BHI: US rig count plunges in 15th straight week, spurred by offshore dropoff

The US drilling rig count fell 56 units—41 of which targeted oil—to settle at 1,069 rigs working during the week ended Mar. 20, capping off the 15th consecutive week in declines, according to data from Baker Hughes Inc.

Since the week ended Dec. 5, the rig count has plunged 851 units (OGJ Online, Dec. 5, 2014). The total of 1,069 is the lowest count since the week ended Oct. 30, 2009, and 734 fewer units compared with this week a year ago.

The US Energy Information Administration noted this week in its “Today in Energy” update that the last major rig count drop during the 2008-09 recession had little impact on overall oil production because of rig efficiency.

“When producers make the decision to lay down some drilling rigs, they generally start by idling the older, least-efficient ones first,” EIA said. “The effect on production depends on the productivity of the remaining rigs.”

The 2008-09 plunge was “more than offset by increases in the productivity of remaining rigs, as those more productive rigs required fewer days to drill and complete a well, had higher initial production rates, and were more able to drill multiple horizontal wells from a single pad.”

EIA said, however, that “because the base level of rig performance is so much higher now than several years ago, it is not clear that productivity gains will offset rig count declines to the same degree as in 2008-09.”

Offshore rigs plunge

Oil rigs now total 825, down 750 units since Dec. 5 and 648 units year-over-year. Gas rigs shed 15 units to 242. Rigs considered unclassified were again unchanged at 2.

Down 11 units to 37, offshore rigs experienced their largest 1-week decline since the week ended June 4, 2010, when the total was halved to 24 in the wake of the deepwater Macondo oil spill. The total of 37 is the fewest since the week ended Nov. 25, 2011.

Rigs drilling in inland waters were down 6 to just 2 rigs working.

This week, Transocean Ltd. said it plans to scrap four of its offshore drilling rigs and stack four others (OGJ Online, Mar. 19, 2015). The company now has reported plans to scrap a total of 16 floaters.

Meanwhile, land rigs lost 39 units to 1,030, down an even 700 year-over-year.

Rigs engaged in horizontal drilling dropped 20 units to 829. Since Nov. 21, 543 horizontal units have gone offline. Rigs drilling directionally, meanwhile, dropped 18 units to 92.

For the second consecutive week, Canada’s rig count surpassed its southerly neighbor in losses, again plunging 80 units, now totaling 140. That total is less than half of the 300 reported two weeks ago and down almost 70% since the country had 440 units at week ended Jan. 16.

Oil rigs in Canada were down 55 units to 30, while gas rigs were down 25 units to 110.

Texas, Permian again lead way

Another precipitous fall in Texas’s rig count headlined the major oil- and gas-producing states this week. Down 36 units this week to 465, the state reached its lowest total since the week ended Dec. 11, 2009.

Since Nov. 21, the Texas rig count has nearly halved, losing 441 units during that time. Since this time last year, the state has lost 393 units.

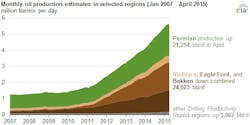

The Permian’s plunge continued this week as it dropped 19 units to 292, down 221 units year-over-year. The Eagle Ford, where production is expected to decline 10,000 b/d to 1.7 million b/d in April, dropped 8 units this week to 138.

EIA last week said in its Drilling Productivity Report (DPR), however, that production from the Permian in April is still expected to increase 21,000 b/d to nearly 2 million b/d (OGJ Online, Mar. 10, 2015).

“The Permian region, where as late as December 2013 half the operating rigs were vertical rigs, still appears to be experiencing significantly larger productivity improvements than other DPR regions,” EIA said this week. “In general, average production from a vertical well is significantly smaller than that from a horizontal well.

“As more vertical rigs are brought offline, the ratio of vertical to horizontal rigs in the Permian, which has only fallen below 1:1 in recent months, is coming closer to, but remains above, the vertical-to-horizontal rig ratio in the other DPR regions,” EIA explained.

Other major producing states

Neighboring Louisiana again reported the second-most losses of the major producing states, falling 18 units to 75. That total, along with the state’s 41 land rigs, is easily Louisiana’s fewest on record dating back to January 2000.

A distant third was New Mexico, which shed 5 units to 53. North Dakota and Ohio each shed 3 units to 98 and 28, respectively. Kansas and Arkansas each shed 2 units to 12 and 9, respectively.

Unchanged from a week ago were Wyoming at 29 and Utah at 8.

For the first time in weeks, several states reported gains. Alaska led the way with a 4-unit rise to 15. Pennsylvania and West Virginia each rose 3 units to respective totals of 50 and 21, reflecting a 6-unit jump in the Marcellus to 69. West Virginia’s rig count has increased in three straight weeks.

Oklahoma and Colorado each gained 2 units to 136 and 39 respectively. California edged up a unit to 15.

Contact Matt Zborowski at [email protected].