/d highest annual average level of US production in 1970.

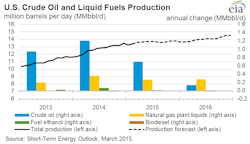

US average regular gasoline retail prices increased for the sixth consecutive week from $2.04/gal on Jan. 26 to $2.49/gal on Mar. 9, reflecting rising crude oil prices and several outages at West Coast refineries.

EIA expects US regular gasoline retail prices, which averaged $3.36/gal in 2014, to average $2.39/gal in 2015, an increase of 5¢/gal from last month's STEO, and $2.73/gal in 2016. The average household is expected to spend $710 less for gasoline in 2015 compared with last year because of lower prices.

Natural gas working inventories on Feb. 27 totaled 1,710 bcf, 492 bcf above the level at the same time in 2014 but 143 bcf below the previous 5-year average during 2010-14. EIA expects the Henry Hub natural gas spot price, which averaged $4.39/MMbtu in 2014, to average $3.07/MMbtu in 2015 and $3.48/MMbtu in 2016, largely unchanged from last month's STEO.