EIA: Continued global oil stock build to keep pressure on oil prices

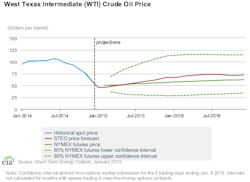

In its most recent monthly Short-Term Energy Outlook (STEO), the US Energy Information Administration reported it expects global oil inventories to continue to build in 2015, keeping downward pressure on oil prices. EIA’s January STEO, which is the first to include estimates for 2016, forecasts Brent crude oil prices will average $58/bbl in 2015, $11/bbl lower than projected last month, and $75/bbl in 2016. The annual average for West Texas Intermediate is expected to be $3-4/bbl below Brent, EIA said.

Based on current market balances, EIA expects downward price pressures to be concentrated in the first half of 2015 when global inventory builds are expected to be particularly strong. EIA projects that Brent prices will reach a 2015 monthly average low of $49/bbl in January and February, and then increase through the remainder of the year to average $67/bbl during the fourth quarter.

Global oil market

EIA expects global oil consumption to grow by 1 million b/d in both 2015 and 2016, following a 900,000 b/d growth in 2014.

Consumption by members outside the Organization of Economic Cooperation and Development increased by 1.2 million b/d in 2014, and is projected to rise by 900,000 b/d in 2015 and 1.1 million b/d in 2016. Russia’s consumption will decline 200,000 b/d in 2015 because of its economic downturn. China is the leading contributor to projected global consumption growth, with consumption expected to increase by an annual average of 300,000 b/d over the next 2 years.

OECD consumption, which fell by 300,000 b/d in 2014, is expected to rise by 100,000 b/d in 2015 and remain relatively flat in 2016. Japan and Europe accounted for almost entire decline in 2014 and are expected to continue to decline over the next 2 years. The US is the leading contributor to projected OECD consumption growth, with its consumption increasing by 300,000 b/d in 2015 and 100,000 b/d in 2016.

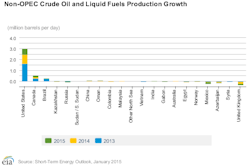

EIA expects supply growth from countries outside of the Organization of Petroleum Exporting Countries to slow over the next 2 tears, mostly because of lower projected oil prices. Non-OPEC production is expected to increase by 700,000 b/d in 2015 and by 500,000 b/d in 2016, with the US as the leading contributor.

OPEC crude oil production averaged 29.9 million b/d in 2014, a slight decline from the previous year, according to EIA. EIA expects OPEC crude oil production to remain flat in 2015 and fall by 300,000 b/d in 2016, with Iraq as the largest contributor of growth of the next 2 years. However, the threat of the Islamic State of Iraq and the Levant (ISIL) on northern Iraqi production and exports still looms.

OECD commercial oil inventories totaled 2.71 billion bbl at yearend 2014, equivalent to roughly 57 days of consumption. Projected OECD oil inventories are expected to rise to 2.78 billion bbl by yearend 2015 and to 2.79 billion bbl at yearend 2016, according to EIA.

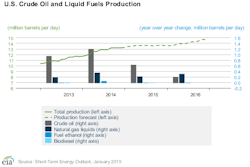

US crude oil production

EIA forecasts US crude oil production to increase from an average of 8.7 million b/d in 2014 to 9.3 million b/d in 2015 and to 9.5 million b/d in 2016.

With WTI crude oil prices expected to average $49/bbl in this year’s first half, EIA expects 2015 drilling activity to decline because of unattractive economic returns in some areas of both emerging and mature oil production regions.

“Many oil companies have cut back on their exploration drilling in response to falling crude prices and will concentrate their drilling activities in established areas that already have productive wells,” said EIA Administrator Adam Sieminski.

Oil prices remain high enough to support some development drilling activity in 2015 in the Bakken, Eagle Ford, Niobrara, and Permian basin, albeit lower than previously forecast.

As noted in this month’s STEO, with WTI crude oil prices projected to start rising in this year’s second half, drilling activity is expected to increase again as companies take advantage of lower costs for both leasing acreage and drilling services, causing production to resume rising at a relatively low WTI crude oil price.

Drilling activity is expected to increase in 2016 and US production should rise to its second highest daily output level since record production was set in 1970, Sieminski noted.